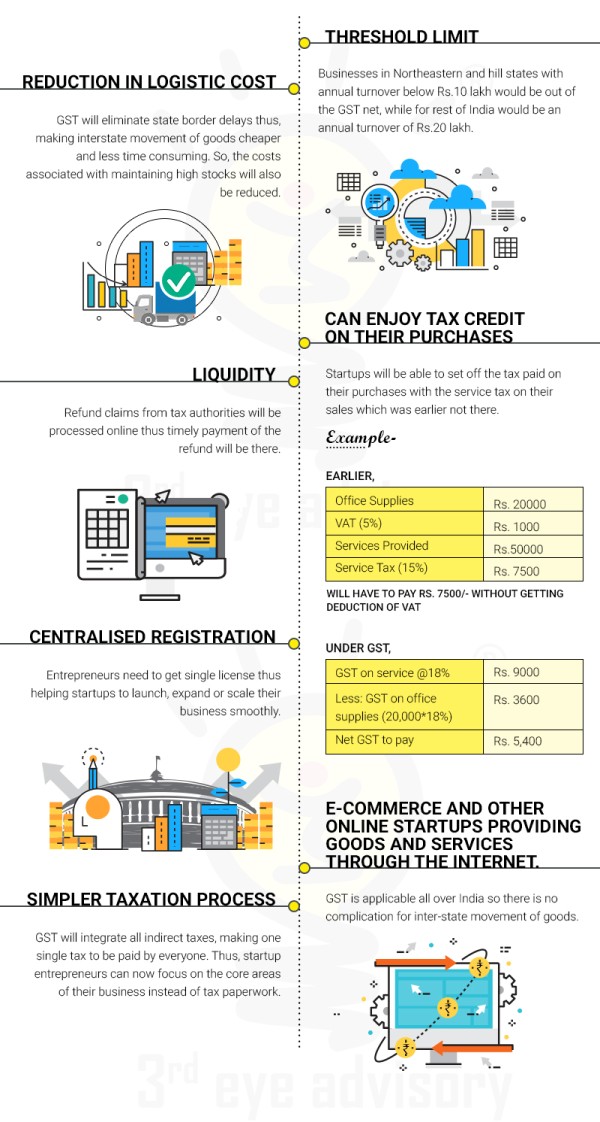

Threshold limit: Businesses in North-eastern and hill states with annual turnover below Rs.10 lakh would be out of the GST net, while for rest of India would be an annual turnover of Rs.20 lakh.

Reduction in logistic cost: GST will eliminate state border delays thus, making the interstate movement of goods cheaper and less time-consuming. So, the costs associated with maintaining high stocks will also be reduced.

Can enjoy tax credit on their purchases: Start-ups will be able to set off the tax paid on their purchases with the service tax on their sales which was earlier not there.

Example:

|

Office Supplies |

Rs. 20000 |

|

VAT (5%) |

Rs. 1000 |

|

Services Provided |

|

|

Service Tax (15%) |

Rs. 7500 |

|

Will have to pay Rs. 7500/- without getting deduction of VAT |

|

Under GST

|

GST on service @18% |

Rs. 9000 |

|

Less: GST on office supplies (20,000*18%) |

|

|

Net GST to pay |

Rs. 5,400 |

Liquidity: Refund claims from tax authorities will be processed online thus timely payment of the refund will be there.

Centralised registration: Entrepreneurs need to get single license thus helping start-ups to launch, expand or scale their business smoothly.

Simpler taxation process: GST will integrate all indirect taxes, making one single tax to be paid by everyone. Thus, start-up entrepreneurs can now focus on the core areas of their business instead of tax paperwork.

E-commerce and other online start-ups providing goods and services through the internet. GST is applicable all over India so there is no complication for inter-state movement of goods.

CAclubindia

CAclubindia