As Promised, I'm back with step-by-step procedure on 'How to Complain in case of GST charged over and above MRP and Illegal collections on the name of GST'.

In this article, I made an attempt to bring awareness in consumers over illegal tax collections in the name of GST by few Traders and various platforms where we can Complaint if we come across such situations.

GST will be successful and customer can enjoy the benefits only when we are aware of some basic principles, Customers should be made aware the inclusion of GST in MRP and it should not to be charged separately. It is illegal.

Maximum Retail Price MRP includes Raw material cost, transportation cost, advertisement cost, margin etc.,

You can know the actual value of a product i.e., taxable value before levying tax by simple method.

Actual value of a product = MRP * 100 / (100+ tax rate)

Mr. Nikhil went to a shop to purchase a Toothpaste of Rs.200/- on which applicable GST is say, 5%, by applying above formula he can know the value and tax included in that product

Actual value = 200 * 100/ (100+5) = 190.5

Tax included in the product = MRP - actual value = 200-190.5 = RS.9.5

Here, is an Illustrative list showing computation of actual value and tax included in the MRP:

|

MRP |

Tax rate |

GST |

Actual value |

|

(1) |

(2) |

(3) = (1) * (2) / (100 + (2)) |

(4) = (1) - (3) |

|

500 |

5 |

23.8 |

476.2 |

|

500 |

12 |

57.1 |

442.9 |

|

500 |

18 |

85.7 |

414.3 |

|

500 |

28 |

133.3 |

366.7 |

Legal Provisions:

Under various laws like Department of Consumer Affairs' Standards of Weights and Measures (Packaged Commodities) Rules,1977, Monopolies and Restrictive trade practices Act-MRTP Act, Consumer Goods (Mandatory Printing of Cost of Production and Maximum Retail Price) Act, 2006 ..etc., MRP-Maximum Retail Price means such price at which the product shall be sold in retail and such price shall include all taxes levied on the product.

Under the GST regime, Central Government established National Anti-Profiteering Authority and recently, on 16th of November, 2017 cabinet approves for creation of posts of Chairman and Technical members to ensure that prices remain under check and to ensure that businesses do not pocket all the gains from GST because profit is fine, but undue profiteering at the expense of the common man is not.

Business Enterprises should pass on benefits of GST to common man, If this is not done, the consumer's interest is protected by the National Anti-profiteering Authority which may order:

(a) Reduction in prices;

(b) Return of the amount not passed on with interest @18% to the recipient;

(c) Imposition of penalty; and

(d) Cancellation of registration of the supplier.

Precautions For Consumers:

1. Do not buy blindly. Demand full information before you buy.

2. Beware of false/misleading advertisements.

3. Do not forget to obtain proper receipt/cash memo. These can be helpful in consumer courts.

4. Double-check your Bills and ask for clarification if you have any doubts.

5. Check for GSTIN on Tax invoice if GST is charged.

6. Even if GSTIN is mentioned but if the trader opted in for Composition scheme, then you are not liable to pay GST.

Where & How to Complaint?

If you have come across such situations like GST is charged over and above MRP, Illegal Collections of GST, charging more than printed MRP then you can complaint to appropriate authority without no-cost and even through Paper Less application within couple of minutes. And after due investigation if department feels Trader is violated laws appropriate action will be taken and sometimes they may impose penalty on trader to Compensate you.

Here, majorly we had FOUR platforms where we can drop our complaint and in each platform we have Option to register our compliant through HELPLINE and ONLINE APPLICATION.

1. Consumer Court

'Consumer Court' is one of the famous and easiest way where we can drop our compliant and action will be taken within couple of days.

a. You can directly make a call to consumer forum through toll-free number 18000-11-4000 or 14404 or even you can send a SMS mentioning your name and city to 0813-000-9809

b. We have another option to reach consumer court through Online mode with simple steps:

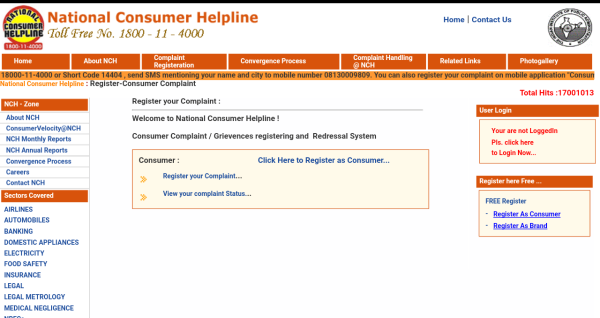

1. Click the below link to go to Consumer Court website

http://www.nationalconsumerhelpline.in/ComplaintFile.aspx

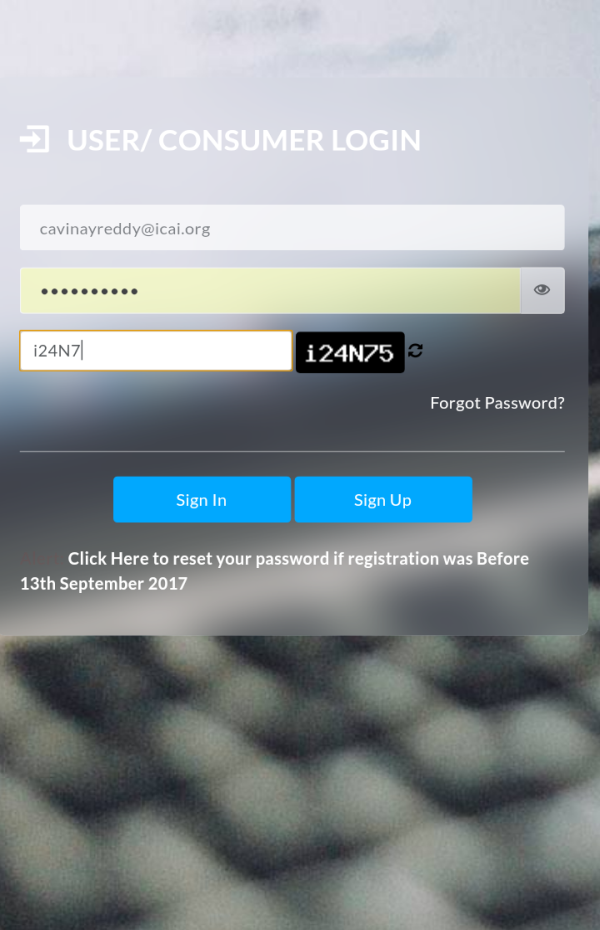

2. Now click on 'Register your Complaint', a dashboard will appear as shown below, then login with your credentials.

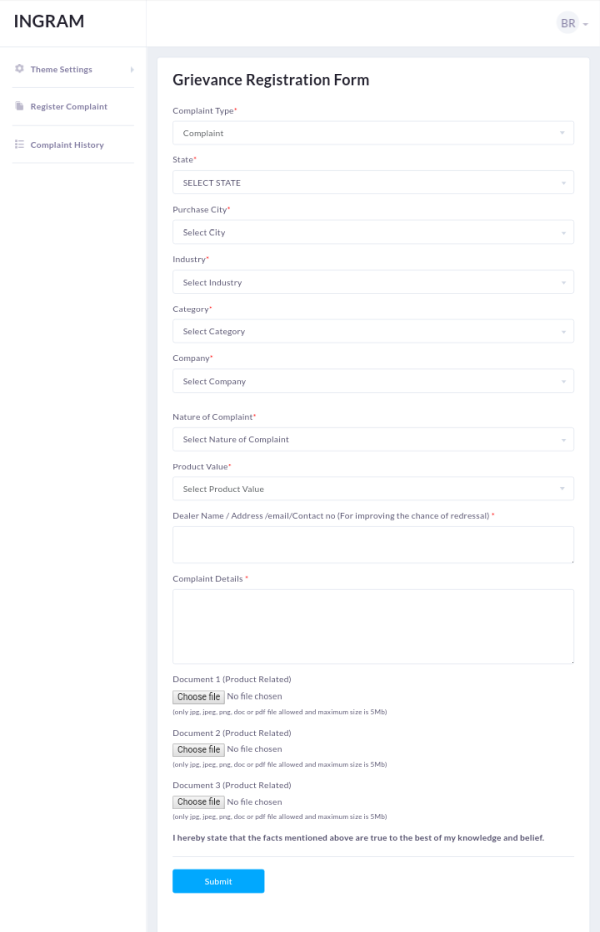

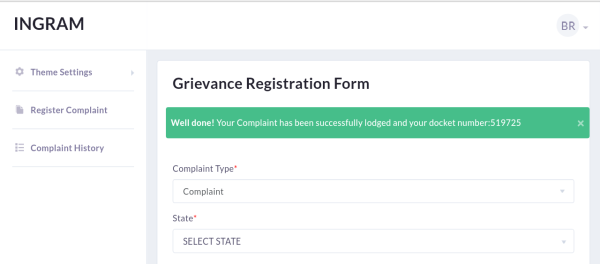

3. After signing in a Grievance registration form will be opened, fill up the details as required.

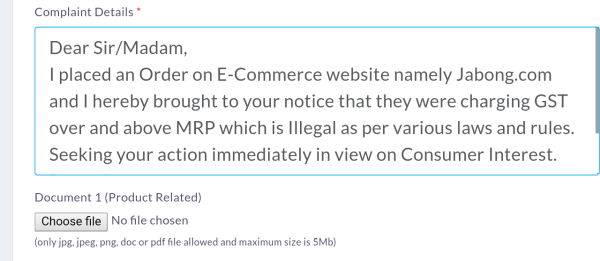

4. Give a brief about your issue in 'Complaint details' tab.

5. You can refer below text for guidance on how to write a compliant.

6. After confirming that details entered are correct click on Submit.

7. After submitting a Compliant registration number will be generated instantly and the same will be sent to your registered mail id.

This Docket number should be quoted in all future correspondence of the case.

8. You can also track your compliant status with your Docket Number and reply from Opponent by clicking on below link:

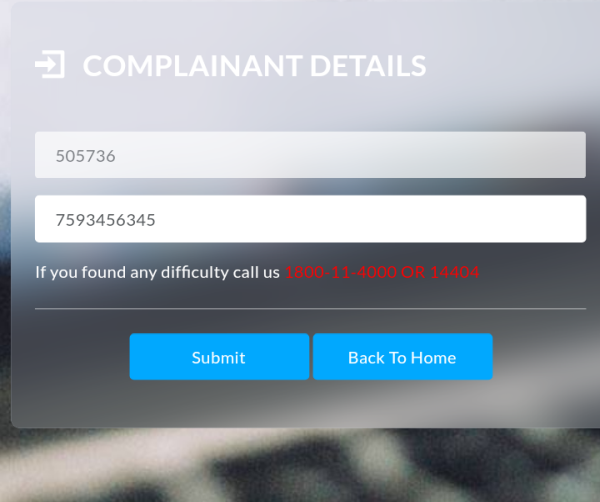

http://consumerhelpline.gov.in/track-complaint.php

9. Enter your Docket number and registered mobile number to know the status of your application.

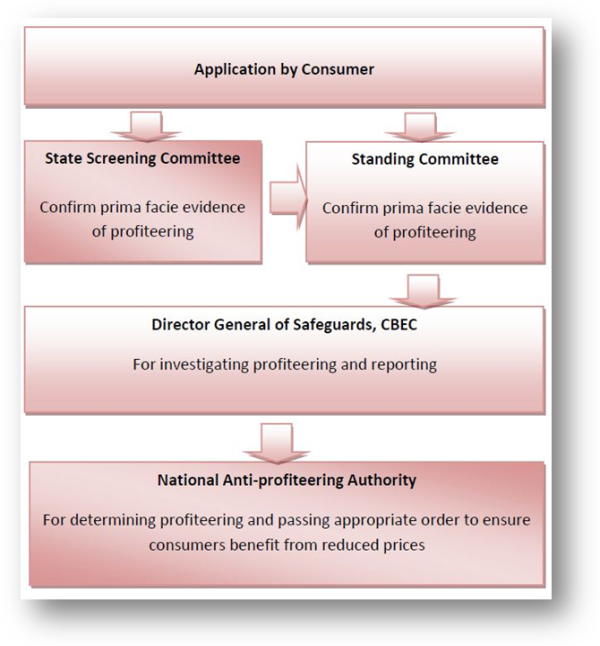

2. Anti-profiteering committee:

Anti-Profiteering authority is established after rollout of GST to ensure benefits of reduced prices are passed on to end consumer, recently Central Cabinet approved for appointment of chairman and other technical team to monitor the issues forwarded by consumer.

Contact details of Standing Committee:

You can drop an e-mail or dial-up to below mentioned contact number if issue is related to central level like E-Commerce cases and your complaint will be registered with Central Authority.

Contact details for state screening committee:

If you have issues with local/state level like restaurants, super markets then you can visit or dial-up to your local authority.

Please follow the below link to know your local Anti-profiteering authority.

http://www.cbec.gov.in/htdocs-cbec/gst/screening-committee-details26.9-2.pdf

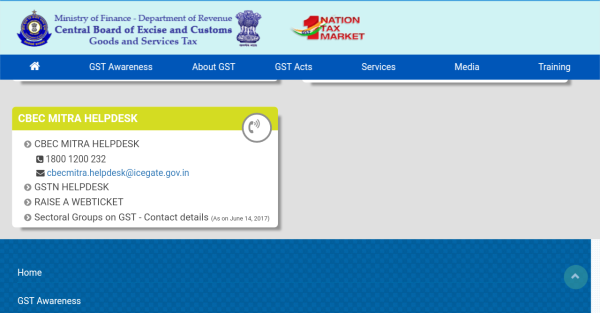

2. CBEC MITRA

a. You can call CBEC MITRA helpdesk on 18001200232 and you can register your compliant.

b. Online Application:

You can drop your compliant within minutes by following the steps listed below:

1. Go to the CBEC-GST website atwww.cbec-gst.gov.in.

2. On the homepage, click RAISE A WEBTICKET at the bottom of the screen.

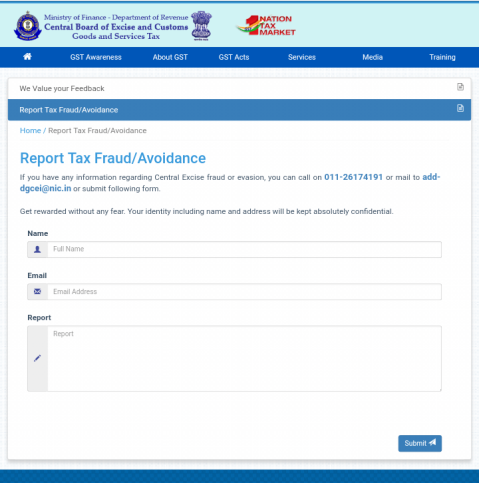

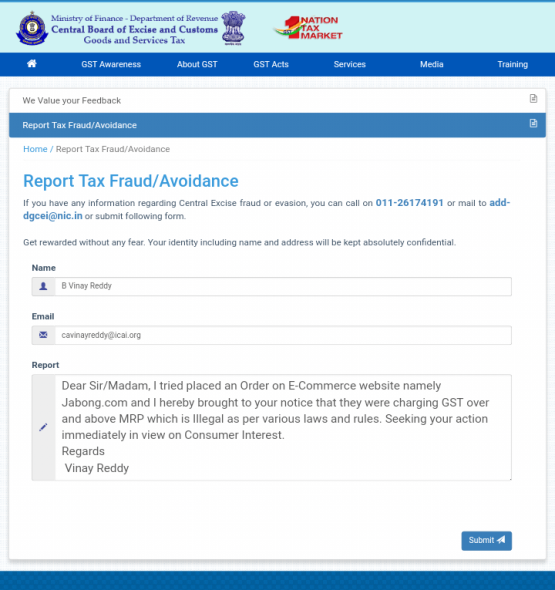

3. On the left pane, select Report Tax Fraud / Avoidance.

4. Fill all fields on this form, and then click Submit. You can refer below filled application for guidance

5. After submitting a mail will be sent to your mail id acknowledging registration of Compliant.

3. Local bodies

Besides central level even state governments are establishing cells to identify anti-profiteering cases and taking stringent actions by imposing penalties.

In Hyderabad, to facilitate consumers for giving complaints, a separate grievance cell is started. Consumers can complain on Civil Supplies Whatsapp number 7330774444 and also can call on the Legal, Metrology Department numbers 7386136907, 27612170 and can lodge complaint through mail to clm-ts@nic.in.

Thanks for your patience on reading my article, hope you may have got some idea on various legal provisions stating tax is included in the MRP itself and you need not pay anything more than that and how to know actual value and tax component in the MRP and how to lodge a compliant if you come across such cases.

The author can also be reached at cavinayreddy@icai.org

'Pay money with Knowledge'

Jai Hind

Disclaimer: The views expressed in this article are solely those of the author and do not criticize anyone intentionally in general or particular.

CAclubindia

CAclubindia