As we promised, we have come up with a new article on investment products/opportunities. This is the continuation of our previous article & we intend to explore all the investment opportunities one by one. We will talk on 'Mutual Funds-Equity' as our 1st topic post our introduction article on investment opportunities.

Reference to our previous Article: Good returns from Risk Free Investments ? - A Myth or Reality!

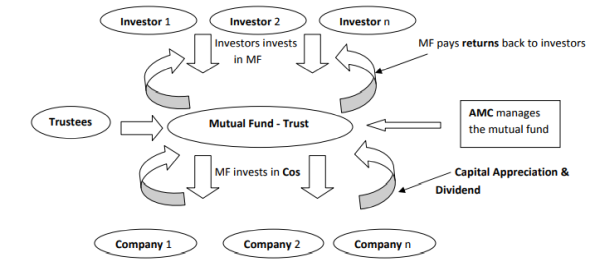

Mutual Funds are basically an investment pool of the investors with a common investing goal.

A trust is formed where all the money pooled will be deployed and investing activity will be done from that trust only. This trust is managed by Asset Management Company (AMC). All the transactions require an approval from the trustees.

Trust & AMC has to abide by Securities and Exchange Board of India (Mutual Funds) Regulations, 1996 & various other Regulations.

Mutual Fund Structure can be better understood with the help of the below diagram:

Mutual funds are the best investment products to beat the inflation and bring hefty returns to high/moderate risk takers.

Mutual funds are managed by high experienced Fund Managers . Small investors who lack expertise in directly investing in stocks via exchanges can blindly route their investment through mutual funds. But do remember, 'Mutual Funds are subject to market risk'

Investment in mutual funds can be done in Lumpsum or SIPs. Mutual Funds help you to diversify risk by investing in innumerable stocks/bonds. So by investing as low as INR 500/-(minimum investment required in SIPs is INR 500/-pm) you can invest in a portfolio of around 20 -100 stocks/bonds.

Investors enjoy choice of innumerable mutual funds to invest their savings/ wealth.

Mutual Funds can be classified in three broad headings:

1) Equity Funds

2) Debt Funds

3) Hybrid (mixture of above 2)

Let's elaborate on Equity Funds.

Equity Funds:

Equity funds are the mutual funds which invest solely/principally in stocks/shares. The primary objective of these funds is to earn maximum returns to their unit holders/investors. They are managed by AMC's top Fund managers. Investing in these funds allows investors to a well diversified portfolio with requisite expertise and liquidity.

Since these funds are linked to stock markets, the risk involved is relatively very high.

Following are the most popular Equity Mutual Funds:

i) Large Cap Funds:

These are the mutual funds which invest in the equity instrument (shares) of companies with large market capitalization.

Example of companies with large market capitalization in India:

** Market capitalization is on 19th Dec 2017.

Some of the top Large Cap Equity Funds based on risk/Return criteria set by us are:

• SBI Blue Chip Fund

• ICICI Prudential Top 100 Funds

• Kotak Select Focus Fund

• HDFC top 200 Fund etc.

Large Caps funds are subject to market risk. But the expertise of AMC's, Fund Managers and their whole team makes sure that your investment are in safe hands and they intend to generates the highest return than any other bonds, Debts, Corporate/Bank FDs etc.

ii) Small/Midcap Funds:

Fund managers of these funds majorly invest in stocks with medium/ low market capitalization. These funds are more risky than the large cap funds. But also give more returns than the large cap funds. Small/Midcap cap companies are the companies in their

growth stage, having strong fundamentals and hence the fund managers grab the opportunities to buy these shares at lower valuations. Fund Managers mainly look for the companies which they think would be a #Multibaggar. But along with high returns, fund managers also face risk of these companies not performing well.

Following are the Small/Midcap Funds which has given an annualized return of more than 30% :

• Mirae Emerging Bluechip – 47.8%

• L&T Emerging Business Fund – 66.66%

• HDFC Midcap opportunities – 40.70%

• Franklin (I) Smaller Cos (G)-41.30%

# What is a Multibagger stock?

From the Investors point of view, Multibagger are the companies which have low identity & are available at cheap valuations, have high quality businesses and have maximum return generating capabilities for investors. Companies are called Multibaggers unless and until they the growth prospects, strong fundamentals are unknown to many investors. Once it comes to the identity of investors at large, it will not be termed as Multibagger.

Some of the characteristics of a Multibagger company are:

a) The company is not popular, have Low identity.

b) Promoters are competent and have a superb track record

c) Debt level within limits

d) Favorable Profitability Ratios, Liquidity Ratios, Solvency Ratios, Activity Ratios etc

e) Recent increase in Production levels. Company is heading to expansion which will lead to higher earnings in the company years.

f) Sources of earnings are increasing and are scalable

iii) Various other types of Mutual Funds are :

a) Thematic Mutual Funds

b) Sector based Mutual Funds

c) Diversified

d) Equity Linked Savings Scheme (ELSS) etc.

I hope the above write up on Introduction to MF & Characteristics of Equity Mutual Funds will help you in taking your Investment decisions.

In future, we will look after the Debt Mutual Funds. Till then stay connected.

The author can also be reached at caandmba@gmail.com

CAclubindia

CAclubindia