Have you ever wondered that

- Why is there a risk of foreign currency associated with every Export-Import House? And what are those risks?

- Why do Foreign Currency Fluctuates?

- What happens when Dollar Appreciates vis-à-vis Rupee Depreciation?

- What happens when Rupee Appreciates vis-à-vis Dollar Depreciation?

- Popular Examples of Companies affected by Foreign Exchange Fluctuation.

In this era of Globalization, where International Businesses are performing exceedingly well and are at peak, we need to identify the different aspects where Foreign Exchange can strike their business.

So, to understand the core notion of it, Let us look it at the each aspect –

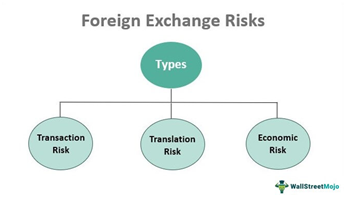

The foreign currency risks arouses when the financial transaction between 2 entities involves two different currencies. For example, Transaction between person residing in India with that one in UK/US/Europe.

When an Indian Exporting firm exports its goods to US and has dollar receivables say 50,000 @spot rates say Rs.80 and at the time inward remittance the Dollar fells to Say Rs.75 then there is a business revenue loss of Rs.250000 [50,000*(80-75)], wiping off all the commercial profits which the company might have earned if foreign currency didn’t fluctuates. Such exposures are known as Transaction Risks.

Another type of risk associated is Accounting Risk a.k.a Translation Risk.When we need to convert/translate the foreign currency denominated assets and liabilities into home currency at the time of preparing financial statements. Say for Example, Company took a loan of worth 50,000 dollars @ 75INR/USD and booked the accounting entry in its books and now on 31st March the dollar rates went up to Say Rs.80 then the loan will have to be translated @Rs.80 and company will book a loss of Rs.250000 on account of Translation Exposure.

Why does Foreign Currency Fluctuates?

Foreign Currency rates are floating and Flexible which means their prices fluctuates and are determined as per the open market forces i.e. Demand and Supply. More of the demand of any currency would lead to increase in value and low demand will lead to fall in their price. These are also driven by many other factors such as

- Prevailing Interest Rates

- Economic Performance of Country

- Balance of Payments Status (Deficit or Surplus)

- Inflation/Recessionary Phase

- Government Action

Concept of Home Currency Depreciation (Dollar Appreciation) and Home Currency Appreciation (Dollar Depreciation)

When the value of your own currency goes down which means the dollar becoming more expensive as compare to Indian Rupee leads to Currency Depreciation. This situation is not at all good for the Indian Importers as they now have to pay more. Say for Eg. an Indian Importer Imports goods worth USD 50,000 @Rs75/USD for a credit period of 3 months and now at the time of payment the dollar appreciates means INR/USD = Rs80, so due to fluctuation Importer now have to pay Rs5 extra per dollar. However, to minimize and mitigate such risks there are various hedging tools which one can used like enter into a forward contract or invoice the bill in domestic currency etc. (we will look at such techniques and tools separately).

The case of Currency Appreciation is just the opposite the case depreciation. This makes the imported products cheaper and Indian Importers will now have increased profits. The Exporters will now have to face fluctuation consequences.

Case Studies

To sum up with let us look at some various real life case studies, there have been several examples where companies have faced significant losses due to fluctuations in foreign exchange rates. One such notable company was the British airline, Flybe, which took significant debts and the debts were denominated in Swiss francs (France Currency). But, the sudden appreciation of the Swiss franc results in a significant increase in the Flybe’s debt burden, which ultimately led to its bankruptcy.

Nike an American MNC reported a loss of $48 million due to currency fluctuations. Nike had significant operations in Japan, where the value of the yen had appreciated against the US dollar. As a result, Nike's revenues from Japan were worth less when converted into US dollars. Additionally, Nike had entered into contracts to purchase Japanese yen at a fixed rate, which resulted in losses when the yen appreciated.

CAclubindia

CAclubindia