Overview of GSTR 2A

- GSTR 2A is a system generated 'draft' Statement of Inward Supplies for a Receiver

- It is auto-populated from the GSTR 1/5, GSTR 6 (ISD), GST 7(TDS), and GSTR 8 (TCS) filed by the supplier taxpayer from whom goods and/or services have been procured or received by the receiver taxpayer in a given tax period.

- The details become available to the receiver taxpayer for view only and the details are updated incrementally as and when supplier taxpayers upload or change their details in their respective GSTR for the given tax period.

- The auto-populated details of a particular supplier/counter party will get frozen when he submits or files his return.

- GSTR 2A of a tax period will remain available for view till a taxpayer submits/files his GSTR 2.

- When the counterparty has not submitted/filed GSTR 1: Any/all invoices uploaded by Supplier Taxpayers in their GSTR 1 will be visible in the GSTR 2A and the same can also be viewed in the GSTR 2 of the recipient.

- When the counterparty has submitted/filed their return: The invoices available in the GSTR 2A will continue to be available for viewing.

► Additionally, Receiver Taxpayers will be able to take action on the invoices.

► ACCEPT/REJECT buttons against invoices will be enabled for action.

► The information available in GSTR 2A will also be available in GSTR 2.

- Taxpayer is not require to file GSTR 2A. It is a read-only document provided, so that taxpayer can have a record of all the invoices received from various supplier taxpayers in a given tax period.

- GSTR 2A for a given tax period will be available for viewing and/or downloading in taxpayer's post-login section of the GST portal.

- Taxpayer cannot make any changes to the GSTR 2A, as it is a read-only

- The information displayed in GSTR 2A is also available in GSTR 2 and any/all actions must be taken in the GSTR 2 by the receiver.

- When GSTR-1 is filed after filing of GSTR-2 by the counter parties, the details declared in GSTR-2 gets auto populated to GSTR-1A and the supplier is expected to take action (Accept/Reject/Pending for action) on such details before filing of his GSTR-1.

- An alert in the form of an email and a message on the dashboard will be sent to the taxpayer when any new details are auto-populated into GSTR 2A.

4 parts of GSTR 2A

- Part A consists of 3 Tables which are auto populated from the Supplier GSTR-1 and / GSTR-5.

► Table 3 consists of B2B Supply details

► Table 4 Consist of Debit / Credit Note

► Table 5 Consist of Amended Debit / Credit Note details

- Part - B (Table 6) of the GSTR-2A consist of ISD details on account of eligible ITC and ineligible ITC and will be auto populated on the basis of GSTR-6 filed by the ISD.

- Part - C (Table 7A) of GSTR-2A consist of TDS Details, which will be auto populated on the basis of GSTR-7 filed by the TDS Deductor.

- Part - C (Table 7B) of the GSTR-2A consist of TCS Details, which will be auto populated on the basis of GSTR-8 filed by the E-Commerce Operator.

- Receiver is expected to take action of either Accept / Reject in information of Part B & C.

Overview of GSTR 2

- Receiver taxpayers are required to file GSTR 2 return (Statement of Inward Supplies) on a monthly basis in which they can accept, modify, reject, or keep pending the invoice level outward supplies information furnished by the supplier taxpayer (in their GSTR 1), to prepare the details of inward supplies and credit or debit notes.

- Receiver taxpayers can also add inward supplies and credit or debit notes received for supplies that are not declared by the supplier taxpayer in GSTR 1.

- GSTR 2 needs to be filed even if there is no business activity (Nil Return) during a given tax period.

GSTR -2 not to be filed by

- The following taxpayers are not required to file GSTR 2:

► Taxpayers under the Composition Scheme (Return

to be filled by them in GSTR 4)

► Non-resident foreign tax payers (Return to be filled by them in GSTR 5)

► Online information database and access retrieval service provider (Return to

be filled by them in GSTR 5A)

► Input Service Distributors (ISD) (Return to be filled by them in GSTR-6)

► Tax Deducted at Source (TDS) deductors (Return to be filled by them in GSTR 7)

► E-commerce operators deducting TCS (Return to be filled by them in GSTR 8)

GSTR 2: Inward supplies

- The inward supplies include

► all inward supplies of goods and/or services,

► including inward supplies of services on which the tax is payable on reverse charge basis.

► also includes inter-state inward supplies, debit notes or credit notes and supplementary invoices issued during a specific tax period.

Due dates to file GSTR 2

- Normal taxpayers cannot file GSTR 2 before the end of the current tax period.

- Following are the exceptions to the rule:

► Casual Dealers

► Taxpayers who have applied for voluntary cancellation of GST registration are allowed to file GSTR 2 before the end of the current tax period if they have received the cancellation order.

- Due date for filing GSTR 2 is 11th to 15th of the month succeeding the tax period.

► Example: The goods and/or services received during the month of January should be filed between 11th to 15th of February. The date of filing GSTR 2 can be extended by the Board/Commissioner by notification.

- As of now July, 2017, GSTR 2 is to be filed from 11th to 25th September, 2017. (Not. No. 29/2017 - Central Tax 05/09/2017)

Late filing of GSTR 2

- A receiver tax payer is charged late fee for filing GSTR 2 after the due date.

- Late fee for filing GSTR 2 after the due date is auto calculated after filing the return.

► The payment of late fee is not required before filing of GSTR 2.

► The fee must be paid before filing GSTR 3, without which the return is considered invalid.

- The charges for late filing of GSTR 2 is INR 100 per day per Act (CGST/SGST) based on the types of inward supplies received by the taxpayer (inter-state, intra-state, or both).

► Depending on the types of inward supplies received, the total charges may be INR 200 (100+100) per day.

Information covered in GSTR 2

► Inward supply invoices in respect of input/input

services/ capital goods received from a registered person other than the

supplies attracting reverse.

► Inward supplies invoices pertaining to input/input services /capital goods

from a registered supplier attracting reverse charge.

► Inward supplies received from an unregistered supplier.

► Import of services.

► Input/ capital goods received from overseas or from SEZ units on a Bill of

Entry.

► Amendments to details of inward supplies furnished in return for earlier tax

periods (including debit notes/ credit notes issued and their subsequent

amendments).

► Supplies received from composition taxable person and other exempt/Nil

rated/Non GST supplies received.

► ISD credit received.

► TDS/TCS credit.

► Advances paid/ adjusted on account of receipt of supply.

► Input tax credit reversal /reclaim.

► Addition and reduction of amount in output tax for mismatch and other reason.

► HSN summary of inward supplies.

Claim of ITC & GSTR 2

- ITC can be claimed up to 12 months from the date on which the original invoice/debit note was issued or annual return was filed, whichever is earlier.

- There will be no transfer in the Electronic Credit Ledger in case there is a gap of more than a year between the original invoice/debit date and date of filing of GSTR 3 for the tax period when such details were uploaded.

Pre conditions for filing GSTR 2

- Pre-conditions for filing of GSTR 2 are:

► The receiver taxpayer should be a Registered

Normal Dealer and should have an active GSTIN.

► Receiver taxpayer should have valid login credentials (i.e., User ID and

password).

► Receiver taxpayer should have valid and non-expired/unrevoked digital

signature certificate (DSC), in case it is mandatory (DSC is mandatory for

companies, LLPs and FLLPs).

► Due date for filing of GSTR 1 of the same tax period should have lapsed.

Steps to File GSTR 2

- Filing

► Receiver taxpayer logs into the GST portal using their login ID and

password.

► Navigate to Services > Returns > Returns Dashboard

► Select the financial year and tax period for which GSTR 2 needs to be filed

and click SEARCH

► All returns pertaining to the given tax period will be displayed in different

tiles

► Select GSTR 2 tile and click on PREPARE ONLINE or PREPARE OFFLINE

- Viewing

► In the post-login mode, taxpayer can access the GSTR 2 return by navigating to the Returns Dashboard and selecting the given financial year and return filing period.

√ Path: Services > Returns > Returns Dashboard

Actions by Receiver in GSTR 2

- Receiver taxpayer will be able to see the supplier-wise summary of all invoices received.

- Against each invoice of each supplier, receiver taxpayer shall take one of four possible actions - Accept, Modify, Reject, and Keep Pending

- The taxpayer can also Add (by using ADD MISSING INVOICE option) all the invoices for the tax period which have not been added by the various Supplier(s), if applicable.

Submission of GSTR 2

- After taking action and entering/uploading all the invoices and details in the various sections of GSTR 2, taxpayer will click SUBMIT to validate the data.

- Once the data is validated, taxpayer can click on FILE GSTR 2 using DSC or EVC

- A confirmation message will pop-up to confirm or cancel the filing with YES and NO options respectively.

► Upon clicking YES, GSTR 2 will be filed and Acknowledgement Reference Number (ARN) will be generated for the same.

After submission of GSTR 2

- ARN is generated on successful submission of the GSTR 2 Return.

- In case the return is filed through an offline utility, a Temporary ID is generated when the taxpayer uploads the JSON file. On successful submission of the return, an ARN is generated.

- An SMS and an email are sent to the taxpayer on successful submission of the GSTR 2.

- Once the Return is submitted after affixing DSC or E-sign as the case may be, the return is available to jurisdictional authority.

- In case of amendments or additions, details of counterparty supplier taxpayers are auto-populated in GSTR 1A.

- Taxpayer will be eligible to avail the credit on reverse charge and non-reverse charge supplies on the basis of invoice which he is expected to add/validate on filing of GSTR 2.

- Current Tax period ITC, as per GSTR 2, can be utilized for return related liability of that tax period only.

- On creation of mismatch report, provisional ITC will be segregated into matched and mismatched ITC and taxpayer can utilize matched ITC against other than return related liabilities only once valid GSTR-3 is filed.

- If receiver taxpayer is filing GSTR 2, post filing of GSTR-1 by the Supplier, then he has to mandatorily take action on the information so received in GSTR 2.

- Taxpayer cannot add the same details, on his own, which are available in his GSTR 2

Action in GSTR 2

- All accepted and modified invoices will become part of GSTR-2 of such tax period.

- Invoices which are kept under pending will be rolled over to next Tax period of GSTR-2.

- Receiver can add any invoice / Debit / Credit notes which are omitted by the Supplier in GSTR-1.

- In respect of Amended B2B, TDS details (TDS), TCS details, Receiver has to take action of either Accept / Reject/ Pending for Action.

- Modified and newly Added invoices/Debit/Credit Note details by the Receiver in GSTR-2 will be auto populated to GSTR-1A of the Supplier in the same Tax period, if the Supplier has not filed his GSTR 3.

► Supplier is expected to take action of Accept / Reject in respect of such details.

- If GSTR 1 has not been filed by the supplier till 10th and GSTR-2 is filed by Receiver before filing of GSTR-1 by the supplier, then all B2B, Amended B2B, Debit and Credit Note and Amended Debit / Credit Note details from GSTR-2 of the Receiver will be auto populated in the GSTR-1 of the Supplier and supplier has to take action of acceptance /deletion / pending for action.

- Receiver has to declare the details of services received where payment to the supplier is not made within 6 months from the date of receipt of invoice and on that ITC has been claimed.

- In such case, output tax liability will be created to the extent of ITC claimed earlier on such services along with the interest. GSTR 3 and Tax liability ledger of the Receiver will get updated.

- In case of reverse charge supplies from un-registered persons, Receiver will issue invoice and same will be reported in Table 4/4A of GSTR-2.

- Amendment of accepted invoice is not

- Any addition of new invoices, amendments of earlier invoices, debit/credit note and amendments in relation to invoices pertaining to a particular FY shall not be allowed after filing of GSTR-3 of September or GSTR 9 of next FY, whichever is earlier.

- In cases where Taxpayers have converted from Normal Taxpayer to compounding taxpayer

► Entries in GSTR 2 filed after the date of conversion can be made only for invoices/documents dated prior to the date of conversion.

► Rectifications will be allowed only in respect of original invoices/documents issued prior to the date of conversion

- In cases where Taxpayers have surrendered/cancelled GSTIN,

► GSTR 2 can be filed for the period for which taxpayer has been active/alive.

► Invoice/debit/credit note date should be prior to the effective date of surrender/cancellation.

- For non-filing of GSTR 1/2/3, a notice will be sent in the form of GSTR-3A.

Instructions to fill

1. Terms used:

► GSTIN: Goods and Services Tax Identification

Number

► UIN: Unique Identity Number

► UQC: Unit Quantity Code

► HSN: Harmonized System of Nomenclature

► POS: Place of Supply (Respective State)

► B to B: From one registered person to another registered person

► B to C: From registered person to unregistered person

2. Table 3 & 4 captures information of:

(i) Invoice-level inward supply information, rate-wise, pertaining to the tax period reported by supplier in GSTR-1, to be made available in GSTR-2, based on auto-populated details received in GSTR-2A;

(ii) Table 3 to capture inward supplies, other than those attracting reverse charge and Table 4 to capture inward supplies attracting reverse charge;

(iii) The recipient taxpayer has the following option to act on the auto populated information: a. Accept, b. Reject, c. Modify (if information provided by supplier is incorrect), or d. Keep the transaction pending for action (if goods or services have not been received)

(iv) After taking the action, recipient taxpayer will have to mention whether he is eligible to avail credit or not and if he is eligible to avail credit, then the amount of eligible credit against the tax mentioned in the invoice needs to be filed;

(v) The recipient taxpayer can also add invoices (not uploaded by the counter party supplier) if he is in possession of invoices and have received the goods or services;

(vi) Table 4A to be auto populated;

(vii) In case of invoices added by recipient tax payer, Place of Supply (PoS) to be captured always, except in case of supplies received from registered person, where it is required only if the same is different from the location of the recipient;

(viii) Recipient will have the option to accept invoices auto populated as well as add invoices, pertaining to reverse charge only when the time of supply arises in terms of section 12 or 13 of the Act;

(ix) Recipient tax payer is required to declare in Column No. 12 whether the inward supplies are inputs or input services or capital goods (including plant and machinery).

3. Details relating to import of Goods/Capital Goods from outside India as well as supplied by an SEZ Unit to be reported rate-wise by recipient tax payer in Table 5.

4. Recipient to provide for Bill of Entry information including six digits port code and seven digits bill of entry number.

5. Taxable Value in Table 5 means assessable value for customs purposes on which IGST is computed (IGST is levied on value plus specified customs duties). In case of imports, the GSTIN would be of recipient tax payer.

6. Table 6 to capture amendment of information, rate-wise, provided in earlier tax periods in Table 3, 4 and 5 as well as original/ amended information of debit or credit note. GSTIN not to be provided in case of export transactions.

7. Table7 captures information on a gross value level.

8. An option similar to Table 3 is not available in case of Table 8 and the credit as distributed by ISD (whether eligible or ineligible) will be made available to the recipient unit and it will be required to re-determine the eligibility as well as the amount eligible as ITC.

9. TDS and TCS credit would be auto-populated in Table 9. Sales return and Net value columns are not applicable in case of tax deducted at source in Table 9.

10. The eligible credit from Table 3, Table 4 & Table 8 relating to inward supplies to be populated in the Electronic Credit Ledger on submission of its return in Form GSTR-3.

11. Recipient can claim less ITC on an invoice depending on its use i.e. whether for business purpose or non-business purpose.

12. Information of advance paid pertaining to reverse charge supplies and the tax paid on it including adjustments against invoices issued should be reported in Table 10.

13. Table 12 to capture additional liability due to mismatch as well as reduction in output liability due to rectification of mismatch on account of filing of GSTR-3 of the immediately preceding tax period.

14. Reporting criteria of HSN will be same as reported in GSTR 1.

(Summary of supplies effected against a particular HSN code to be reported only in summary table. It will be optional for taxpayers having annual turnover upto Rs. 1.50 Cr but they need to provide information about description of goods.)

Input tax credit reversal /reclaim under Table 11 of GSTR 2

► Rule 37(2) reversal of input tax credit on account of non payment of consideration of supply by the recipient within the prescribed time limit.

► Rule 39 (1) (j) (ii): reduction of output tax credit on account of issuance of a credit note to the ISD by the supplier

► Rule 42(1) m: reversal of credit attributable towards exempt supplies and for non business purpose.

► Rule 43 1 (h): Reversal of input credit along with interest attributable on capital goods used in exempt supplies.

► Rule 42 (2) (a) reversal of credit attributable on the capital goods used party for business purpose and taxable supplies and also partly for non business purpose and for exempt supplies.

► Rule 42 (2) (b) : re-credit of amount paid in excess than determined under Rule 42 on input tax credit in respect of inputs and input services partly used for business/ non business purpose and for making both exempt and taxably supplies.

► On account of amount paid subsequent to reversal of ITC, will reduce the liability.

► Any other liability (to be specified)

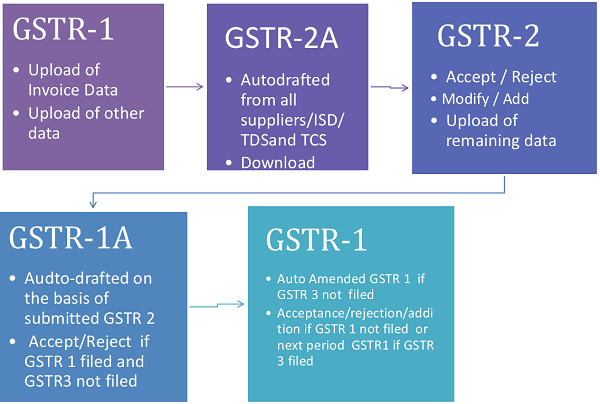

INTERACTIVE RETURNS

INTERACTIVE RETURNS: PROCESS FLOW

Click here to view the article as an attachment

CAclubindia

CAclubindia