It's been a week since the election results were announced, it was indeed a shocker, not only to the general public but also to the incumbent themselves and the markets too, which witnessed wild swings, ranging 5000 points in Nifty and 9000 points in Bank nifty during the week. Such wild moves would be etched in the memories of market participant for long despite them having witnesses many of such.

Yet we write to you this article when the dust is settled on the Government formation, Portfolio allocation and policy making (but wait…which is very much clear despite there being a bit of uncertainty) as PM Modi is a reformist and with not able to attain majority and forming the government with support of its allies (Coalition government) will the policy making take a shift from reforms to welfare schemes, i.e. subsidies vs Capex.

On the subsidies vs Capex front

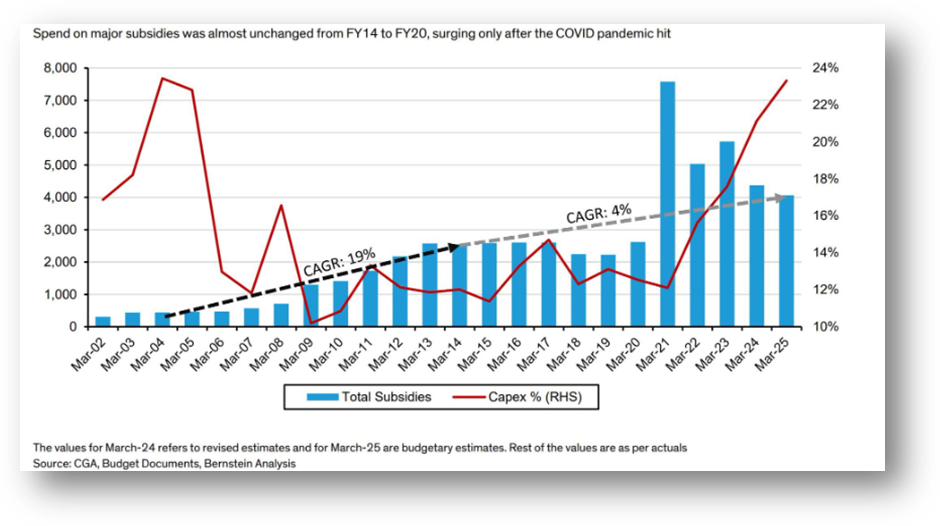

The growth of subsidies as a percentage of government spending surged at a 19% compound annual growth rate (CAGR) from FY04 to FY14. However, from FY14 to FY24, the growth rate of subsidies slowed to 4%. (This is when the MODI government had strong majority)

Meanwhile, the expansion of capital expenditure (Capex) is quite evident, particularly if the current government retaining power and the policy stability it offers. We can observe significant (Capex) investments in public infrastructure, which is imperative for us to realize the 10+trillion-dollar economy dream, at least for the next few decades vs China's investment of $7 Trillion dollar a year.

The Coalition front is it a boon or bane

The world's largest democracy has elected the NDA government for the third consecutive time. However, unlike previous outcomes, this time we will have a coalition government at the centre overseeing the economy and shaping policies.

However, a coalition government tends to dilute the decision-making power previously held by the central authority, which had been implementing various reforms at an economic cost. While the reform implemented are beneficial in the long run, it has caused short-term disruptions that are still felt today. With a new group of politicians in the cabinet, accountability often improves. The inclusion of various reformist leaders, who have successfully governed their states to what they are now, brings fresh perspectives and leadership to nationwide policy-making. Remember (it's important to recognize the risks associated with the concentration of power)

The election outcome was indeed surprising and even more surprising after seeing the exit polls. The results did bring in volatility and swings in the market ranging >8 % intraday fall and >5 % downside closing.

As a result, the markets gained some clarity during the week, leading to a record rebound in both the Nifty and Bank Nifty indices. The market had managed to return to pre-election result levels v/s

In 2004 the Nifty fell 19% in the first three days after the election before starting a gradual recovery which took 90 trading days to retrace the decline. In 2019 the market reaction to the results was an initial pop and then a grinding decline of nearly 10%. It took a 105 days for the Nifty to retrace the 10% correction after the 2019 election result.

Why, and how did markets experience this bounce back?

- The markets have reacted negatively because of unrealistic expectations of 400+ and 370+. But, the India story is not dependent on anyone, Irrespective of the party we support, India story is here to stay!!

- The fundamentals are intact with major growth drivers and multiple engines the economy is poised to do well in the long run. Growth is robust, with the Return on Equity (ROE) currently at 16% and expected to increase to 17% in FY27 and 18% in FY28 and FY29. With ROE exceeding the cost of equity and positive tailwinds, the outlook remains strong.

- The recent market decline, coupled with the likelihood of a narrow trading range, is expected to reduce the premium valuation we currently hold compared to Asia ex-Japan from 45-50% down to 30-35%. Thereby FII's would definitely come back once the premium which we command compared to Asia x Japan near historical average 30-35%

- The government will refocus on people, finances, and growth. The new cabinet will bring fresh excitement, and the upcoming budget will be promising.

- A coalition government is not necessarily detrimental to the economy; from 1989 to 2014, we have experienced coalition governments before, and during those years, our GDP grew by over 8% annually.

Way forward

- Forward P/E on MSCI India is trading at 23x vs historical average of 20x

- Sectors will change in the Market, PSUs may take a break from dominating in the Bull Run. Small cap and Mid cap tend do well in coalition government.

- Investments in clean energy and infrastructure is set to touch a new global high of $3 Trillion sector and India would likely be a major beneficiary(ReNew, Infra, Engineering)

- The rally is expected to be broad-based from now on, with good momentum on both sides. This contrasts with last year's concentrated rise and rally, which was dominated by PSUs

- The important levels to watch are 21,800; if this level is breached on a closing basis, it could open up the possibility of reaching 21,191 and 20,250, which should act as crucial support. Until these levels are broken (21800), movements in either direction should be well-capitalized.

- The portfolio allocation signifies that BJP has the control over key ministries and market discounts that hoping for policy continuity and no hurdles in growth for the investments made earlier

- The budget in due in the month of July, majorly we expect that focus will be given more on reforms than what market expects it to be a populist budget.

- With earning season to start next month, the market move will be dictated by various global factors such as Crude, Interest rate cuts and FII flows. If the earnings meet the expectation, one might expect P/E repricing to happen and that might be one amongst the couple of reasons for markets to rally further.

- The government capex is seeping in through private and once the private capex picks, with policy continuity and investments, that would lead to increase in earnings estimate and what seemed expensive might look favourable.

Concluding the risk is in not staying invested than in staying invested

CAclubindia

CAclubindia