EasyOFFICE: The Best TDS Return Filing Software in India

Specially for Chartered Accountants, Tax Professionals, and Corporates

Managing TDS (Tax Deducted at Source) compliance is a crucial and challenging task for businesses and Tax Professionals in India. The complexities of filing returns, calculating deductions, and maintaining accurate records can be daunting. That's why thousands of Chartered Accountants, Tax Professionals, and Corporates trust EasyOFFICE, India's leading taxation software, for their TDS return filing needs. Packed with a range of features designed to simplify the TDS process, EasyOFFICE stands out as the best TDS return filing software in India.

Key Features that Make EasyOFFICE -The Best TDS Software in India

1. Filing of TDS/TCS Returns

EasyOFFICE Software streamlines the filing of both TDS and TCS returns, supporting all TDS Return forms such as 24Q, 26Q, 27Q, and 27EQ. Whether it's filing regular returns or making corrections, the software allows you to file directly online to the Income Tax India portal with ease.

2. Regular or Correction Returns Online

The software enables users to file both regular and correction returns online directly on the Income Tax India portal. This eliminates the need for manual interventions and minimizes errors, ensuring that your returns are filed accurately and on time.

3. Bulk PAN Verification for All Deductees & Employees

EasyOFFICE offers a bulk PAN verification feature, allowing you to verify the PAN details of all Deductees and employees in one go. This feature saves time and ensures data accuracy, preventing potential mismatches during return filing.

4. Auto Generation of TDS Certificates Form 16, 16A, 27D

Generating TDS certificates has never been easier. EasyOFFICE Software automatically generates Forms 16, 16A, and 27D in PDF format, digitally signs them, and even offers an email facility to send these certificates directly to the recipients, ensuring timely and efficient compliance.

5. Direct Uploading of 15G and 15H on ITD Portal

With EasyOFFICE Software, you can directly upload Forms 15G and 15H on the Income Tax Department (ITD) portal from within the software. This eliminates the need for manual uploads and ensures a smooth process for submitting these forms.

6. Data Validation Process

Data accuracy is crucial when it comes to TDS Return filings. EasyOFFICE Software incorporates a robust data validation process that checks for errors and inconsistencies before uploading the return. This feature helps in minimizing errors and ensures that your data is accurate and compliant.

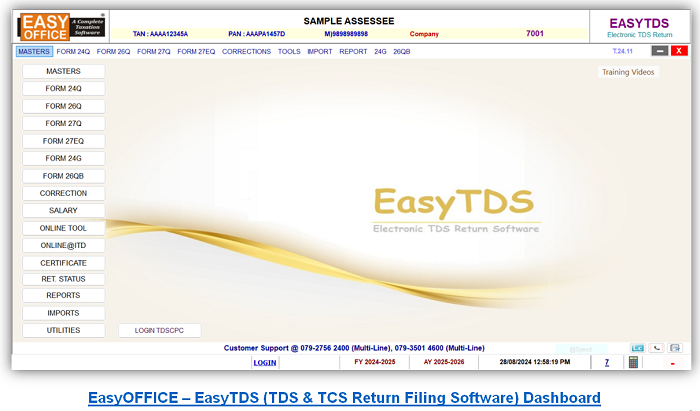

EasyOFFICE - EasyTDS (TDS & TCS Return Filing Software) Dashboard

7. Challan E-Payment &Challan Printing

EasyOFFICE allows for the e-payment of dues directly from the software, using ITNS-281 and other forms. It also includes an online challan verification feature and allows you to print challans, making the payment process smooth and hassle-free.

8. Justification Report Request and Generation

If there are any mismatches or discrepancies in your TDS returns, EasyOFFICE Software helps you request and generate a justification report in an Excel format. This report provides a detailed breakdown of the error issues, making it easier to correct any errors.

9. Data Import/Export Facility

The software supports importing and exporting data from various formats such as consolidated files (. tds file), .txt files, and Excel sheets. This flexibility ensures smooth data migration and integration, saving time and reducing manual work.

10. Comprehensive Registers and Reports

EasyOFFICE Software provides several important registers such as the Certificate Register, Challan Register, TDS Register, and Deductee-wise /Employee-wise Transactions Report. It also offers detailed reports like the TDS Report for Audit and unconsumed Challan Report, providing all the information you need at your fingertips.

11. Automatic Calculation of Interest and Late Fee

The software automatically calculates interest and late fees for delayed payments or filings, ensuring that you are aware of your liabilities in advance and can avoid any penalties.

12. Compliance Check for Higher TDS Rates

EasyOFFICE Software includes a compliance check feature that ensures TDS is charged at higher rates in certain cases, such as non-furnishing of PAN. This helps in avoiding non-compliance issues and penalties.

13. Multiple Validations for Default Predictions

To minimize errors and defaults, EasyOFFICE Software performs multiple validations before the return is uploaded. It helps predict potential defaults, allowing users to correct errors beforehand and avoid notices or penalties from the Income Tax Department.

14. Simplifying Employee TDS Calculation on Annual Salary

One of the standout features of EasyOFFICE's TDS Software is its capability to automatically calculate employee TDS based on their annual salary. This feature streamlines the TDS computation process by factoring in salary components, exemptions, deductions, and applicable tax slabs. It ensures accurate TDS deduction at the source and eliminates the need for manual calculations. This not only saves time but also minimizes errors, ensuring compliance with the latest tax regulations.

Why EasyOFFICE - TDS Software is the Preferred Choice for Tax Professionals& Corporates

EasyOFFICE Software is more than just a TDS filing software; it is a comprehensive solution designed to simplify complex TDS processes. Here's why it's Trusted by Thousands of Chartered Accountants, Tax Professionals, and Corporates across India:

- Ease of Use: The user-friendly interface ensures that even users with minimal technical knowledge can navigate and use the software effectively.

- Time-saving: Features like bulk PAN verification, auto-generation of forms, and direct uploading to the ITD portal save significant time.

- Accuracy: The robust validation processes and error-checking features ensure that your data is accurate and compliant.

- Support: Regular updates and dedicated customer support ensure that users are always equipped to handle the latest changes in tax laws and regulations.

Special Price Benefit Offer for Practicing Chartered Accountants

Recognizing the critical role that Chartered Accountants play in financial compliance and advisory, EasyOFFICE Software is available at a Special Discounted Pricing benefit exclusively for Practicing CA. This offer ensures that you have access to the best-in-class TDS & TCS software without straining your budget.

The Ultimate TDS Return Filing Software

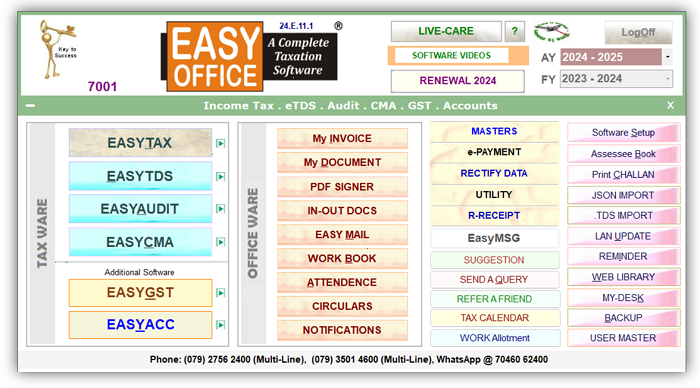

EASYOFFICE - A Complete Taxation Software goes beyond just TDS return filing by offering a comprehensive suite of features that make it the Best TDS software in India. With automated employee TDS calculation on annual salary, bulk PAN verification, auto-generation of TDS certificates, and seamless integration with the Income Tax India portal, it simplifies complex processes. Other powerful tools include direct uploading of Forms 15G and 15H, data validation, e-payment options, and multiple reports for audit and compliance.

Conclusion

Choosing the right TDS return filing software is crucial for maintaining compliance and ensuring smooth operations. EasyOFFICE, with its comprehensive features, ease of use, and robust support, stands out as the best TDS software for Chartered Accountants, Tax Professionals, and Corporates. It simplifies complex processes, saves time, and ensures accurate filings, making it the go-to choice for thousands of Tax Professionals across India.

Join with Thousands of happy CA's and Tax Professionals who trust EasyOFFICE for their TDS & TCS needs. With a special pricing offer exclusively for practicing Chartered Accountants, there has never been a better time to elevate your practice with the power of EasyOFFICE Software.

Experience the best in TDS return filing with EasyOFFICE Software and streamline your tax compliance today!

EASYOFFICE ensures that TDS filing is not just easy but also accurate and compliant.

CAclubindia

CAclubindia