What is CMA Data Preparation?

CMA Data Preparation refers to the process of compiling and presenting detailed financial information about a business to banks or financial institutions to assess its financial health and creditworthiness. The Credit Monitoring Arrangement (CMA) data is crucial for businesses, particularly when they are seeking loans, credit facilities, or working capital from banks. It provides a comprehensive picture of the company's financial performance, liquidity position, profitability, and future projections.

Key Components of CMA Data Preparation

- Past Financial Statements:

- Includes the two years of financial statements (balance sheet, profit and loss account) to provide a historical perspective of the company's financial performance.

- Projected Financial Statements:

- Financial projections for the next two to five years, showing expected growth, revenue, and profitability. This helps banks assess the company's future performance and its ability to repay loans.

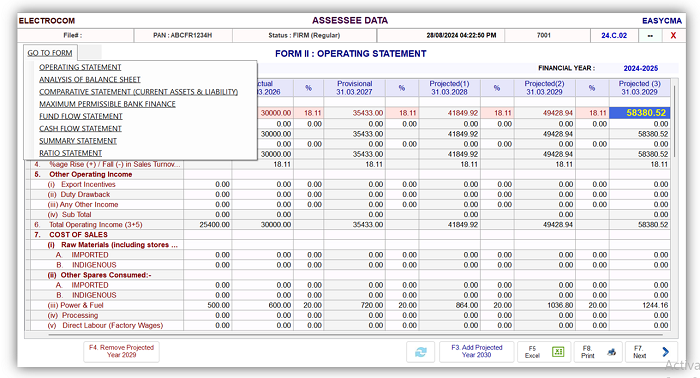

- Operating Statement:

- A detailed analysis of the company's operating income and expenses, often on a multi-year basis, highlighting key trends and financial stability.

- Maximum Permissible Bank Finance (MPBF):

- A statement that calculates the maximum working capital finance a business can obtain from a bank, based on its current assets and liabilities.

- Fund Flow and Cash Flow Statements:

- Analysis of cash inflows and outflows over a specific period to understand liquidity and cash management.

- Ratio Analysis:

- Key financial ratios such as current ratio, debt-equity ratio, and profitability ratios are calculated to evaluate financial health and performance efficiency.

- Working Capital Assessment:

- Analyzes the working capital requirements and sources of funding to ensure the business can meet its short-term obligations.

- Depreciation Schedule:

- Details the depreciation of the company's assets, using either the Written Down Value (WDV) or Straight Line Method (SLM).

Importance of CMA Data Preparation

- Loan Approval: Banks and financial institutions use CMA data to determine a business's eligibility for loans and other credit facilities.

- Financial Planning: Helps businesses plan their financial needs and manage resources efficiently.

- Transparency: Provides a transparent and comprehensive view of the company's financial status, which is essential for building trust with lenders.

- Risk Assessment: Assists banks in evaluating the risks associated with lending to a particular business and deciding on the terms and conditions of the loan.

Preferred Tools and Software for CMA Data Preparation

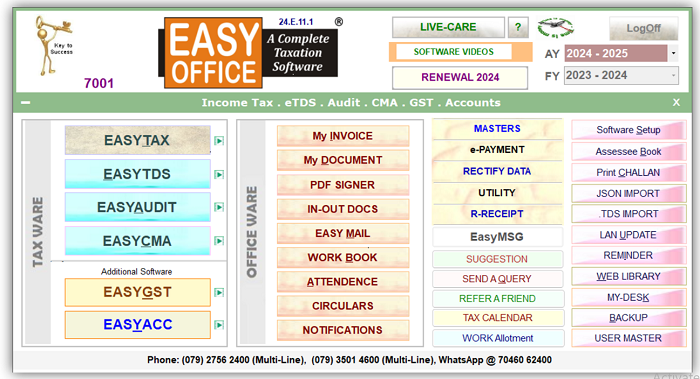

Traditionally, CMA data was prepared manually, which was time-consuming and prone to errors. Modern CMA data preparation software, such as EasyCMA (amodule of EasyOFFICE software), automates this process, ensuring accuracy and saving significant time and effort. Such software helps in generating comprehensive CMA reports, calculating MPBF, creating projected financial statements, and performing detailed financial analysis, making the process efficient and reliable.

In summary, CMA data preparation is a critical financial process for businesses seeking to secure loans from banks, as it provides a detailed analysis of the company's financial health and creditworthiness.

EasyCMA (Credit Monitoring Analysis) Software

The Best Software for CMA Data for Chartered Accountants & Tax Professionals

Chartered Accountants (CAs) and Tax professionals require precision, efficiency, and comprehensive solutions for financial analysis and reporting. EasyOFFICE Software has emerged as the go-to software for these professionals in India, offering unparalleled features for Credit Monitoring Arrangement (CMA) data preparation. Trusted by thousands of CAs, Tax practitioners, and corporates across India, EasyOFFICE Software sets the benchmark in simplifying complex financial processes and providing robust solutions.

Why EasyOFFICE is the Best Choice for CMA Data Preparation

EasyOFFICE is an all-in-one suite for financial professionals, and its EasyCMA module specifically stands out as the preferred choice for CMA data preparation Software. Here's what makes EasyOFFICE the best software for Chartered Accountants and tax professionals in India:

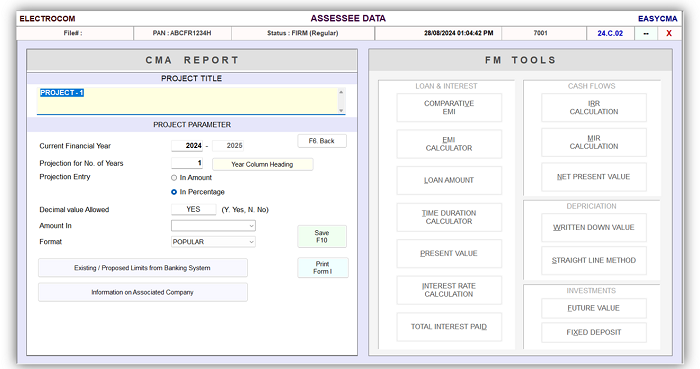

1. Comprehensive Multi-Year CMA Data Preparation

EasyCMA simplifies the intricate task of preparing CMA data by allowing multi-year data projections based on percentage increases. This feature enables professionals to generate detailed financial projections, which are crucial for businesses seeking bank loans and financial stability.

2. Automated MPBF Statement Generation

The Maximum Permissible Bank Finance (MPBF) statement is a critical component of CMA data. EasyCMA automates the preparation of this statement, including a detailed comparative analysis of balance sheets, fund flow statements, and ratio analysis. This automation not only saves time but also reduces errors, enhancing the accuracy of financial reporting.

3. Detailed Depreciation Chart

Accurate depreciation calculation is essential for financial reporting and compliance. EasyCMA offers a seamless way to prepare depreciation charts using both the Written Down Value (WDV) and Straight Line Method (SLM). This feature helps in maintaining accurate financial records in line with accounting standards.

4. Advanced Financial Tools

EasyCMA is more than just a CMA data preparation tool; it's a comprehensive financial toolkit that includes:

- Auto Interest Calculation: Automatically computes interest, simplifying complex calculations and minimizing errors.

- EMI Calculations: Effortlessly calculate Equated Monthly Installments (EMIs) for various loan types, aiding in financial planning.

- Rate of Interest Calculation: Determine the effective rate of interest for different financial instruments with precision.

- FDR Interest Calculation: Calculate the interest on Fixed Deposit Receipts (FDRs) with ease.

- Loan Calculator: Provides detailed loan repayment schedules, aiding in financial decision-making.

- IRR/MIRR Calculations: Perform Internal Rate of Return (IRR) and Modified Internal Rate of Return (MIRR) calculations for investment evaluation.

Trusted and Reliable

EasyOFFICE Software's reputation as India's leading taxation software is built on its reliability, ease of use, and comprehensive functionality. The software is trusted by thousands of professionals who rely on its accuracy and efficiency for their financial needs. Whether it's tax computation, ITR filing, TDS/TCS returns, or audit e-filing, EasyOFFICE has the right tools to simplify every aspect of a CA's workflow. EasyOffice Software is also known as Software for Chartered Accountants.

EasyOFFICE Software: A Holistic Solution

Beyond CMA data preparation, EasyOFFICE Software offers various modules to cater to the diverse needs of Chartered Accountants and tax professionals. It includes utilities for balance sheet preparation, GST compliance, office management, and much more, making it an indispensable tool for modern financial practices. EasyOFFICE Software is highly appreciated & trusted by Tax Professionals throughout in India.

Conclusion

For Chartered Accountants and tax professionals looking for a reliable and comprehensive solution for CMA data preparation, EasyOFFICE Software is the best choice. Its powerful EasyCMA module, combined with a range of financial tools and automation features, makes it the leading software in India. Trusted by thousands of professionals, EasyOFFICE Software not only enhances efficiency but also ensures accuracy and compliance, solidifying its position as the Best CMA Data Preparation Software in India.

CAclubindia

CAclubindia