Latest Update

Have you faced any technical difficulty while generating an E-way bill using the E-way bill portal? Here is a solution for you.

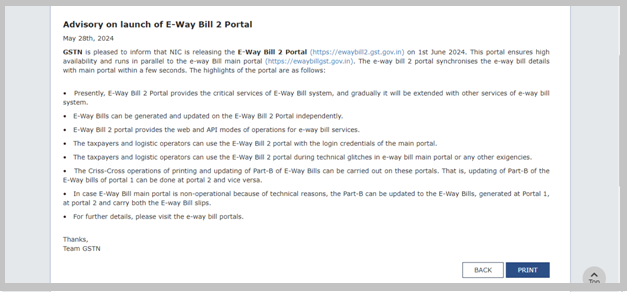

Recently, NIC released the E-Way Bill 2 Portal, as shown in the below image.

Which aims to provide high-availability services for E-way bills

Taxpayers and logistics operators can use the existing username and password created and used in the e-way bill portal. Data from the E-way Bill2 portal will be validated, merged, and made available at the primary E-way Bill portal for all business and analytical purposes. This portal is also integrated with an additional e-invoice portal for e-way bill generation so as not to affect e-invoice generation with e-way bills.

E-Way Bills can be generated and updated on the E-Way Bill2 Portal independently. Eventually, the e-Waybill1 and e-Waybill2 systems will be seamlessly merged and integrated, and this will eliminate the dependency on the e-Waybill1 system during any exigencies. The e-way bill2 portal synchronizes the e-way bill details with the main portal within a few seconds.

The E-way Bill 2 portal will provide the following critical services to taxpayers and logistic operators:

- Generate E-way bills.

- Update vehicle details

- Update transporter details.

- Print E-way Bills

- Cancel E-way bills

The criss-cross operations of printing and updating Part B of E-Way Bills can be carried out on these portals. That is, updating the e-way bills on the e-way bill1 portal can be done at the e-way bill2 portal, and vice versa. In case the E-Way Bill main portal is non-operational because of technical reasons, Part-B can be updated to the E-Way Bills generated at the E-Way Bill1 Portal, at the E-Way Bill2 Portal, and carry both the E-Way Bill slips.

You can visit the E-way Bill 2 Portal for more information at this URL: https://ewaybill2.gst.gov.in.

What is an E-way bill?

An e-way bill is a document required to be carried by a person in charge of the conveyance carrying any consignment of goods of value exceeding fifty thousand rupees as mandated by the government in terms of Section 68 of the Goods and Services Tax Act read with Rule 138 of the rules framed thereunder. It is basically generated from the E-Bill Portal (click to visit) by logging in with your credentials.

When is it required?

As per the e-way bill rules, the e-way bill is required to be carried along with the goods at the time of transportation if the value of the consignment is more than Rs. 50,000/-.

Under this circumstance, the consumer can get the e-way bill generated from the taxpayer or supplier based on the bill or invoice issued by him.

Purpose of the E-way Bill

The main objective of such compliance is to track the movement of goods across states in India under the Goods and Services Tax (GST) regime. It's essential to have a digital document generated online for the movement of goods that contains details of the consignment, the supplier, recipient, and transporter. Let’s highlight some of the key purposes:

- Ensure Tax Compliance: By generating an E-way bill for the movement of goods, it becomes easier for tax authorities to track transactions and ensure that appropriate taxes are being paid.

- Preventing tax evasion: Before the implementation of E-way bills, there were instances of tax evasion where goods were being transported without proper documentation or by underreporting the value of goods. E-way bills help curb such practices, as every movement of goods above a certain value threshold requires an E-way bill.

- Reduction of paperwork: E-way bills replace the traditional paperwork involved in the movement of goods, such as delivery challans and tax invoices, with a digital document and also increase the logistics process.

CAclubindia

CAclubindia