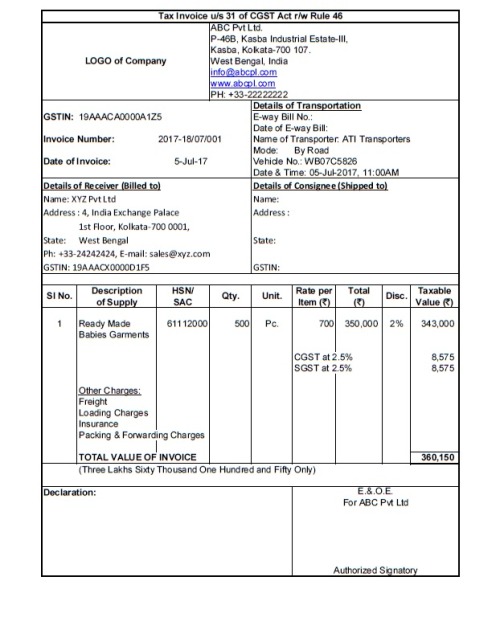

Below is the draft format for tax invoice under Goods & Services Tax. This format is prepared considering the rule of GST regarding valid tax invoice. Please note that this is one kind of tax invoice, the design can be adopted and modified according to one's needs.

Points to note:

1. In case of export of goods or services, the invoice shall carry an endorsement-

'SUPPLY MEANT FOR EXPORT ON PAYMENT OF NTEGRATED TAX' or 'SUPPLY MEANT FOR EXPORT UNDER BOND OR LETTER OF UNDERTAKING WITHOUT PAYMENT OF INTEGRATED TAX'

In case of export, the tax invoice shall contain some additional details-

a. Address of delivery,

b. Name of the country of destination,

c. and any other details as may be necessary

NB: DGFT has vide Trade Notice No. 09 dated 12.06.2017 has discontinued the use of IEC No. with introduction of GST. Those who are not having IEC number and are also not required to obtain registration number as per GST Rules, are required to mention PAN number which will be used as IEC number.

http://dgft.gov.in/Exim/2000/TN/TN17/TN0918.pdf

2. CBEC has vide notification No.12/2017- Central Tax dated 28.06.2017 has specified the types of assesses who are required to mention HSN codes mandatorily in the tax invoice. If anyone doesn’t fall under the mentioned category, then mentioning of HSN Code is not mandatory. However, the same can be mentioned on a voluntary basis in the tax invoice.

To Understand various nitty-gritty of a tax invoice read the following article-

The Various nitty-gritty of tax invoice under GST

CAclubindia

CAclubindia