Introduction

The income tax portal has introduced a new feature that enables users to ‘Discard ITR’ for unverified original, belated, or revised ITRs starting from the assessment year 2023-24. It is a good move by the income tax department as it will increase the scope for taxpayers for revision of their income tax return, which was earlier limited to omission and error. However, so far there is no provision in law for discarding the ITR hence going forward its legal validity can be questioned.

The new 'Discard' facility allows taxpayers to manage their ITR filings more efficiently and helps rectify any inaccuracies or omissions within the specified windows. But it's essential to use it with caution as once discarded, an ITR can't be restored.

Process to Discard ITR

The discard option can be used repeatedly, provided the ITR status remains as unverified or pending verification. The facility is only available for the AY24 onwards for the respective ITR till the specified time limit for filing ITR under section 139(1)/139(4) /139(5). Once an ITR is discarded, it cannot be reinstated. The action is irreversible, and therefore it is essentially disclaiming that the ITR was not filed at all.

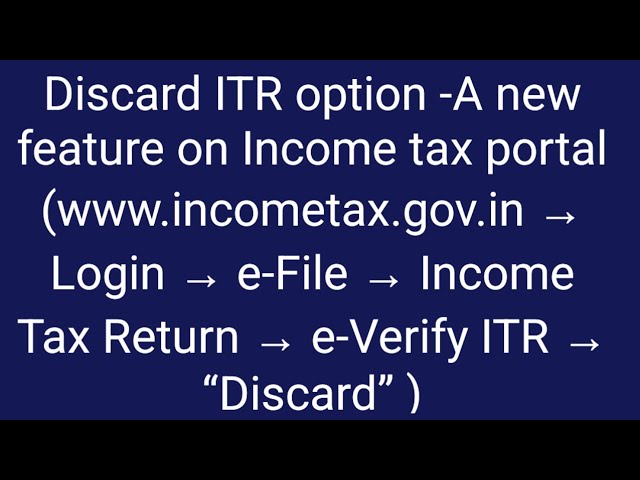

To locate the 'Discard' option, follow the website pathway: Income tax → Login → e-File → Income Tax Return → e-Verify ITR → “Discard.”

Is it Compulsory to file subsequent ITR after discard?

No, It is not compulsory to file a subsequent ITR if you have discarded your previously unverified ITR. However, given that the taxpayer has uploaded the return data earlier, it is generally anticipated that they would file another ITR subsequently. Moreover, if you have dispatched your ITR V to CPC and it is intransit, but you realize that the details were not reported correctly, you are explicitly advised not to discard such returns.

Discard Return FAQs

Question 1: I filed my Original ITR u/s 139(1) on 30th July 2023 but not yet verified. Can I Discard it?

Response: Yes, user can avail the option of "Discard" for the ITRs being filed u/s 139(1) /139(4) / 139(5) if they do not want to verify it. User is provided a facility to file an ITR afresh after discarding the previous unverified ITR. However, if the "ITR filed u/s 139(1)" is Discarded and the subsequent return is filed after the due date u/s 139(1), it would attract implications of belated return like 234F etc., Thus, it is advised to check whether the due date for filing the return u/s 139(1) is available or not before discarding any previously filed return.

Question 2: I Discard my ITR by-mistake. Is it possible to reverse it?

Response: No, if ITR is Discarded once, it can’t be reversed. Please be vigilant while availing Discarding option. If an ITR is Discarded, it means that, such ITR is not filed at all.

Question 3: Where can I find "Discard option"?

Response: User can find Discard option in below path : www.incometax.gov.in → Login → e-File → Income Tax Return → e-Verify ITR → "Discard"

Question 4: Is it mandatory to file subsequent ITR if I "Discarded" my previous unverified ITR ?

Response: A user, who has uploaded the return data earlier, but has made use of the facility to discard such unverified return is expected to file subsequent an ITR later on, as it is expected that he is liable to file the return of income by way of his earlier action.

Question 5: I sent my ITR V to CPC and it is in transit and not yet reached CPC. But I don’t want to verify the ITR as I get to know that details not reported correctly. Can I still avail "Discard" option?

Response: User shall not discard such returns, where the ITR-V has already been sent to CPC. There is an undertaking to this effect before discarding the return.

Question 6: When can I avail this "Discard" option and can I avail this "Discard" option multiple times or only once?

Response: User can avail this option only if the ITR status is "unverified" / "Pending for verification". There is no restriction on availing this option multiple times. Precondition is "ITR status" is "Unverified" / "Pending for verification".

Question 7: My ITR filed for AY 2022-23 is pending for verification. Can I avail this "Discard" option?

Response: User can avail this option only from AY 2023-24 onwards for the respective ITR. This option will be available only till time limit specified for filing ITR u/s 139(1)/139(4) /139(5) (i.e., 31st December of respective AY as of now).

Question 8: I discarded my Original ITR 1 filed on 30th July 2023 on 21st August 2023 and I want to file subsequent ITR on 22nd August 2023. Which section should I select?

Response: If user discards the Original ITR filed u/s 139(1) for which due date u/s 139(1) is over, they are required to select 139(4) while filing subsequent return. As there is no prior valid return exist, date of Original ITR / Acknowledgement number if Original ITR fields are not applicable. Further, if user wants to file revised return in future, he needs to provide details of "Original filing date" and "Acknowledgement number" of the valid ITR i.e., ITR filed on 22nd August 2023 for filing revised ITR.

CAclubindia

CAclubindia