Introduction

As we all are aware about the word "Depreciation", Do you know what does it actually means Depreciation is an accounting practice used to spread the cost of a tangible or physical asset over its useful life. As in any business Fixed Assets are required to be depreciated to asset's value has been used up in any given time period. Companies depreciate assets for both tax and accounting purposes and have several different.

As we all are aware income from business & profession are subject to tax under the head of "Profit & gains from Business & profession" of Income Tax Act 1961

While computing Taxable PGBP an Allowable Expenses & deductions are need to be subtracted & Depreciation is one of the important deductions that an assessee will get deducted in his total earnings lets understand it in detail

Depreciation under Companies Act

Do you know there is different treatment prescribed under both acts & there are some of the key differences between depreciation under companies Act & Income Tax Act

Firstly, let's talk about depreciation as per Companies Act

Depreciation is calculated annually based on the methods specified in the statute. Companies Act prescribes two methods for calculating depreciation:

- Straight Line Method (SLM) and

- Written Down Value Method (WDV).

Such Act has also specified useful life of the various class of assets in Schedule II, as a basis to determine the rate of depreciation under SLM, WDV or Unit of Production (UOP) method. The method of depreciation selected affects the profit as well as the carrying value of assets of a Company.

Why there is difference between depreciation under both Acts

Depreciation is basically claimed for two purposes:

- Accounting Purpose

- Taxation Purpose

Under Company Law, depreciation is calculated based on the useful life of an asset

determined by the company which mainly refers to 2 basic aspects i.e. A decrease in the value of the assets and allocation of the cost of assets to the useful life of the assets.

While in taxation, depreciation refers to the reduction in net taxable income to reduce the amount of tax payable by the company. As depreciation on assets is allowed as an expense to the company while arriving at income under the head of Income from business and profession, from the year in which asset is put to use for the first time and is calculated on the basis of the block of assets at the rates specified in the income tax act in that regard.

As the depreciation under Income Tax Act & Companies Act will be different which raise a timing difference which need to be accounted in the books via Differed Tax Assets/Differed Tax Liabilities as per accounting standard 22

Let's Understand Depreciation as per income tax act in detail.

Depreciation under Income Tax Act

Section 32 of Income tax Act 1961 governs the computation of depreciation for the purpose of computation of taxable incomes from Business/Profession

First, Let's talk about the conditions to be satisfied in order to claim Depreciation:

- The Asset must be wholly or partly owned by the Assessee.

- The Asset must be use in the Business or Profession of an Assessee. If the assets are not used exclusively for the business, but for other purposes as well, depreciation allowable would be proportionate to the use of business purpose under section 38 of the act

- Depreciation on Land & Goodwill can not be claimed

- Depreciation can be claimed by co- owners to the extent of value of Asset owned by each co-owner

- Depreciation is mandatory Deduction allowed under the said head &shall be allowed or deemed to have been allowed as a deduction irrespective of a claim made by a taxpayer in the profit & loss account.

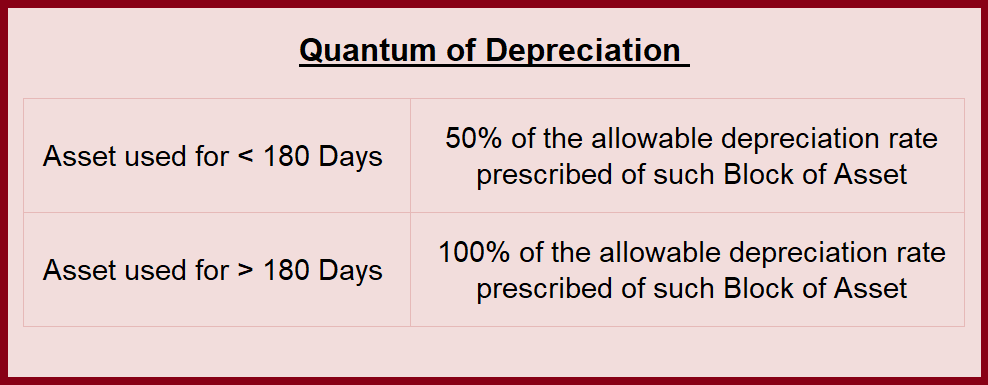

Quantum of Depreciation

The Asset must be put to use at any time during the previous year. As the amount of depreciation is not claimed on the proportionate basis as below

** Such Restriction applies only to the year of acquisition & not for the subsequent years.

Computation of Depreciation Allowance

Block of Assets

Depreciation is calculated on the WDV of a Block of assets. Block of assets is a group of assets falling within a class of assets comprising of:

- Tangible assets, being building, machinery, plant or furniture.

- Intangible assets, being know how, patents, copyrights, trade-marks, licenses, franchises or any other business or commercial rights of similar nature.

The block of Assets is identified depending on its life, nature & similar use. Individual Assets are not taken in to consideration rather all related assets are grouped in one Block & the prescribed rates will apply.

Rates of Depreciation

Following are the rates prescribed by Act used frequently in FY 23 - 24

|

PART A Tangible Assets |

||

|

I |

Buildings |

Rate |

|

Block 1 |

Building used Mainly for residential purpose except hotels and Boarding House |

5% |

|

Block 2 |

Buildings which are not mainly used for residential Purpose & not covered by Block 1 & 3 |

10% |

|

Block 3 |

Buildings procured on or after September 1, 2002, for installing plant and machinery forming part of water treatment system or water supply project and which is used for the purpose of business of providing infrastructure facilities under clause (i) of subsection (4) of section 80-IA |

40% |

|

Block 4 |

Purely temporary erections like wooden structures |

40% |

|

II |

Furniture & Fittings |

|

|

Block 1 |

Furniture & Fittings including electrical fittings |

10% |

|

III |

Plant &machinery |

|

|

Block 1 |

Motor Cars other than those used in a business of running them on hire, acquired during the period from 23.08.2019 to 31.03.2020 &put to use on or before 31.03.2020 |

30% |

|

Block 2 |

Motor Cars other than those used in a business of running them on hire, acquired or put to use on or after 01.04.1990 (Other than Block 1) |

15% |

|

Block 3 |

Lorries/taxis/motor buses used in a business of running them on hire purchased on or after 23 August 2019 but before the 1 April 2020 and is put to use before 1 April 2020 |

45% |

|

Block 4 |

Moulds Used in rubber & Plastic goods factories |

30% |

|

Block 5 |

Aero planes, Aeroengines |

40% |

|

Block 6 |

Specified air pollution control equipment's |

40% |

|

Block 7 |

Lifesaving medical equipment's |

40% |

|

Block 8 |

Containers made of glass or plastic used as re-fills |

40% |

|

Block 9 |

Renewable Energy saving devices |

40% |

|

Block 10 |

Computers including computer software's |

40% |

|

Block 11 |

Books (Annual publications or other than annual publications) owned by assessees carrying on a profession |

40% |

|

Block 12 |

Books owned by assessees carrying on business in running lending libraries |

40% |

|

Block 13 |

Plant &machinery (General Rate) |

15% |

|

IV |

Ships |

|

|

Block 1 |

Ocean Going ships |

20% |

|

Block 2 |

Vessels ordinarily operating on inland waters |

20% |

|

Block 3 |

Speed boats operating on inland waters |

20% |

|

PART B Intangible Assets |

||

|

Block 1 |

Know-how, Patents, Copyrights, Trademarks, Licenses, Franchises or any other business or commercial rights of similar nature not being goodwill of a business or profession |

25% |

Additional Depreciation

In case of any new machinery or plant (excluding ships and aircraft) acquired and installed after March 31, 2005 by an assessee who is engaged in the business of manufacture or production of any article or thing - additional depreciation under Income Tax Act of 20% of actual cost shall be allowed.

Where the asset is used for less than 180 days than 50% depreciation i.e, 1/2 of 20% (i.e. 10%) is available (Balance 50% of Additional Depreciation can be claimed in next year).

Non-Applicability

On the following Plant and Machinery (P&M) no Additional Depreciation can be claimed

- Additional Depreciation is only on Plant and Machinery and not other assets like Furniture and Buildings.

- Ships and Aircrafts

- Second hand or used P & M

- P & M used in office/Home/Guesthouse

- Office Appliances

- Road Transport Vehicles(Car etc)

- 100% Depreciable Assets (like Pollution Control Equipments)

Note

- Additional Depreciation is only for factories or power generation units, not for dealer or service providers.

- Additional Depreciation is not allowed under new tax regime

After understanding above discussion let's take one illustration to understand the concept deeply,

Illustration

Mr. X, a proprietor engaged in manufacturing business having following particulars

- Opening WDV as on 1.4.2023 Rs. 30,00,000

- New Plant & Machinery Acquired & put to use on 08.06.2023 Rs. 20,00,000

- New Plant & Machinery Acquired & put to use on 15.12.2023 Rs. 8,00,000

- Computer acquired & installed in the office premises on 02.01.2024 Rs. 3,00,000

Compute Depreciation & Additional Depreciation for AY 24.25

Solution

|

Calculation of closing WDV of plant & machinery |

||

|

Particulars |

Plant & Machinery |

Computer |

|

Opening WDV as on 01.04.2023 |

30,00,000 |

|

|

ADD: Acquired during the year |

||

|

Put to use for > 180 days i.e. 08.06.23 |

20,00,000 |

|

|

Put to use for < 180 days i.e. 15.12.23 |

8,00,000 |

|

|

Computer purchased & put to use < 180 days |

3,00,000 |

|

|

Closing WDV as on 31.03.2024 |

58,00,000 |

3,00,000 |

|

Total assets put to use for >180 days |

50,00,000 |

|

|

Total assets put to use for <180 days |

8,00,000 |

3,00,000 |

|

Computation of depreciation & additional Depreciation for AY 24-25 |

||

|

Particulars |

Plant & Machinery |

Computer |

|

Normal Depreciation: |

||

|

15% of Rs. 50,00,000 (>180 Days) |

7,50,000 |

|

|

7.5%(Half of 15%) of Rs. 8,00,000 (<180 days) |

60,000 |

|

|

20%(Half of 40%) of Rs. 3,00,000 (<180 days) |

60,000 |

|

|

Additional Depreciation |

||

|

20% on Rs. 20,00,000 newly acquired Plant & Machinery (>180 Days) |

4,00,000 |

|

|

10% on Rs. 8,00,000 newly acquired Plant & machinery (<180 days) |

80,000 |

|

|

Total Depreciation allowed for AY 24-25 |

12,90,000 |

60,000 |

CAclubindia

CAclubindia