Permanent Account Number, is an essential identification number issued by the Income Tax Department of India. The Permanent Account Number (PAN) is a ten-digit alphanumeric code issued by the Income Tax Department. Here is a concise explanation of its formation with examples:

First three characters: They represent an alphabetic series running from AAA to ZZZ.

Fourth character: It represents the status of the PAN holder. Some examples are:

- "A" for Association of Persons (AoP)

- "B" for Body of Individuals (BOI)

- "C" for Company

- "F" for Firm/Limited Liability Partnership

- "G" for Government Agency

- "H" for Hindu Undivided Family (HUF)

- "J" for Artificial Juridical Person

- "L" for Local Authority

- "P" for Individual

- "T" for Trust

Fifth character: For individuals, it represents the first character of the last name/surname. For non-individuals, it represents the first character of the name.

Next four characters: They are sequential numbers from 0001 to 9999. These numbers help differentiate between multiple PAN holders with similar details.

Last character: It is an alphabetic check digit that ensures the integrity of the PAN. This digit is calculated based on the other characters in the PAN.

Combining all the above items provides a PAN with its unique identity. [Eg : ABCTY1234D]

Importance of PAN

Here are the key points highlighting the importance of PAN:

- PAN serves as a unique identifier for individuals, businesses, and entities for tax-related purposes, including filing tax returns, paying taxes, and conducting financial transactions.

- PAN is mandatory for various financial transactions such as opening bank accounts, buying/selling property, investing in securities, and more.

- PAN enables the government to track financial transactions and identify instances of tax evasion or money laundering. It aids in maintaining transparency and accountability in the financial system.

- PAN is necessary for individuals and businesses engaged in international transactions, including foreign investments, receiving foreign funds, and conducting business abroad. It facilitates cross-border financial activities.

- PAN serves as an essential document for the Know Your Customer (KYC) process. Financial institutions and service providers require PAN for verifying and establishing the identity of customers.

Documents required for Applying for a PAN card

To apply for a PAN Card, you will need to submit the following documents:

- For Individual Applicants: Proof of identity (Aadhaar, Voter ID, Driving License, etc.) andproof of address (utility bill, bank account statement, passport, etc.)

- For Hindu Undivided Family (HUF): Affidavit issued by the Karta of the HUF, mentioning the name, address, and father's name of every coparcener, proof of identity, address, and date of birth (if applying individually)

- For Companies Registered in India: Copy of Registration Certificate issued by the Registrar of Companies

- For Firms and Limited Liability Partnerships Registered or Formed in India: Copy of Registration Certificate issued by the Registrar of Companies and a copy of Partnership Deed

- For Trusts Formed or Registered in India: Copy of Registration Certificate Number issued by a Charity Commissioner.

- For Association of Persons: Agreement Copy or Registration Number Certificate issued by the Registrar of Co-operative Society or Charity Commissioner. Document issued by the Central or State Government, mentioning address and identity

- For Non-Indian Citizens: Proof of identity (Copy of PIO/OCI, Passport, etc.) and proof of address (bank statement, NRE Bank statement, VISA copy, etc.)

How to apply pan card online

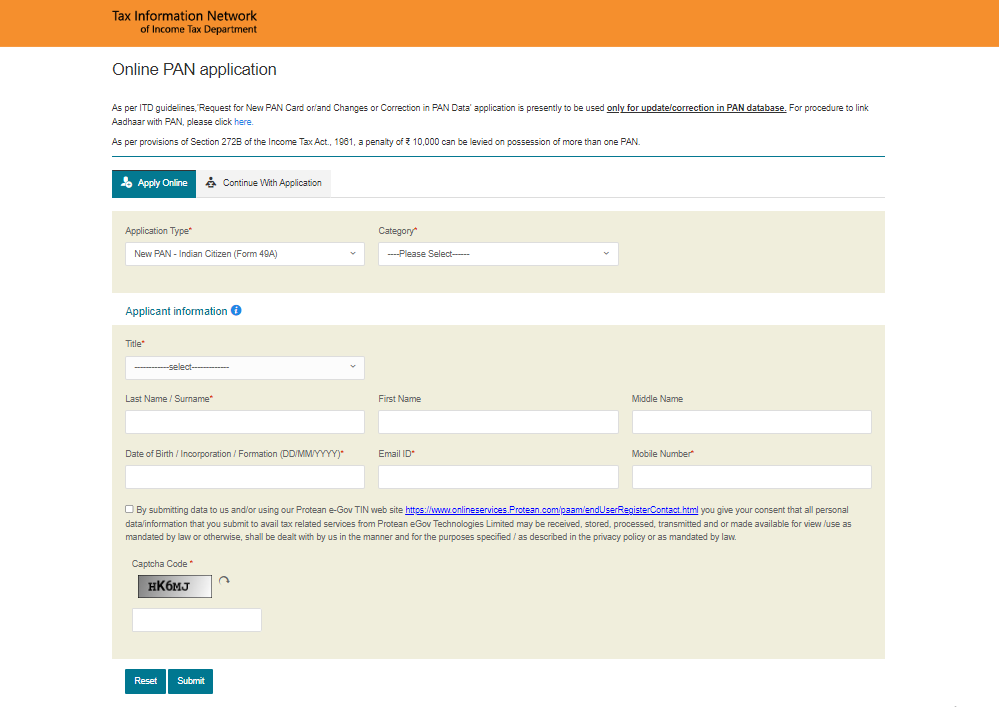

To apply for a PAN card through NSDL:

- Visit the NSDL website and select the "New PAN Indian Citizen (Form 49A)" option.

- Read the detailed instructions provided on the website before filling out the form.

- Fill in all the required details accurately on the PAN card application form.

- Pay the processing fee online using credit/debit card, demand draft, or net banking.

- After submitting the form and making the payment, an acknowledgement slip with a 15-digit number will be generated and sent to your email.

- Choose one of the two options for further processing:

- E-Sign the application using Aadhaar OTP authentication.

- Send the application with the required documents to the NSDL PAN office by courier within 15 days of online submission.

- If you choose to send the application by courier, include all necessary documents as per the instructions.

- NSDL will verify the application and documents upon receipt.

- Once verified, NSDL will issue the PAN card within 15 days.

How to Check Pan Card Status Online

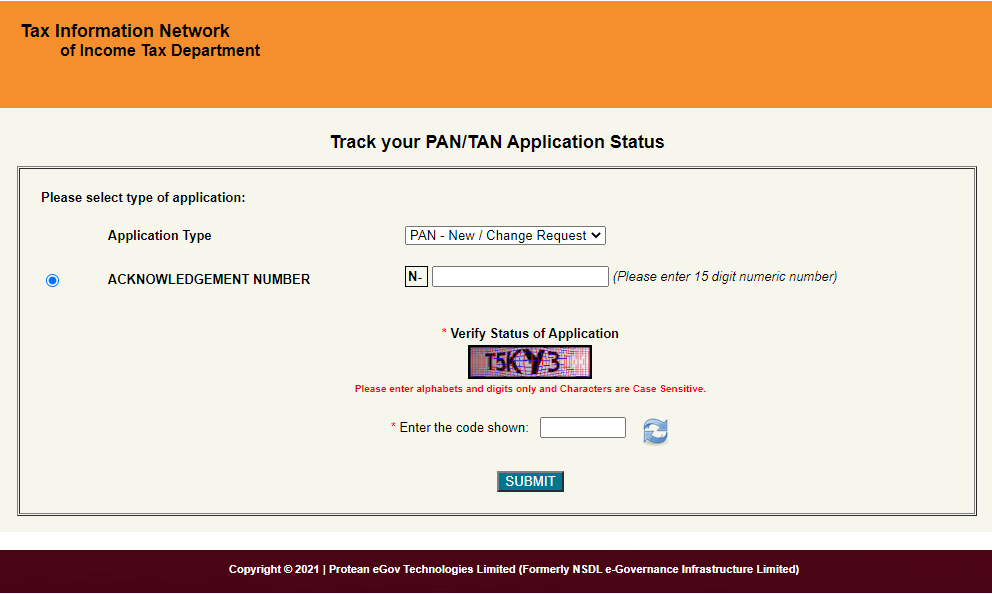

Here are the steps to check Pan card status online :

- Visit the official website of NSDL at https://tin.tin.nsdl.com/pantan/StatusTrack.html

- Select “PAN-New/Change Request” from the “Application Type” section

- Enter your 15-digit acknowledgement number in the given field

- To verify status of PAN card application, enter the captcha code from the given box

- Click on “Submit” button. Your NSDL PAN Card status will appear on your screen.

How to Apply Duplicate PAN Card Online if PAN card is lost /How to Make Changes or Corrections in PAN Card

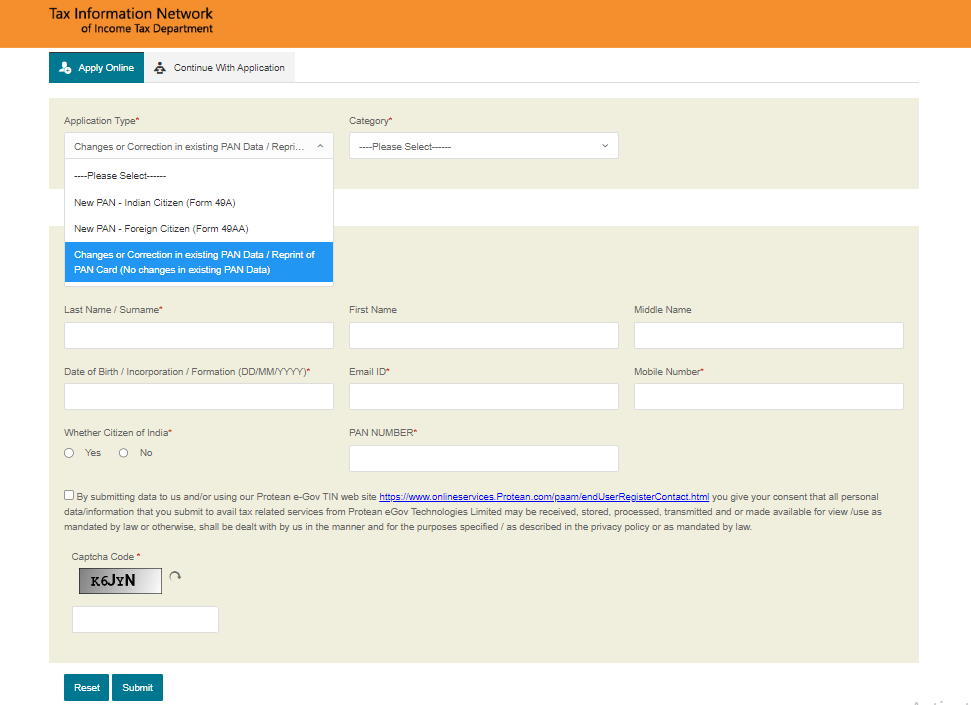

To apply for a duplicate PAN card online if your PAN card is lost, follow these steps:

- Visit the NSDL website.

- Select the application type as "Changes or correction in existing PAN data/ Reprint of PAN card (No changes in existing PAN data)."

- Fill in all the required fields and click on "Submit." A token number will be generated and sent to your registered email for future reference.

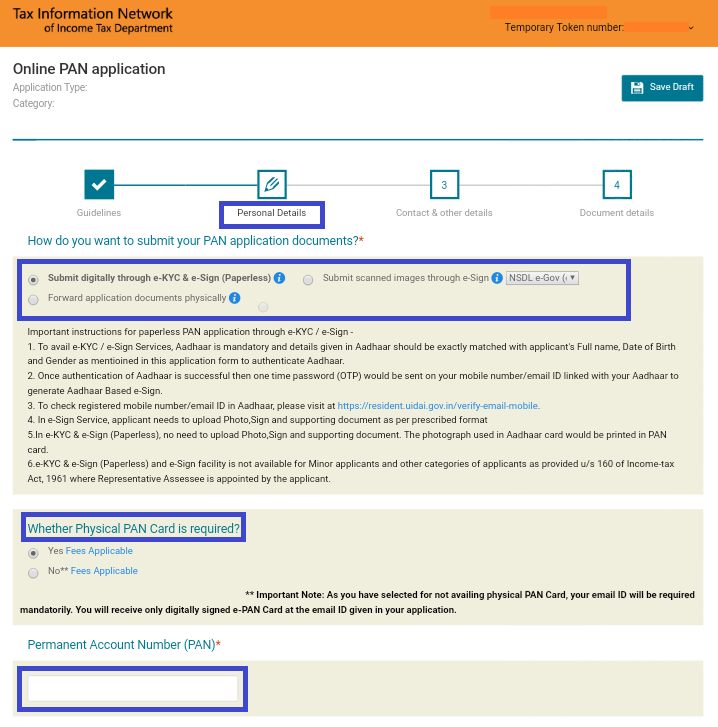

- Provide personal details and choose the PAN application submission mode.

- Choose one of the processing options:

- Submit digitally through e-KYC & e-sign.

- Submit scanned images through e-sign.

- Forward application documents physically.

- Select whether you need a physical PAN card or an e-PAN card. If opting for an e-PAN card, provide a valid email ID to receive the digitally signed e-PAN card.

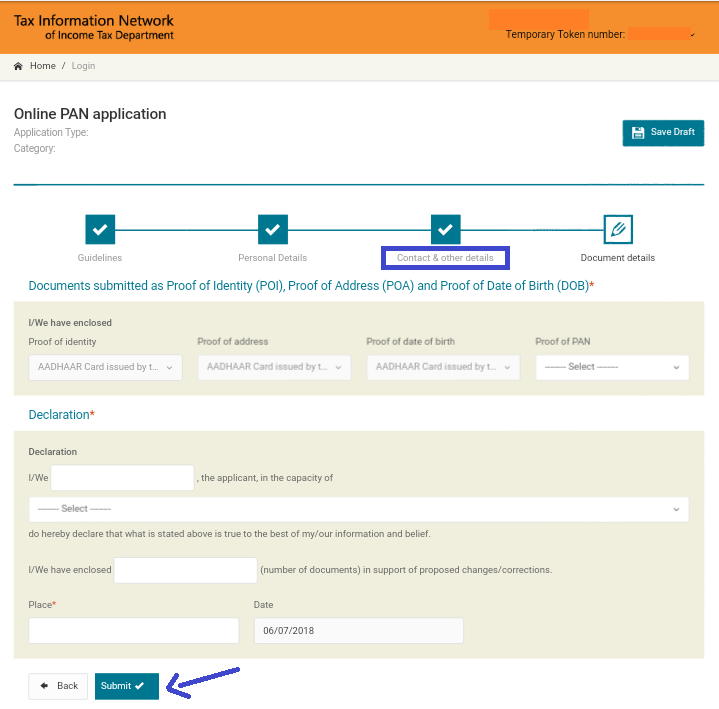

- Fill in the "Contact & other details" and "document details" pages and submit the application.

- You will be redirected to the payment page. Make the payment, and an acknowledgement receipt will be generated.

- The PAN card will be issued to you within 15-20 working days.

CAclubindia

CAclubindia