De-dollarization refers to the process by which countries reduce their reliance on the U.S. dollar in international trade and finance. This movement has been gaining momentum as nations seek to diminish the dollar's dominance in global markets. Understanding the implications of de-dollarization is crucial, as it signifies a potential shift in economic power and the reconfiguration of the global financial system.

Historical Context: The Rise of the U.S. Dollar

Post-World War II Dominance

After World War II, the U.S. dollar emerged as the world's primary reserve currency. The Bretton Woods Agreement of 1944 established a system of fixed exchange rates, with the dollar pegged to gold and other currencies pegged to the dollar. This system solidified the dollar's central role in global finance. It is a reserve currency, medium of engage and unit of account. The dollar holding the supremacy signifies that what ever happens in the US tends to affect has multiplier effect across the global landscape as it holds the position of the Reserve currency

The fall of Bretton Woods

In 1971, President Nixon ended the dollar's convertibility to gold, leading to the collapse of the Bretton Woods system. Despite this, the dollar remained dominant due to the size and stability of the U.S. economy, its deep financial markets, and the widespread use of the dollar in global trade and finance.

What is De-Dollarization?

De-dollarization involves a significant decrease in the use of the U.S. dollar for global trade and financial transactions, leading to reduced demand for the dollar by nations, institutions, and corporations. This shift would weaken the dominance of the dollar-based global capital market, where international borrowing and lending occur primarily in dollars.

Two scenarios could contribute to the erosion of the dollar's status. The first involves negative events that compromise the perceived safety and stability of the dollar, as well as the U.S.'s overall position as the world's foremost economic, political, and military power.

The second scenario encompasses positive developments outside the U.S. that enhance the credibility of other currencies, such as economic and political reforms in China. As Wise noted, "A country's reserve currency must be viewed as safe and stable, and it must provide a source of liquidity that is adequate to meet growing global demand."

The US has successfully defended role as global currency but until now…… will it maintain its dominance or lose out to factors as outlined below

Factors Driving De-Dollarization

Geopolitical Tensions and Bilateral Trade Agreements

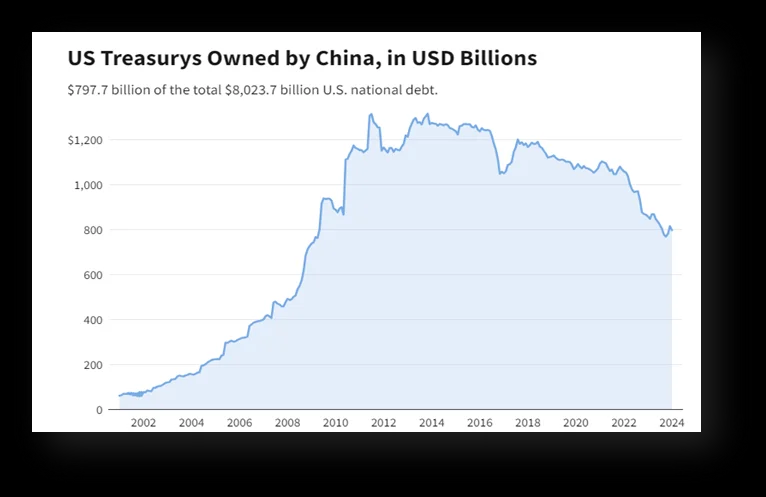

Increasing geopolitical tensions, particularly between the U.S. and major economies like China and Russia, have accelerated de-dollarization efforts. Sanctions and trade disputes have prompted these countries to seek alternatives to the dollar to protect their economies from U.S. influence. After the US Sanction of Russian Reserves in $, led to major economies divesting their $ holdings and reserves and opted to settled bilateral trades in local currency.

Let's delve deep into one such case

- China now settles half of its cross border trade in renminbi, up from zero in 2010

- Rise in RMB use highlights sanctions-proofing strategy of Beijing and its allies, such as Russia

- China's promotion of CIPS, its home-grown alternative to Swift, may support rise in RMB use (Development of Alternative Payment Systems)

- Recently India and china agreeing to settle payments by Maldives in Maldivian Rufiyaa

- India and china agreeing to settle bilateral trade in yuan

- UAE Dirham is emerging as third currency for Bilateral trade amongst southeast nations

- Emergence of BRICS+ as next super power

- After the recent meet of BRICS with Saudi Arabia and deciding to settle the trades in local currency and netting off the difference with gold purchase. Resulted in

- China Exports of transportation to Saudi rising 400% in first 4 months of CY24 vs 201

- India Exports of engineering good rising to $1.25 Billion from $625 Million

Economic Diversification

Countries are also motivated by the desire to diversify their foreign exchange reserves and reduce exposure to dollar-related risks. Holding a more diverse portfolio of currencies can mitigate the impact of U.S. economic policies on their economies.

Technological Advancements

Advancements in financial technology, such as digital currencies and block chain, provide new avenues for international transactions that bypass traditional banking systems dominated by the dollar. These technologies enable more efficient and secure cross-border payments, supporting the de-dollarization trend.

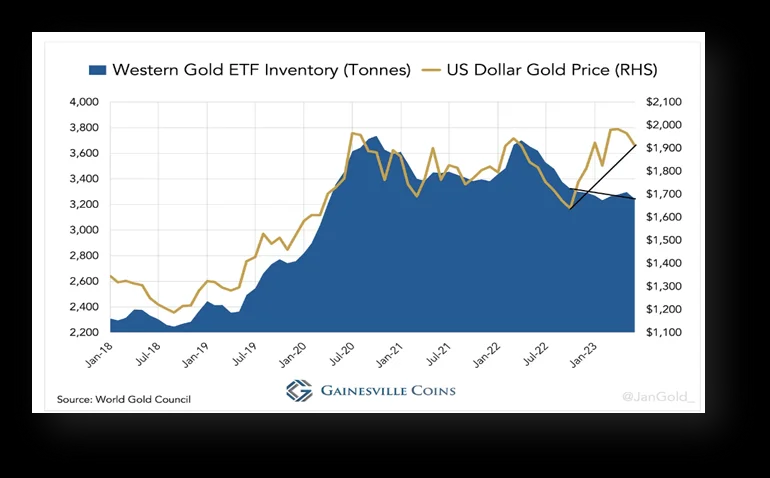

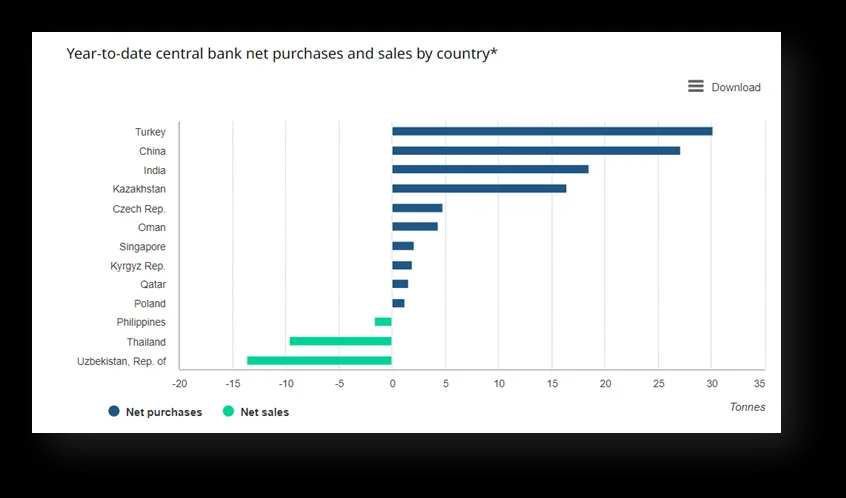

Accumulation of Gold Reserves

Many countries are bolstering their gold reserves as a hedge against dollar volatility. Gold is seen as a stable store of value, and increasing gold holdings can strengthen a country's financial stability independent of the U.S. dollar. Gold slowly gaining the status of reserve currency. That's why we have been seeing an exceptional rally in gold, as major economies are offloading their reserve in $ and buying gold after the 2022 fiasco.

Implications of De-Dollarization

Impact on the U.S. Economy

De-dollarization could have profound effects on the U.S. economy. The dollar's dominance allows the U.S. to borrow at lower costs and run large trade deficits. A decline in demand for dollars could lead to higher interest rates and reduced economic flexibility.

Shifts in Global Power

As countries reduce their dependence on the dollar, the balance of global economic power may shift. Emerging markets and developing economies could gain more influence, leading to a more multipolar world order. Rise of multi-polarized world.

Changes in Global Financial Markets

De-dollarization could lead to greater currency volatility and changes in capital flows. Financial markets would need to adapt to a more diverse currency landscape, potentially increasing transaction costs and complexity.

Enhanced Financial Sovereignty

For countries pursuing de-dollarization, enhanced financial sovereignty is a significant benefit. By reducing their exposure to dollar-related risks, these nations can pursue independent economic policies and protect themselves from external shocks.

Challenges to De-Dollarization

Entrenched Dollar Dominance

The dollar's entrenched position in global finance is a significant obstacle to de-dollarization. It remains the most widely used currency for trade and investment, and dislodging it will require substantial changes in international economic practices.

Market Liquidity Concerns

The deep liquidity of dollar-denominated assets is unmatched by other currencies. Alternative currencies may struggle to offer the same level of market liquidity, making them less attractive for international transactions.

Coordination among Nations

Successful de-dollarization requires coordinated efforts among multiple countries. Achieving consensus on complex financial and economic policies is challenging, particularly among nations with diverse interests and economic conditions.

Future Prospects

Gradual Transition

De-dollarization is likely to be a gradual process rather than an abrupt shift. While some countries are making significant strides, the dollar's entrenched position means that a complete overhaul of the global financial system will take time.

Rise of Digital Currencies

The development and adoption of digital currencies, including central bank digital currencies (CBDCs), could accelerate de-dollarization. Digital currencies offer a new mechanism for international trade and finance, potentially bypassing traditional dollar-dominated systems.

Increased Regional Cooperation

Regional cooperation and the strengthening of regional currencies could play a pivotal role in de-dollarization. Initiatives that promote monetary stability and cooperation within regions will be crucial in reducing dependence on the dollar.

Conclusion

De-dollarization represents a significant shift in the global economic landscape. Driven by geopolitical tensions, economic diversification, and technological advancements, countries are increasingly seeking alternatives to the U.S. dollar. While the process faces numerous challenges, the potential implications are profound, affecting everything from the U.S. economy to global financial markets and the balance of international power. As the world moves towards a more multipolar financial system, understanding and navigating the complexities of de-dollarization will be crucial for policymakers, businesses, and investors alike.

Disclaimer: This article provides general information existing at the time of preparation and we take no responsibility to update it with the subsequent changes in the law. The article is intended as a news update and Affluence Advisory neither assumes nor accepts any responsibility for any loss arising to any person acting or refraining from acting as a result of any material contained in this article. It is recommended that professional advice be taken based on specific facts and circumstances. This article does not substitute the need to refer to the original pronouncement

CAclubindia

CAclubindia