I have been writing this Article to simplify the process of filing FC-GPR form. Form FC-GPR is required to be filled at the time of receiving Foreign Direct Investment (FDI) from the non-resident investor. This FDI comes either 'Automatic Route' or 'With the approval of Government". Here, I am not emphasizing much on the eligibility norms and guidelines relating to FDI prescribed under FEMA Act rather I will enlighten about the steps to be taken and process to be followed relating to FDI.

Let me take you through all this step by step-

ISSUE OF 'FIRC' & 'KYC OF INVESTOR' BY AUTHORIZED DEALER

The authorized dealer of the Indian entity after the receipt of fund from the non-resident investor will issue "Certificate of Foreign Inward remittance" & "Know your Customer Form in respect of the Non-resident Investor" which is required for the purpose of filing FC-GPR Form.

REGISTRATION OF ENTITY USER

Meaning of Entity

- A company within the meaning of section 1(4) of the Companies Act, 2013,

- A Limited Liability Partnership (LLP) registered under the Limited Liability PartnershipAct, 2008,

- A startup which complies with the conditions laid down in Notification No. G.S.R 180(E) dated February 17, 2016 issued by Department of Industrial Policy andPromotion, Ministry of Commerce and Industry, Government of India.

Entity user

- An entity user would be the sole person authorized by the Indian entity who is responsible for reporting foreign investment details of an Entity.

- One person can also be an entity user for more than one entity. However, the personhas to obtain separate registrations for the same as the registration is entity specific.

- One entity can have only one entity user. If the entity wishes to change the Entityuser, it may contact RBI helpdesk, the details of which are available under "ContactUs".

Registration process

For Registration- Go to the website

https://firms.rbi.org.in/firms/faces/pages/login.xhtml

Select registration form - For New Entity User

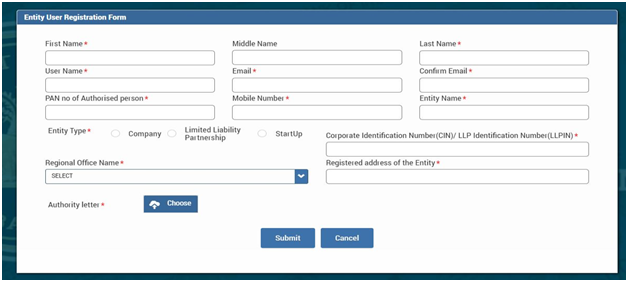

Fill the required details like-

(Name of the Authorized person of the Entity, Create User name,fill mail id, Pan of authorized person, Mobile no, fill Entity Name, select Entity type and fill CIN/LLPIN,Select regional Office and Fill Registered address of the Entity)

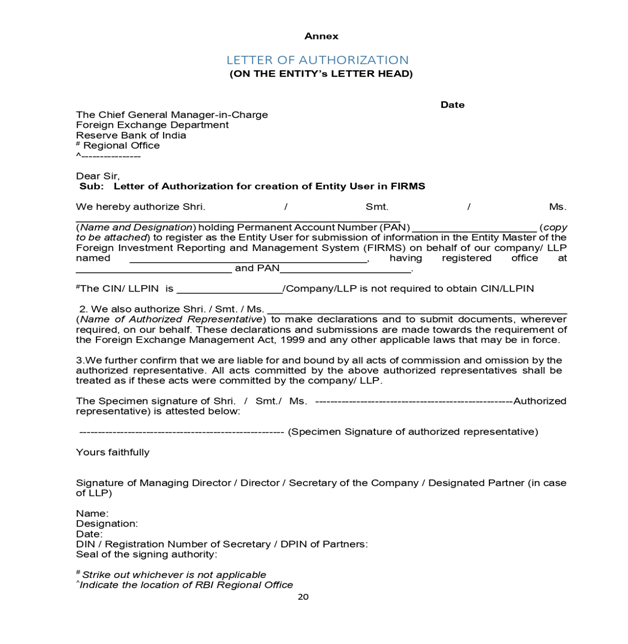

Documents upload

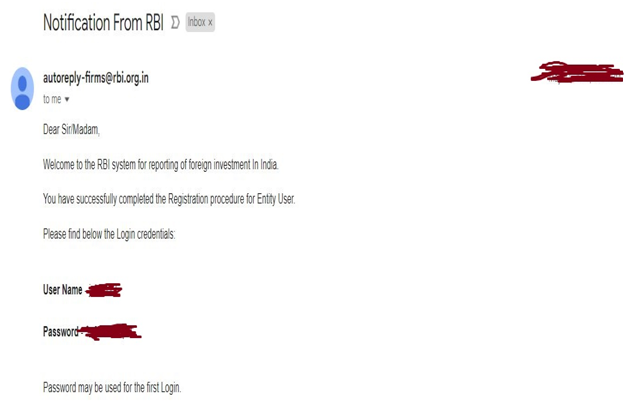

Authority Letter submitted by the entity user will be verified by RBI and after RBI's approval, the user will receive the password on their registered email ID from RBI email ID autoreply-fid@rbi.org.in.

After getting this mail, login to the main screen using the credentials provided in the mail and then change the password.

CREATION OF ENTITY MASTER

After logging, following screen appears

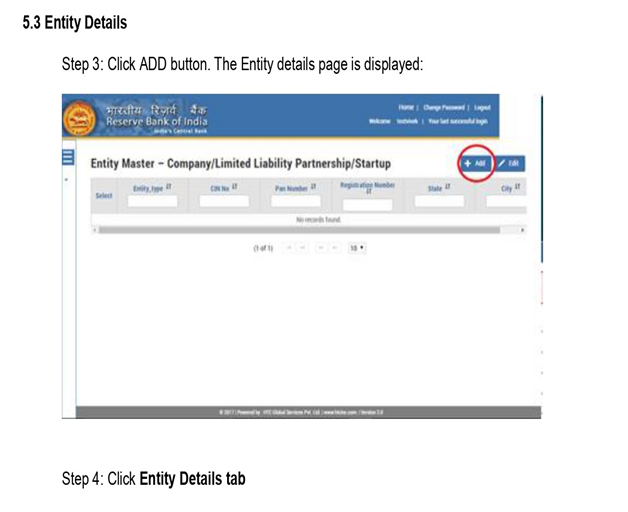

Click on the drop down arrow, then this screen appears

Click on Add button, Entity details will be displayed like this

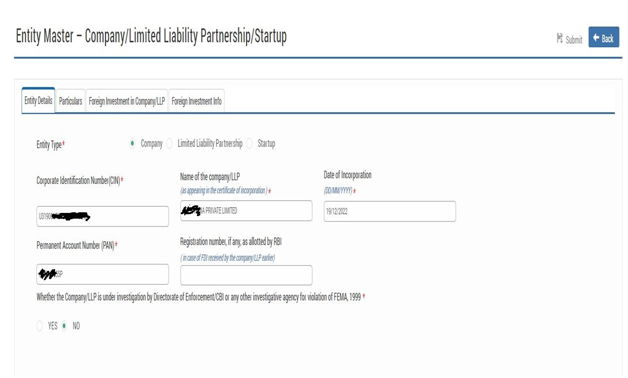

CREATION OF ENTITY DETAILS

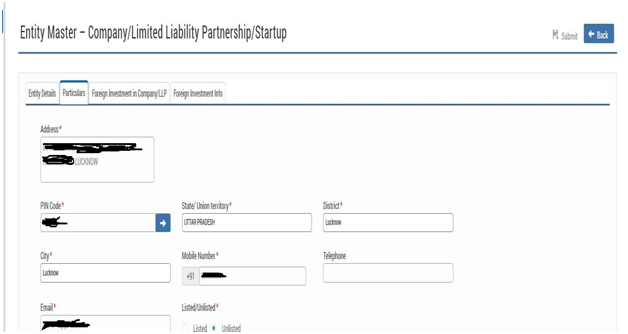

Then, go to the next Tab "Particulars" which appears as

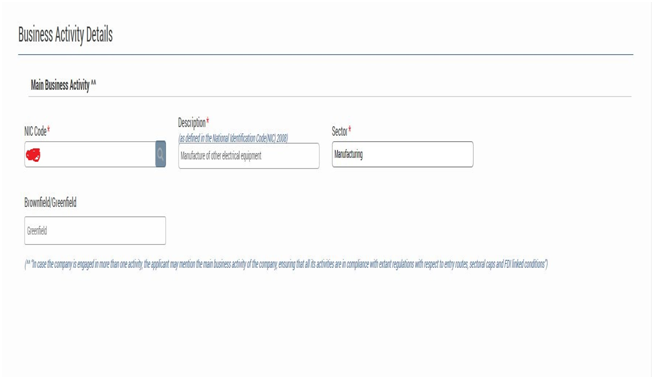

At the bottom, there is tab of business details which is as below

Be careful, while selecting the category "Greenfield" or "Brownfield"

Greenfield Investment- Greenfield investment is investment in new plants. It is establishing new production capacity by an investor or company, Greenfield FDI in India is investment by a foreign investor in fresh production facilities.

Brownfield Investment-Brownfield investment is an investor investing in an existing plant. Brownfield investment is mainly made through merger and acquisitions.Brownfield FDI is an investment made by a foreign company in existing production arrangements.

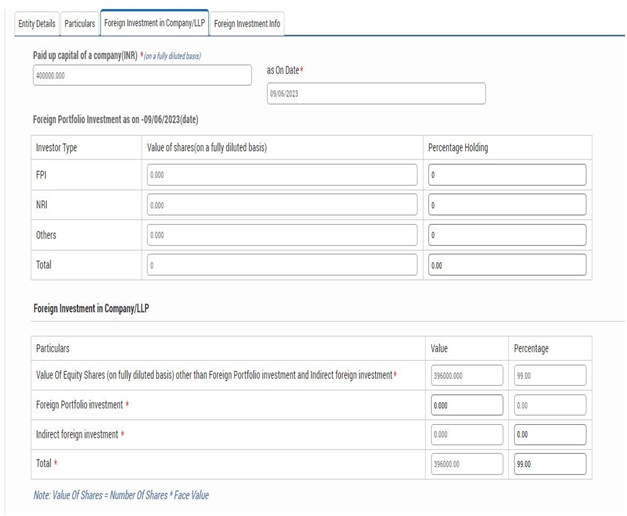

Go to the Third Tab "Foreign Investment in Company/LLP"

Under this tab, fill all these details-

Paid up capital of the company/ Capital Contribution for LLP.

Fully diluted basis means the total number of shares that would be outstanding if all possible sources of conversion are exercised. It includes:

1. Equity shares: As equity shares

2. CCDS/ CCPS: Equivalent Equity shares .(If the conversion ratio is not fixed upfront, the company may enter the maximum number of equity shares possible upon conversion in compliance with the pricing guidelines )

3. Share warrants: Equivalent Equity shares considering 100% exercise upfront

4. ESOPs: Equivalent Equity shares considering 100% exercise upfront

Note: If a start-up company has issued, convertible notes the same shall not be included in the paid-up capital on fully diluted.

To report only Capital Instruments held by person resident outside India on a repatriable basis

Since, I am discussing about the FDI treatment, so here under the tab

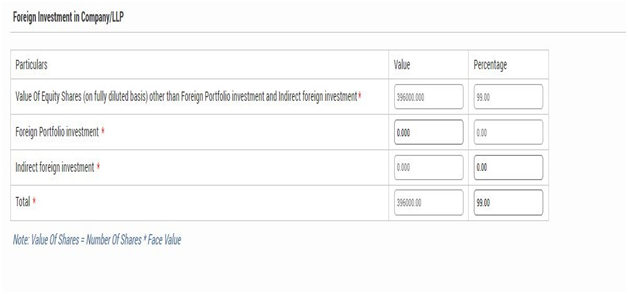

FOREIGN INVESTMENT IN COMPANY/LLP

We will fill details under "Value of Equity shares(on fully diluted basis) other than Foreign Portfolio Investment and Indirect Foreign Investment"

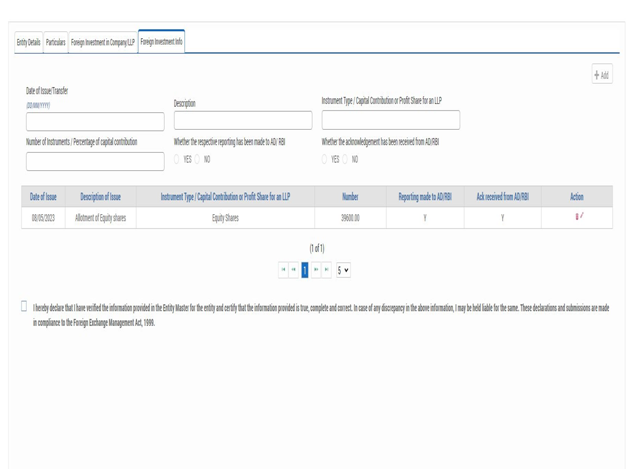

FOREIGN INVESTMENT INFO

Based on the details filled under the third Tab "Foreign investment in Company/LLP" foreign investment info will show details of FDI like this as shown below:

Now, The final step Click on the declaration checkbox and finally submit the Form.

CORRECTION IN ENTITY MASTER

Note: No changes/correction can be made in "Entity master" , it can be edited in this following way:

For any correction in the entity master details, the request can be made at fedsupport@rbi.org.in and helpfirms@rbi.org.in in the following format:

- User ID:

- CIN/LLP Number:

- Registered Email Id:

- Issue description (Reasons for the change):

- What are the changes need to be done? :

|

S.No |

Date field to be updated |

Old Value (Existing) |

New value (to be updated) |

Confirmation for change in Entity Master (Please attach scan copy of request letter signed by Managing Director / Director / Secretary of the Company / Designated Partner (in case of LLP)

CAclubindia

CAclubindia