Dear Friends,

As you are aware that an "Actuary "plays an important part in the insurance sector and he/she is well decorated and trusted professional. Actuaries analyse the financial costs of risk and uncertainty. They use mathematics, statistics, and financial theory to assess the risk of potential events, and they help businesses and clients develop policies that minimize the cost of that risk. Actuaries' work is essential to the insurance industry.

DEFINITIONS

Cambridge Dictionary Defines-"a person who calculates how likely accidents, such as fire, flood, or loss of property, are to happen, and tells insurance companies how much they should charge their customers".

Wikipedia Defines – "An actuary is a business professional who deals with the measurement and management of risk and uncertainty. The name of the corresponding field is actuarial science. These risks can affect both sides of the balance sheet and require asset management, liability management, and valuation skills. Actuaries provide assessments of financial security systems, with a focus on their complexity, their mathematics, and their mechanisms.

While the concept of insurance dates to antiquity, the concepts needed to scientifically measure and mitigate risks have their origins in the 17th century studies of probability and annuities. Actuaries of the 21st century require analytical skills, business knowledge, and an understanding of human behavior and information systems to design and manage programs that control risk.

The Institute of Actuaries of India - "Actuary" means a person skilled in determining the present effects of future contingent events or in finance modelling and risk analysis in different areas of insurance, or calculating the value of life interests and insurance risks, or designing and pricing of policies, working out the benefits recommending rates relating to insurance business, annuities, insurance and pension rates on the basis of empirically based tables and includes a statistician engaged in such technology, taxation, employees' benefits and such other risk management and investments and who is a fellow member of the Institute.

MAIN ACTIVITIES OF AN ACTUARY- Traditional responsibilities of Actuaries in life and general insurance business include designing and pricing of policies, monitoring the adequacy of the funds to provide the promised benefits, recommending fair rate of bonus where applicable, valuation of the insurance business, ensuring solvency margin and other insurance risks like legal liability, loss of profit, etc.

They also define the risk factors, advise on the premia to be charged and re-insurance to be purchased, calculate reserve for outstanding claims and carry out financial modelling.

An Actuary works as consultant either individually or in partnership with other Actuaries in multi-disciplines life insurance, information technology, taxation, employees' benefit, risk management, investment, etc. Evidently, the scope of the functions and duties of an Actuary has increased considerably under the changed conditions.

LET'S SUMMARISED functions of an Actuary;

a) Actuaries Make Financial Sense of the Future

Actuaries are experts in assessing the financial impact of tomorrows uncertain events. They enable financial decisions to be made with more confidence by:

- Analysing the past

- Modelling the future

- Assessing the risks involved, and

- Communicating what the results mean in financial terms.

b) Actuaries Enable More Informed Decisions

Actuaries add value by enabling businesses and individuals to make better- informed decisions, with a clearer view of the likely range of financial outcomes from different future events.

The actuaries' skills in analysis and modelling of problems in finance, risk management and product design are used extensively in the areas of insurance, pensions, investment and more recently in wider fields such as project management, banking and health care. Within these industries, actuaries perform a wide variety of roles such as design and pricing of product, financial management and corporate planning.

Actuaries are invariably involved in the overall management of insurance companies and pension, gratuity and other employee benefit funds schemes; they have statutory roles in insurance and employee benefit valuations to some extent in social insurance schemes sponsored by government.

Actuarial skills are valuable for any business managing long-term financial projects both in the public and private sectors.

Actuaries apply professional rigor combined with a commercial approach to the decision-making process.

c) Actuaries Balance the Interests of All

Actuaries balance their role in business management with responsibility for safeguarding the financial interests of the public. The duty of Actuaries to consider the public interest is illustrated by their legal responsibility for protecting the benefits promised by insurance companies and pension schemes. The professions code of conduct demands the highest standards of personal integrity from its members.

APPOINTMENT AND FUNCTIONS OF AN ACTUARY IN INSURANCE COMPANY

It means a person who compiles and analyses statistics and uses them to calculate insurance risks and premiums.

"ACTUARY" is a well-known word in insurance industry. An Actuary is an appointed and most important officer of an Insurance Company. An Appointed Actuary have specified qualification and should be a member of Institute of Actuaries of India. As per IRDAI Regulations, every Insurance Company is required to appoint and Actuary possessing specified qualification and experience.

REGULATION 2 OF IRDAI (APPOINTED ACTUARY) REGULATIONS,2017

ii) "Actuary" means an actuary as defined in clause (a) of sub-section (1) of section 2 of Actuaries Act 2006;

iii. "Appointed Actuary" means an actuary mentioned in Regulation 3 below;

REGULATION 3. PROCEDURE FOR APPOINTMENT OF AN APPOINTED ACTUARY

A. An insurer registered to carry on insurance business in India shall, subject to sub-regulation (B) and sub-regulation (F) appoint an actuary, who shall be known as the 'Appointed Actuary' for the purposes of the Act.

B. A person shall be eligible to be appointed as an Appointed Actuary for an insurer, if he or she is:

i. Ordinarily resident in India;

ii. A Fellow member in accordance with the Actuaries Act, 2006;

iii. A Fellow member satisfying the following requirements in case of a Life insurer:

a. Passed specialization subject in life insurance. Currently, the specialization shall mean Specialist Application-level subject as prescribed by the Institute of Actuaries of India.

b. Relevant experience of at least 10 years in life insurance industry out of which at least 5 years shall be post fellowship experience.

c. The applicant shall have at least 3 years post fellowship experience in annual statutory valuation of a life insurer.

iv. A Fellow member satisfying the following requirements in case of a general insurer or reinsurer:

a. Passed specialization subject in general insurance. Currently, the specialization shall mean Specialist Application-level subject as prescribed by the Institute of Actuaries of India.

b. Relevant experience of at least 7 years in general insurance industry out of which at least 2 years shall be post fellowship experience.

c. The applicant shall have at least 1 year post fellowship experience in annual statutory valuation of a general insurer.

v. A Fellow member satisfying the following requirements in case of a health insurer:

a. Passed specialization subject in health or general insurance. Currently, the specialization shall mean Specialist Application-level subject as prescribed by the Institute of Actuaries of India.

b. Relevant experience of at least 7 years in health or general insurance industry out of which at least 2 years shall be post fellowship experience.

c. At least 1-year post fellowship experience shall be in respect of annual statutory valuation of a health insurer or a general insurer.

vi. An employee of the insurer;

vii. A person who has not committed any breach of professional or other misconduct;

viii. Not an appointed actuary of another insurer in India;

ix. A person who possesses a Certificate of Practice issued by the Institute of Actuaries of India;

x. Not over the age of 65 years.

REGULATION 8. POWERS OF APPOINTED ACTUARY

A. An Appointed Actuary shall have access to all information or documents in possession, or under control, of the insurer if such access is necessary for the proper and effective performance of the functions and duties of the Appointed Actuary.

B. The Appointed Actuary may seek any information for the purpose of sub-regulation (A) of this regulation from any officer or employee of the insurer.

C. The Appointed Actuary shall be entitled:

(i) to attend all meetings of the management including meeting of the directors of the insurer;

(ii) to speak and discuss on any matter, at such meeting, —

a. that relates to the actuarial advice given to the directors;

b. that may affect the solvency of the insurer;

c. that may affect the ability of the insurer to meet the reasonable expectations of policyholders; or

d. on which actuarial advice is necessary.

(iii) to attend, —

a. any meeting of the shareholders or the policyholders of the insurer; or

b. any other meeting of members of the insurer at which the insurer's annual accounts or financial statements are to be considered or at which any matter in connection with the Appointed Actuary's duties is discussed.

REGULATION 9. DUTIES AND OBLIGATIONS

In particular and without prejudice to the generality of the foregoing matters, and in the interests of the insurance industryand the policyholders, the duties and obligations of an Appointed Actuary of an insurer shall include: —

(i) Ensuring that all the requisite records have been made available to him or her for the purpose of conducting actuarial valuation of liabilities and assets of the insurer;

(ii) Rendering actuarial advice to the management of the insurer, in particular in the areas of product design and pricing, insurance contract wording, investments and reinsurance;

(iii) Ensuring the solvency of the insurer at all times;

(iv) Complying with the provisions of the section 64V of the Act in regard to certification of the assets and liabilities that have been valued in the manner required under the said section;

(v) Complying with the provisions of the section 64 VA of the Act in regard to maintenance of required control level of solvency margin in the manner required under the said section;

(vi) Drawing the attention of management of the insurer, to any matter on which he or she thinks that action is required to be taken by the insurer to avoid–

(a) Any contravention of the Act; or

(b) Prejudice to the interests of policyholders;

(vii) Complying with the Authority's directions from time to time;

(viii) Ensuring that overall pricing policy of the insurer is in line with the overall underwriting and claims management policy of the insurer;

(ix) Ensuring adequacy of reinsurance arrangements;

(x) Contributing to the effective implementation of the risk management system;

(xi) Complying with the provisions of section 21 of the Act in regard to further information required by the Authority;

(xii) In addition to the above, the duties of an Appointed Actuary of an insurer carrying on life insurance business shall include:

a. Certifying the actuarial report and abstract and other returns as required under section 13 of the Act;

b. Complying with the provisions of the section 112 of the Act in regard to recommendation of interim bonus or bonuses payable by life insurer to policyholders whose policies mature for payment by reason of death or otherwise during the inter-valuation period;

c. Complying with section 40B & 40C of the Act;

d. Ensuring that the premium rates of the insurance products are fair;

e. Certifying that the mathematical reserves have been determined taking into account the guidance notes issued by the Institute of Actuaries of India and any directions given by the Authority;

f. Ensuring that the policyholders' reasonable expectations have been considered in the matter of valuation of liabilities and distribution of surplus to the participating policyholders who are entitled for a share of surplus;

g. Submitting the actuarial advice in the interests of the insurance industry and the policyholders;

h. Coordinating the calculation of mathematical reserves;

i. Ensuring the appropriateness of the methodologies and underlying models used, as well as the assumptions made in the calculation of mathematical reserves;

j. Assessing the sufficiency and quality of the data used in the calculation of mathematical reserves;

k. Informing the Board of insurer about the reliability and adequacy of the calculation of mathematical reserves.

(xiii) In addition to (i) to (xi) above, the duties of the Appointed Actuary of the insurer carrying on general insurance business or health insurance business include:

a. Ensuring that the premium rates of the insurance products are fair;

b. Ensuring that the actuarial principles, in the determination of liabilities, have been used in the calculation of reserves for incurred but not reported claims (IBNR) and other reserves (including incurred but not enough reported claims (IBNER) and premium deficiency reserve (PDR) where actuarial advice is sought by the Authority;

c. Complying with section 40B & 40C of the Act;

d. Coordinating the calculation of IBNR and other reserves (including IBNER and PDR) where actuarial advice is sought by the Authority;

e. Ensuring the appropriateness of the methodologies and underlying models used, as well as the assumptions made in the calculation of IBNR and other reserves (including IBNER and PDR) where actuarial advice is sought by the Authority;

f. Assessing the sufficiency and quality of the data used in the calculation of IBNR and other reserves (including IBNER and PDR) where actuarial advice is sought by the Authority;

g. Informing the Board of insurer about the reliability and adequacy of the calculation of IBNR and other reserves (including IBNER and PDR) where actuarial advice is sought by the Authority.

(xiv) informing the Authority in writing of his or her opinion, within a reasonable time, whether,

a. the insurer has contravened the Act or any other Acts;

b. the contravention is of such a nature that it may affect significantly the interests of the owners or beneficiaries of policies issued by the insurer;

c. the directors of the insurer have failed to take such action as is reasonably necessary to enable him to exercise his or her duties and obligations under this regulation; or

d. an officer or employee of the insurer has engaged in conduct calculated to prevent him or her exercising his or her duties and obligations under this regulation.

(xv) If an Appointed Actuary is disqualified to act as an Actuary, he/she ceases to exist as Appointed Actuary forthwith;

(xvi) While carrying out his/her duties and obligations, the Appointed Actuary shall pay due regard to generally accepted actuarial principles and practice.

10. ABSOLUTE PRIVILEGE OF APPOINTED ACTUARY

A. An Appointed Actuary shall enjoy absolute privilege to make any statement, oral or written, for the purpose of the performance of his functions as Appointed Actuary. This is in addition to any other privilege conferred upon an Appointed Actuary under any other Regulations.

B. Any provision of the letter of appointment of the Appointed Actuary, which restricts or prevents his duties, obligations and privileges under these regulations, shall be void.

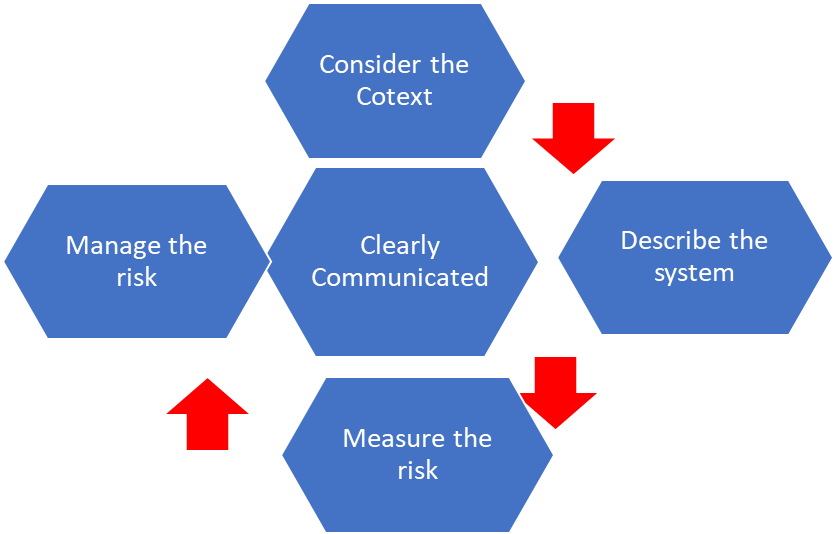

RISK MANAGEMENT AND ROLE OF AN ACTUARY

Risk management is used to assist organisations to avoid, reduce the likelihood of, or minimise the impact of, events that might otherwise cause them significant harm, whether that be financial, reputational or any other damage.

In essence, risk management is an important tool to reduce losses, control uncertainty and optimise decision making to improve performance.

Actuaries are skilled professionals whose comprehensive training includes the use of statistical analysis to understand risks and uncertainties. They are therefore well placed to support organisations' risk management efforts. However, an actuarial approach to risk management places a particular focus on measuring and understanding the impact of risks, both positive and negative, on the outcomes experienced and considering how the risks and their impacts may evolve over time.

Where appropriate an actuarial approach will place financial values on risk. In particular an actuarial approach considers risks more broadly, seeking to understand the range of potential impacts and the interaction of risks, rather than adopting a distinct impact and probability for each risk separately.

Actuarial risk analysis is not just based on short-term horizons but may extend many decades into the future when necessary. This focus on understanding long term impacts allows decision makers to better understand the typical range within which outcomes are expected to lie, as well as appreciating the potential impacts of more extreme events occurring.

The training and experience actuaries receive provides them with a uniquely broad-based combination of skills suited to risk management, allowing them:

- To explore the full range of risks that might affect an organisation;

- To quantify risks and their implications in the short and long terms;

- To quantify the value of any mitigation versus the cost of undertaking it;

- To illustrate the range of possible outcomes;

- To link financial and non-financial factors, such as the social and environmental impact for example from rising global temperatures;

- To integrate risk analysis into the wider economic business management process; and

- To communicate the risks to decision-makers in a balanced and effective way.

Risk managers cannot be experts in all areas where risks to an organisation may develop. They must discuss risks with the stakeholders and gather other experts' views of known and emerging risks. By gathering as much robust and relevant data/information as possible on the risks that exist, they can build up a more accurate picture of the drivers for risks and their likelihood and potential impact. This then allows for more informed choices about which risks are more or less important to study further. The more we can prioritise the risks that really matter to the stakeholders under consideration, the better the decision-making process will be for managing those risks.

Actuaries are involved in almost all key functions of an insurance company, such as Product Development, Underwriting, Pricing, Reserving, Valuation of Insurance Business, Investment and estimation of Solvency Margin of the Insurance Company, etc. They are making certain vital assumptions, carrying our necessary analysis and reports and provide valuable information and advices to the top management of the company.

What are actuarial errors or mistakes, it may be any deviation of actual results from the expected outcomes or errors or mistakes in actuarial calculations, while assumptions made while designing products or determining premium rate for a product, inadequate data leading to wrong interpretation or conclusions etc.,

Actuaries are made some vital assumptions with reference to mortality, interest rate forecast and expense calculations in developing a life /general insurance product. At later stage if any assumptions go wrong, that would lead to Actuarial Risk.

Proper assumptions and estimations of various factors affecting launch of new product or while deciding rate of premium for product is essential to succeed that product and bring competition in the market.

It is also duty of an Actuary to estimate the expected value of claims and the probability of occurrence of claims to a reasonable level of accuracy, while estimating the premium rates for a general insurance product. For process of estimation an Actuary required authenticated, reliable and true data. An Actuary is also involved in estimating the outstanding claims liability including IBNR and IBNER to ensure adequate provisions of reserves are made to make payments for future claims liabilities. If any of these estimates or assumptions goes wrong then there may be liquidity or pricing risk for the company.

The Actuaries are also involved in estimating the Solvency Margin of an Insurance Company and ensure that the company complied with the regulatory solvency ratio 1.5 times at all time.

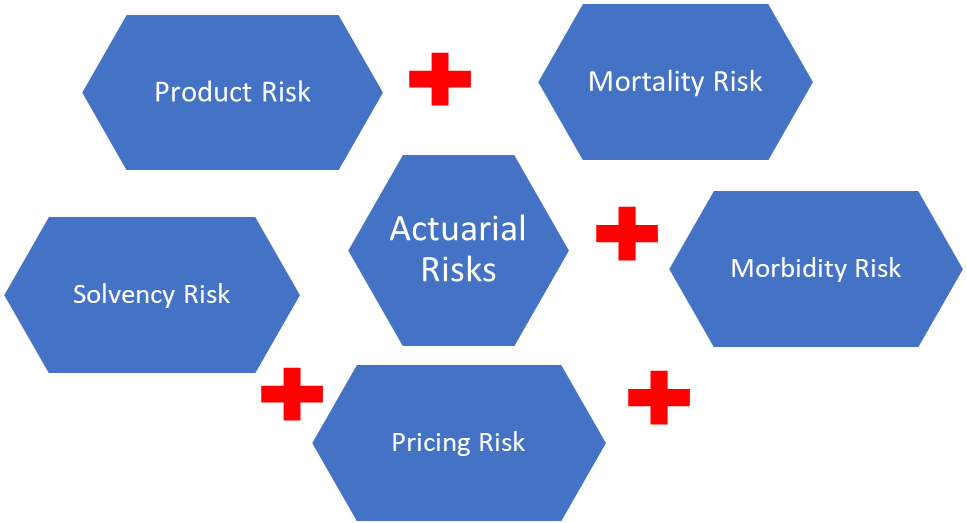

ACTUARIAL RISK MANAGEMENT PRINCIPLES

KEY FACTORS INFLUENCING ACTUARIAL RISKS

We know that an Actuary is involved generally all decision-making steps in an Insurance Company, from product development to estimating and maintaining Solvency Margin. Any estimate or assumptions if any deviates from actuals as estimated would give raise of actuarial risk.

1. PRODUCT RISK

Actuaries have to make certain product assumptions, while developing a product relating to life or general insurance.

Suppose if insurance company wants to introduce new product in the market, then actuary has to estimate the mortality rate of the target customers to whom the product is being designed, the appropriate amount of expenses the product is likely to incur over the policy period, the overall administrative and marketing expenses that the insurer has budgeted to assume for the product and rate of return that the investment of policy fund is likely to generate for the policy period, etc.

In case of Health Insurance Product an Actuary has to estimate or assume morbidity rate for targeted segment of the policy. If any of these estimates goes wrong or actual result is drastically different from the expected (assumed) outcomes, which would trigger Product Risk.

2. MORTALITY RISK

Refers to rate of people dying upon the total number of lives exposed to risk in every age or age group.

MORTALITY RATE=Number of people dying at age(dx)/ Number of people living or surviving at age (lx)

i.e., Mortality Rate=dx/lx

The Mortality is most commonly presented in the form of a life table or mortality table which represents the probability of person dying at age(x) before attaining age (x+1). The probabilities are worked out generally based on the historical experience of policyholders who had already been insured with particular insurance company.

Thus, the mortality rate is estimated for every age/age group individually. Generally, the mortality rate is calculated based on the mortality investigation carried out by the life insurer once every periodical interval. The result of such mortality investigation is used for monitoring the assumptions made by the Actuary at the time of pricing of the product.

The Actuary has to estimate the mortality rate of the target customers to whom the product is being designed. He/she has to look at the risk profile of the existing policyholders, who have already been insured with the company for a similar product, if similar experience product is available in the market. If relative data is not available with the company, or the product being developed for new risk, then he/she has to look at certain secondary data available at some reliable sources such as Statistics from Government Department or Ministry of Health, Indian Medical Association, other research papers etc., and make necessary assumptions regarding the current status of mortality rate. Suppose is required, reliable, authenticated date is also not available with the secondary source. Then assumptions or estimations made by Actuary may goes wrong and this will be called as Mortality Rate Risk.

3. MORBIDITY RISK

Refers to rate of people falling sick upon total number of people lives exposed to risk in every age or age group. This is also called "Sickness Rate".

The Morbidity Rate is used in developing a Health Insurance Policy either for individual customers or group policy for Corporate Customers. Morbidity or Sickness Rate is one of the primary parameters used in estimating premium rates for a new risk for which there are no historical data available from where claim cost can be estimated. If an insurance company wants to develop a new product targeting a new customer segment for which there are no policies available at present. In such case the company would use the morbidity data collected from certain public ally available sources like Hospitals, Indian Medical Research Council, Department of Health, data from Government of India, etc.

The Morbidity Rate is estimated for each individual age or age group of proposed customer segment or group of customers for a mass group of customers. An Actuary uses data available with secondary sources for calculating premium for new products and any deviations from the actuals would lead to Morbidity Risk.

4. BURNING COST

Refers to cost of claims and loss allocated expenses and it is the ratio of cost of claims to the premium.

The Burning Cost is estimated by multiplying the claims frequency and claims severity.

Claims Frequency; refers to Number of Claims and the

Claims Severity; refers to Average Claims Cost which is arrived at by dividing the total amount of claim cost by the number of claimants.

The Burning Cost is also called as "PURE PREMIUM" as it is the ratio of claim to the rate of premium and it is the rate where premium is equal to the cost of claim before adding any of the expenses like management expenses and profit margin.

We required two parameters to estimate Burning Cost:

- Claim Frequency;

- Claim Severity.

Methods of calculating Burning Cost;

- Burning Cost=Claim Frequency Average Claim Amount; or

- Burning Cost=Average Claim Amount Claims Incident rate; or

- Burning Cost= Expected Claim Frequency Per Policy X Expected Cost Per Claim or Average Exposure Per Policy.

The correct estimation of above terms and necessary and important and hence, there may be risk involved if we have made wrong estimate.

5. PRICING RISK

Pricing refers to the process of arriving at the premium rate for the risk that the insurer wants to cover. The process of Premium determination varies drastically for life insurance and general insurance. In case of life insurance, the factors considered for premium are the mortality rate, rate of return the policy or the portfolio is expected to earn during the policy period (Term of the Policy) and the expenses that the insurer incur from procuring the business to settlement of claim or maturity of the policy.

The basic process of pricing involves determining the probability of occurrence of risk and if the insured risks occur, then the insurer has to estimate the expected value of risk/loss that he has to indemnify to the insured or policyholder.

Payment of losses or claims depends on two random variables. The first is the number of losses that may or may not occur during a specified policy period.

Let's us suppose an insured for health policy has not claimed any amount during some years of the policy, but in third year he has lodged claims in two or three times during previous year. This random valuation is called "Frequency of Claims or Losses" and the second random variable is the amount of loss or Severity of Claim that the insurer has to pay to the insured on occurrence of insured event. The amount of loss is referred as the Severity.

The expected value of claims can be estimated by combining the possibility of occurrence of loss/frequency of claim and the amount of loss or severity of claims during the policy period.

Since the concept of insurance is based on the concept of pooling of risks of many to pay the claims of few insured, who has suffered insured loss. So proper estimate is required and any wrong estimate leads to Pricing Risk.

6. SOLVENCY RISK

Solvency refers to insurer's financial ability to meet the liabilities including claims liabilities arising from the insurance business underwritten.

Solvency Ratio is indicator disclosing the financial health of the insurers. The Solvency Ratio is the ratio is the ratio of Available Solvency Margin (ASM) to Required Solvency Margin (RSM) and the Solvency Ration should be at least 1.50 at all times, as per IRDAI Regulations. It means that your assets should be 1.50 times of your liabilities at all times. Lower Solvency Ratio leads to takeover and cancellation of certificate of registration of insurance company by the regulator and more Solvency ratio indicates poor allocation of resources by the company i.e., poor Capital Gearing Ratio.

The value of Available Solvency Margin= Assets-Liabilities

The value of assets and liabilities are estimated through the process of valuation. The under or over valuation of assets and liabilities will affect the ASM. The valuation of claims liabilities includes not only current year's liability but also the future liabilities including IBNR and IBNER. Improper estimates of such liabilities or inadequate or overprovision of IBNR and IBNER would impact the Solvency Margin of the company.

The Solvency of insurer would be greatly influenced by various factors like, Capital Gearing Ratio, keeping higher level of Solvency than required, similarly maintaining just the minimum required Solvency Level may also be risky. Suppose in case of any catastrophe strikes in a year, the Solvency of the company would be in trouble, poor quality of underwriting, having higher level of exposure limit, high concentration of risk in certain areas which are catastrophic prone, inadequate reserving, etc., would affect Solvency to a greater extent.

CONCLUSION

We have just passed through a very dangerous and turbulent phase of World Pandemic, COVID-19, which has derailed the whole world and claimed lives of more than 50.00 Lakhs of people. All establishments have closed due to lock-down all over the world, businesses, shops, schools, colleges, Malls, etc. have been completely closed due to that COVID-19. Till date we are living in fear with this pandemic.

An insurance company just as a banking company deals with the money of public and amassing huge cash received as a premium from their policyholders. The protect their policyholders from various types of perils, they agreed for against payment of small premium as consideration. The insurance works on the basis of collection of premiums from large number of people and payment for few sufferings from insured perils. Thus, for an insurance company the most important work is to manage various types of risks. They need experts for assessment, analysing and management of risks. An actuary plays an important role in this regard, they are experts in statistics, mathematics, science, calculations and estimations and risk management. They provide expert advice to the management based on their skills and data analysis and are responsible to protect the financial viability of an insurance company.

DISCLAIMER: The above article is only for information and knowledge of readers. The article has been prepared on the basis of available information and materials at the time of preparation. The views expressed here are the personal views of the author and same should not be taken as professional advice. In case of necessity do consult with concerned professional.

CAclubindia

CAclubindia