QUESTION

XYZ Limited is a company engaged in real estate and construction business. In order to build a land bank in various parts of India that were likely to see commercial development and anticipating a future upward trend in land prices in various parts India.

XYZ Limited hired the services of Mr. Mahesh to assist in the process of acquisition of lands. XYZ Limited issued a detailed offer letter to Mr. Mahesh for purchase of around 100 acres of land at the maximum price of Rs. 10,00,000/- per acre in different parts of India within a period not exceeding five years.

The said offer was accepted by Mr. Mahesh by a letter of acceptance. Upon exchange of offer and acceptance, a legally binding and valid contract came to be force between XYZ Limited and Mr. Mahesh.

Mr. Mahesh received from XYZ Limited a sum of Rs. 1000 Crore as a loan/advance for the purchase of lands as specified in the contract between the parties. Mr. Mahesh purchased various movable and immovable properties with the funds received from XYZ Limited. Since all the funds could not be directly invested in land as required by the contract, investments were made by Mr. Mahesh by himself or through his company in purchase of immovable property, including land, built-up residential and commercial buildings, etc. and Investment in fixed deposits in name of Mr. Mahesh and PQR Limited(95% shareholding by Mr. Mahesh) also investment in movable property including bank balance and few vehicles.

In the meantime, Director of Enforcement initiated suo moto proceedings under the Prevention of Money Laundering Act, 2002(PMLA) and registered a complaint under Sections 3 and 4 of the PMLA and attached the property of Mr. Mahesh under the Prevention of Money Laundering Act, 2002.

In view of the above, answer the following question:

(a) Discuss the attachment of property involved in money laundering under PMLA;

(b) Explain the extent of punishment prescribed under PMLA; and

(c) Discuss Appellate Authority establish under PMLA and what is the time limit to file appeal.

SOLUTIONS

LET'S CONSIDER APPLICABLE PROVISIONS OF PMLA,2002

SECTION 3: Whosoever directly or indirectly attempts to indulge or knowingly assists or knowingly is a party or is actually involved in any process or activity connected with the proceeds of crime and projecting it as untainted property shall be guilty of offence of money-laundering.

SECTION 4: Punishment for money-laundering.—Whoever commits the offence of money-laundering shall be punishable with rigorous imprisonment for a term which shall not be less than three years but which may extend to seven years and shall also be liable to fine which may extend to five lakh rupees:

Provided that where the proceeds of crime involved in money-laundering relates to any offence specified under paragraph 2 of Part A of the Schedule, the provisions of this section shall have effect as if for the words "which may extend to seven years", the words "which may extend to ten years" had been substituted.

SOLUTION (a)

AS PER SECTION 5(1) OF THE PMLA, Where the Director or any other officer not below the rank of Deputy Director authorised by the Director, has reason to believe (the reason for such belief to be recorded in writing), on the basis of material in his possession, that;

(a) any person is in possession of any proceeds of crime; and

(b) such proceeds of crime are likely to be concealed, transferred or dealt with in any manner which may result in frustrating any proceedings relating to confiscation of such proceeds of crime, he may, by order in writing, provisionally attach such property for a period not exceeding one hundred and eighty days from the date of the order, in such manner as may be prescribed.

It may be noted that no such order of attachment shall be made unless, in relation to the scheduled offence, a report has been forwarded to a Magistrate under section 173 of the Code of Criminal Procedure, 1973, or a complaint has been filed by a person authorised to investigate the offence mentioned in that Schedule, before a Magistrate or court for taking cognizance of the scheduled offence, as the case may be, or a similar report or complaint has been made or filed under the corresponding law of any other country.

Further, notwithstanding anything contained in above , any property of any person may be attached , if the Director or any other officer not below the rank of Deputy Director authorised by him for the purposes of Section of the PMLA has reason to believe (the reasons for such belief to be recorded in writing), on the basis of material in his possession, that if such property involved in money-laundering is not attached immediately, the non-attachment of the property is likely to frustrate any proceeding under the Act.

For the purposes of computing the period of one hundred and eighty days, the period during which the proceedings under Section 5 of PMLA is stayed by the High Court, shall be excluded and a further period not exceeding thirty days from the date of order of vacation of such stay order shall be counted.;

SECTION 5(2) states that the Director, or any other officer not below the rank of Deputy Director, shall, immediately after attachment under sub-section (1), forward a copy of the order, along with the material in his possession, to the Adjudicating Authority, in a sealed envelope, in the manner as may be prescribed and such Adjudicating Authority shall keep such order and material for such period as may be prescribed.

SECTION 5(3) PROVIDES THAT every order of attachment made under sub-section(1) shall cease to have effect after the expiry of the period specified in sub-section(1) or on the date of an order made under sub-section (3) of section 8, whichever is earlier.

AS PER SECTION 5(4) OF PMLA, nothing in this section shall prevent the person interested in the enjoyment of the immovable property attached under sub-section (1) from such enjoyment. It may be noted that person interested, in relation to any immovable property, includes all persons claiming or entitled to claim any interest in the property.

SECTION 5(5) states that the Director or any other officer who provisionally attaches any property under sub-section (1) shall, within a period of thirty days from such attachment, file a complaint stating the facts of such attachment before the Adjudicating Authority.

SOLUTION(b)

Offence of money-Laundering and Punishment for money-Laundering are specified under Section 3 and 4 of the Prevention of Money Laundering Act, 2002 respectively.

SECTION 3 OF THE PREVENTION OF MONEY LAUNDERING ACT, 2002 PROVIDES THAT whosoever directly or indirectly attempts to indulge or knowingly assists or knowingly is a party or is actually involved in any process or activity connected with the proceeds of crime including its concealment, possession, acquisition or use and projecting or claiming it as untainted property shall be guilty of offence of money-laundering.

PLEASE NOTE THAT : proceeds of crime means any property derived or obtained, directly or indirectly, by any person as a result of criminal activity relating to a scheduled offence or the value of any such property.

ACCORDING TO SECTION 4 OF THE PREVENTION OF MONEY LAUNDERING ACT, 2002, whoever commits the offence of money-laundering shall be punishable with rigorous imprisonment for a term which shall not be less than three years but which may extend to seven years and shall also be liable to fine.

PLEASE NOTE THAT where the proceeds of crime involved in money-laundering relates to any offence specified under paragraph 2 of Part A of the Schedule to the PMLA, shall be punishable with rigorous imprisonment for a term which shall not be less than three years but which may extend to ten years and shall also be liable to fine.

SOLUTION (c)

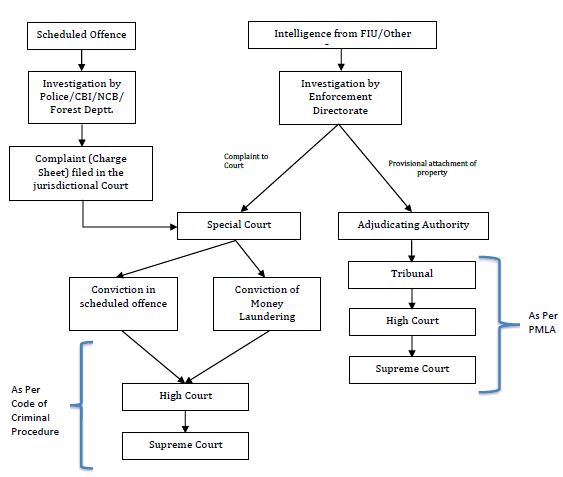

The Act provides for separate provisions pertaining to attachment and confiscation of property; and a separate procedure for adjudging an offence under the Act. Though, the Act provides for a well laid appellate remedy against the attachment of the property, it also lays down the aspect of a Special Court for the trial of the scheduled offence along with the offence under the Act. However, procedure regarding any appeal against the order of the Special Court is prescribed to be governed by the Criminal Procedure Code.

The procedure is explained via following pictorial representation.

PROCEDURE OF ADJUDICATION

APPELLATE TRIBUNAL

SECTION 26: The Director or any person aggrieved by an order made by the Adjudicating Authority under this Act, may prefer an appeal to the Appellate Tribunal.

Appeal has to be filed within a period of forty-five days from the date of receipt of a copy of the order made by the Adjudicating Authority.

Appellate Tribunal may entertain an appeal after the expiry of the period of forty-five days if it is satisfied that there was sufficient cause for not filing it within that period.

HIGH COURT

SECTION 42: Any person aggrieved by any decision or order of the Appellate Tribunal may file an appeal to the High Court within sixty days from the date of communication of the decision or order of the Appellate Tribunal to him on any question of law or fact arising out of such order.

Although, the Second Appeal, unlike many other statues is not restricted in its scope to the "Question of Law" but extends to the "Question of fact" as well, however, it is also an established fact that while determining whether the Question of Law arising in a case is a substantial one, the general rule is that the High Court will not interfere with the concurrent findings of the Courts below unless the order appealed is not based on any evidence, or on misreading of evidence, wrong inferences, ignored evidences and facts etc.

Thus, in an appeal against the judgment of the Hon'ble Tribunal, Prevention of Money Laundering, the High Court, generally, is not required to go into the question of fact or appreciation of evidence, however, if it is apparent that certain evidences, information etc. was not considered or misconstrued etc., Hon'ble High Court may apart from 'question of law' can also consider the 'question of fact'.

High Court may, if it is satisfied that the appellant was prevented by sufficient cause from filing the appeal within the said period, allow it to be filed within a further period not exceeding sixty days.

WRIT JURISDICTION

Albeit, the Act lays down a formal procedure for appeal against the decision of the Adjudicating Authority pertaining to attachment of the property, being proceeds of crime, the Hon'ble High Court may entertain Writ petitions, even though an alternate remedy by way of normal forum of hierarchy of Tribunal and Courts is available.

However, Hon'ble High Courts shall entertain the Writ petitions and exercise their discretionary powers as provided in terms of Article 226 of the Constitution of India, only in exceptional circumstances, where either the Adjudicating Authority acted without jurisdiction or there was violation of the principles of Natural Justice.

In the recent decision of the Hon'ble High Court of Delhi in the case of Rose Valley Hotels and Entertainments Limited v. Secretary, Department of Revenue, Ministry of Finance , while entertaining a writ petition filed against the confiscation order passed by the Adjudicating Authority, relied on the decision of the Hon'ble Supreme Court in the case of Whirlpool Corpn. v. Registrar of Trade Marks , wherein, the Supreme Court laid down the triple test for entertaining a writ petition despite availability of the remedy of an appeal in contractual matters i.e., firstly if the action of the respondent is illegal and without jurisdiction, secondly if the principles of natural justice have been violated and thirdly if the petitioner's fundamental rights have been violated.

SPECIAL COURTS

Scheme of the Act, provides power to a Special Court for trial of offence of Money Laundering as provided in Section 3 read with Section 4 of the Act. Special Court is nothing but Courts of Session which are designated as a Special Court for the purposes of such Act by the Central Government in consultation with the Chief Justice of High Court.

By virtue of Section 44 of the Act, the Special Court is entitled to try the offences under Section 3 read with Section 4 of the Prevention of Money Laundering Act as well as the connected scheduled offences. Thus, the Special Court shall undertake the trial of the Scheduled Offence along with the offence under the Act.

Shorn of all embellishment, the special Court is a court of original criminal jurisdiction and to make it functionally oriented some powers are conferred by the statute. It has to function as a court of original Criminal jurisdiction not being bound by the terminological status description of magistrates or a Court of Sessions except those specifically conferred and specifically denied. Under the Code, it will enjoy all powers which a Court of original criminal jurisdiction enjoys save and except the ones specifically denied.The Court has to be treated as a Court of original criminal jurisdiction and shall have all the powers as any Court of original criminal jurisdiction has under the Criminal Procedure Code except those specifically denied. This clause provides that the offences punishable under this Act shall be tried only by the Special Court.

The Special Judge empowered under this Act, can try offences under the Prevention of Money Laundering Act along with Scheduled Offences. The said power of the Special Court to try an offence under the PMLA along with the scheduled offence was upheld by Jharkhand High Court in one of the matter while discussing the provisions of Section 44 of the Act.

The Court which has taken cognizance of the scheduled offence, being a Court other than the Special Court which has taken cognizance of the complaint of the offence of money laundering, is enabled on an application by the authority to commit the case related to the scheduled offence to the Special Court. Upon the receipt of the case, the Special Court is mandatorily required to proceed to deal with the case from the stage at which it was committed.

Furthermore, the provisions of Section 47 of the Act provide for the appellate and revisionary remedy. In terms of the provision of Section 47 of the Act, the aggrieved party can avail the remedy of appeal to the High Court and the Supreme Court respectively against the orders of the Special Court, in terms of the powers and procedure laid down by Chapter XXIX or Chapter XXX of the Code of Criminal Procedure, 1973.

Thus, instead of providing a specific procedure, as laid down for the attachment orders passed by the Adjudicating Authority, the Act provides for the procedure laid down under the Code of Criminal Procedure, 1973 for appeal against the order of the Special Court.

DISCLAIMER: The case study presented here is only for sharing information and knowledge with the readers. The views expressed are personal. In case of necessity do consult with professionals for more clarity and understanding on subject matter.

CAclubindia

CAclubindia