Introduction

Gratuity is a monetary benefit given by employer to his employee after rendering a service of minimum of 5 years or more in his establishment. Gratuity act applies where 10 or more persons are employed or were employed on any day of the preceding 12 months. Once Gratuity act applies, the employer can't escape from liability by reducing the number of employees.

Table of Contents

Who are eligible to get the Gratuity?

An employee is eligible for gratuity in case of

- Retirement or Resignation

- Superannuation

- On Death or Disablement due to accident or disease.

If he has completed 5 years of complete service with the company. There is one exception, if an employee has expired or disabled, the time period of 5 years not applicable and he would be eligible for every one year completed of his service.

How calculation of Gratuity are Done?

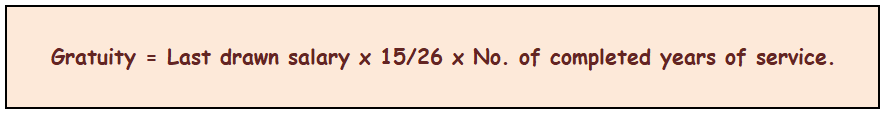

1. In case of employee covered under payment of Gratuity Act 1972

Gratuity is payable at the rate of 15 days salary for every completed year of service or part thereof in excess of six months.

For example

if you have completed 6 years 7 months in an organization, you are eligible for 7 years Gratuity. But if you have completed 6 years 5 months in an organization, you are eligible for 6 years Gratuity.

- Working days in a month will be considered of 26 days

- Salary means last salary drawn i.e. Basic Salary + Dearness Allowance

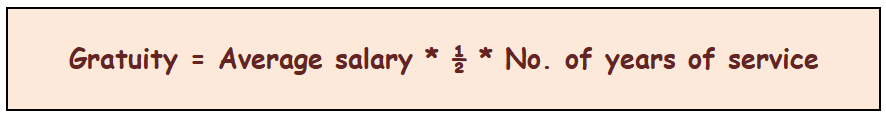

2. In case of employee not covered under payment of Gratuity Act 1972, if paid the calculation is as under.

Gratuity is payable at the rate of 15 days salary for complete year of service.

For example

if you have completed 6 years 7 months in an organization, you are eligible for 6 years Gratuity. But if you have completed 6 years 5 months in an organization, you are eligible for 6 years Gratuity.

- Working days in a month will be considered of 30 days

- Average Salary means Average of last 10 months salary i.e. Basic Salary + Dearness Allowance.

Exemption and Tax liability

If employees get Gratuity at the time of Resignation, Retirement, or Superannuation. There are 3 categories under Gratuity Act--

1. Gratuity Received by Govt. Employees

Section 10 (10) (i)grants exemption for gratuity received by govt. employees is fully exempt.

2. Gratuity Received by Non Govt. Employees covered under payment of Gratuity Act 1972

Section 10 (10) (ii)grants exemption for gratuity received, in case of employee covered under payment of Gratuity Act, least of the following-

- Last drawn salary * 15/26 * No. of completed years of service.

- 20,00,000

- Actual Gratuity received

For Example:

Mr. Shyam has worked for 15 years 8 month in ABC Pvt. Ltd. At the time of retirement he received a Gratuity of Rs. 8,00,000. His basic salary was Rs. 50,000, Dearness Allowance was Rs. 10,000. What amount is exempted under Income Tax?

Answer:

| Last drawn salary * 15/26 * No. of completed years of service = (15 * 60,000 * 16) / 26 |

Rs. 5,53,846 |

| Statutory limit | Rs. 20,00,000 |

| Gratuity received | Rs. 8,00,000 |

So, Rs. 5,53,846 is exempt and balance Rs (8,00,000 - 5,53,846) = Rs. 2,46,154 is taxable.

Note:

- In case of employees of seasonal establishment-7 days salary will be taken into consideration instead of 15 days

- In case of piece rated employee- 15 days' salary will be computed on the basis of average of total wages (excluding overtime wages) received for a period of three months immediately preceding the termination of his service.

3. Gratuity Received by Non Govt. Employee not covered under payment of Gratuity Act 1972

Section 10 (10) (iii)grants exemption for gratuity received, in case of employee not covered under payment of Gratuity Act, least of the following-

- Average salary x ½ x No. of years of service

- 20,00,000

- Actual Gratuity received.

For Example:

Mr. X has worked for 15 years & 8 month in ABC Pvt. Ltd. At the time of retirement he received a Gratuity of Rs. 8,00,000. His average salary of last 10 months was Rs. 50,000, Dearness Allowance was Rs. 10,000. What amount is exempted under Income Tax?

Answer:

| Average salary x 1/2 x No. of years of service = (15 * 60,000 * 15)/30 |

Rs. 4,50,000 |

| Statutory limit | Rs. 20,00,000 |

| Gratuity received | Rs. 8,00,000 |

So, Rs. 4,50,000 is exempt and balance Rs. (8,00,000 - 4,50,000 ) = Rs. 3,50,000 is taxable

In case of Death of Employee, Gratuity received by his wife or his legal heirs are fully exempt in their hands.

Forfeiture of Gratuity

If an employee's services are terminated due to any act, willful omission or negligence causing damage or loss to or destruction of property of the employer, the employee's gratuity shall be forfeited to the extent of damage or loss.

The full amount of gratuity can be forfeited if an employee's services have been terminated due to:

- His riotous or disorderly conduct or any other violent act;

- Committing an offense involving moral turpitude.

Frequently Asked Questions

When gratuity is taxable?

When an employee receives gratuity during their service fully taxable but also have certain exemptions.

What are the tax exemptions for gratuity?

Retirement gratuity for members of the Defence Service under Pension Code Regulations is fully exempt from tax.

Employees of Government enjoy full tax exemption on death cum retirement gratuity under section 10(10)(i) of the Act.

For private sector employees covered by the Payment of Gratuity Act, 1972, the exemption limit is the least of Rs. 20 lakhs, actual gratuity received, or a formula based on years of service and last drawn salary.

For private sector employees not covered by the Payment of Gratuity Act, 1972, the exemption limit is the least of Rs. 10 lakhs, actual gratuity received, or a formula based on years of service and last drawn salary.

What is considered as salary for calculating tax exemption on gratuity?

Here salary includes basic salary and dearness allowance if it's given in the terms of employment for retirement benefits.

CAclubindia

CAclubindia