CAclubindia Articles

GST Glossary: Meaning of Business, Supply, Deemed Supply and Composite Supply

CA Shiwali Dagar(A) Any trade, commerce, manufacture, profession, vocation, adventure, wager, or any other similar activity, whether or not it is for a pecuniary benefit.

Convergence - Divergence? The Evolving Relationship Between Direct and Indirect Taxes in India - Part 1

Nitin Bhuta 16 April 2025 at 10:45In this article, the author has attempted to explore complementary or completely opposing perspectives by examining aspects such as revenue recognition of revenues and expenditures, inventories, capital expenditures (Capex), and related party transactions.

Process of Transfer of Shares of Private Company In Demat Form

CS Divesh Goyal 16 April 2025 at 09:03The author will cover the "Process and provisions of transfer of shares of Private Limited Company in Demat form instead of Physical shares" in this column.

High Court Ruling on NBFC's Net Owned Fund Requirement: A Precedent for Regulatory Clarity

Affluence Advisory 16 April 2025 at 08:29The recent High Court ruling on the Net Owned Fund (NOF) requirement for Non-Banking Financial Companies (NBFCs) has provided much-needed clarity on the regulat..

Sky is the Limit: A CA Finalist's Journey from Indore to Times Square

Ishwin Kaur 16 April 2025 at 08:29Shakti: Sky is the Limit celebrates the rise of female Chartered Accountants in India, highlighting their powerful contributions to the economy and society. From just 8% in 2000 to 48% today, women like Ishwin Kaur are redefining success with passion, purpose, and the divine strength of Shakti.

Taxable Event of GST

CA Shiwali Dagar"Taxable event" is that on happening of which the charge is fixed. It is that event which, on its occurrence, creates or attracts the liability of tax.

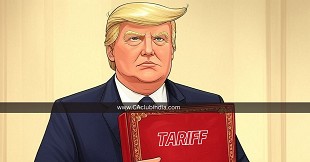

"Tariff" karu kya Uski, Jisne mera portfolio laal kiya hai!

CA Umesh Sharma 15 April 2025 at 07:23On April 2, 2025, President of United States of America Donald Trump imposed reciprocal tariffs at the rate of 34% on China, 27% on India, 20% on the European Union, and 24% on Japan and other countries.

Impact of Fuel Cess on Consumer Purchasing Power

Kotte Murali Krishna 15 April 2025 at 07:23The cess on petroleum products paid by a manufacturing company to the transporter of input goods becomes part of the cost of sales, as it cannot be claimed as Input Tax Credit (ITC).

Importance of OPC Annual Return for Maintaining Compliance

Ishita Ramani 14 April 2025 at 06:40This article will help you know the importance of the OPC Annual Return and its benefits for the same.

ITR Filing 2025: List of Documents You Need to File Your ITR

Alliance Tax Experts 14 April 2025 at 06:40Filing your Income Tax Return (ITR) correctly and on time is essential for avoiding penalties, claiming deductions, and maintaining financial credibility.

Popular Articles

- TDS Rules on Cash Withdrawals: Starting From April 2026

- Fixed Deposit Limits from 2026 along with New IT Rules

- UPI Transaction Limits Starting From April 2026

- 15G and 15H Scrapped: Now One Form for All Eligible Taxpayers

- How Much Can Senior Citizens Earn Tax-Free After Budget 2026?

- Diksha Goyal, All India Topper (AIR-1), CA Final January 2026 in an exclusive interaction with CAclubindia

- Locked GSTR-3B Era Begins: How ECRS and RCM Validation Is Changing GST Compliance

- ITR-U After Reassessment Notice? Budget 2026 Proposal Explained with Tax Cost & Penalty Protection

Trending Online Classes

-

DT & Audit (Exam Oriented Fastrack Batch) - For May 26 Exams and onwards Full English

CA Bhanwar Borana & CA Shubham Keswani

CA Bhanwar Borana & CA Shubham Keswani

CAclubindia

CAclubindia