Articles by Shivani

ITR Filing Due Date FY 2023-24 (AY 2024-25)

Shivani 28 December 2023 at 15:30For FY 2022-23 (AY 2023-24), the original ITR filing deadline was July 31, 2023, with no late fee. If missed, you can file a belated return by December 31, 2023, but with a late fee and interest.

Taxpayers Could Gain the Ability to File Revised GST Returns From 2025

Shivani 26 December 2023 at 11:39The government is looking for a significant change in the Goods and Services Tax system by considering the introduction of the option for taxpayers to file updated or revised returns.

GST Demands and Penalties

Shivani 20 December 2023 at 17:17Under the Goods and Services Tax system, demand can be raised when there is a short payment or incorrect utilization of ITC by the taxpayer.

AG (Accountant General) Certificate

Shivani 14 December 2023 at 11:59The Accountant General is a government official responsible for maintaining financial records and ensuring the accuracy and transparency of financial transactions.

Understanding the Tax Implications of Gambling Winnings

Shivani 05 December 2023 at 09:19Today, we delve into what kind of taxes are obligatory on gambling winnings.

Navigating Foreign Income Flows in India: A Comprehensive Guide

Shivani 01 December 2023 at 11:00Individuals and businesses drawn to India's varied and flourishing economy are enticed by opportunities for international trade. Effectively managing foreign cash flow in this country necessitates a sophisticated grasp of regulatory schemes, tax protocols, and financial strategies.

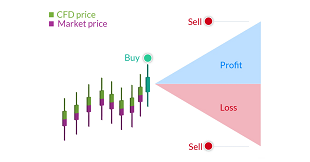

The Impact of Social Media Trends on CFD Market Predictions

Shivani 28 November 2023 at 12:24This article explores how social media trends are impacting CFD market predictions and the implications for traders.

Boost Your Financial Planning with the Fixed Deposit Calculator

Shivani 21 November 2023 at 17:36Financial planning is the process of managing your money to achieve your short-term and long-term goals. It involves setting your financial objectives, budgetin..

Robo-Advisors: A Modern Approach to Investment Management

Shivani 15 November 2023 at 09:03In the ever-evolving landscape of investments and finance, navigating the complexities requires a thorough understanding of various financial instruments, strategies, and market dynamics.

Save Time With Suvit's Data Entry Automation Feature

Shivani 09 November 2023 at 15:39In this blog, we’ll have a look at how you can use data entry automation with Suvit and improve the overall accounting of your business!

Popular Articles

- No More Forced ITC Order: New Rules from Jan 2026

- Income Tax Return Filing Due Date For AY 26-27: Full Details With New Updates

- Revised Return Due Date Extension

- TDS Rate Chart For Tax Year 2026-27: With Revised Section Codes in Challans

- Simplified GST Changes in Budget 2026: Finance Bill 2026 CGST and IGST Amendments

- Tax Deduction Rules for Employee Contributions From April 2026

- ICAI, ICSI & ICMAI to Launch Short-Term Courses to Develop 'Corporate Mitras' in Tier-II & III Towns

- Income Tax Amendments in Budget 2026: Topic-wise Summary of Key Proposals

Trending Online Classes

-

DT & Audit (Exam Oriented Fastrack Batch) - For May 26 Exams and onwards Full English

CA Bhanwar Borana & CA Shubham Keswani

CA Bhanwar Borana & CA Shubham Keswani -

IDT LIVE Exam Oriented Batch | May 2026, Sept 2026 & Jan 2027

CA Arpita Tulsyan

CA Arpita Tulsyan

CAclubindia

CAclubindia