Introduction

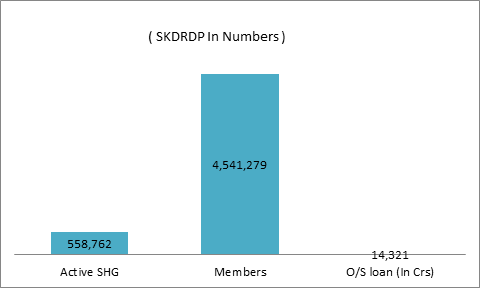

What began as a Small experiment by Padma Vibhushan Dr Veerandra Heggade in the sector of Financial Inclusion Plan has grown up to become a sleeping giant in the State of Karnataka having spread out in almost all the 31 districts of the State with a very good track record of managing the loan book portfolio which has become a rarity these days. SKDRDP also known as Sri Kshetra Dharmasthala Rural Development Program began its operations in the year 1991 at a place called as Navoor, a small village in Belthangadi Taluk of Dakshina Kannada District of Karnataka as a Trust to Run & Manage SHG (Self Help Group) which has risen over the years to become an formidable organization for the betterment of Rural poor, inculcating seeds of empowerment to Women at large who stand at almost 80% of the loan portfolio beneficiaries with their unique approach of financing the SHG. If you do a quick analysis the Average size of an SHG stands anywhere between (8 - 10 members)

|

Particulars |

|

|

Active SHG |

5,58,762 |

|

Members |

45,41,279 |

|

O/S loan (In Crs) |

14,321 |

SKDRDP as a BC and BF

SKDRDP took an active part in implementing the financial inclusion plan of the Government of India by working as a Banking Business Correspondent and Business Facilitator (BC and BF) in all the areas of its operation. Under the programme SKDRDP is promoting Self Help groups, enabling the poor people in the remote villages to access banking facilities at their door steps. SKDRDP is BC and BF to State Bank of India, Union Bank of India, Canara Bank, IDBI bank, Karnataka Grameena Bank and Bank Of Baroda.

Banking Business correspondent & Business facilitator explained

Credit Access for the rural people and masses has always been a mirage because of low credit worthiness of the rural population due to very low savings and lack of financial products to cover their needs, so in short they are left from the mainstream of financial inclusion in the overall economy. India has a total of 742 districts and reaching out to the rural power is a huge task and it is worthwhile to note that SKDRDP is doing a path braking work in the state of Karnataka with disbursements of almost Rs 70,000 Crores since its inception from the year 1991 till date. The arithmetic of loan is very simple, SKDRDP acts a banking correspondent of the above mentioned banks who lend to SHG through SKDRDP at around 7% and they take a fee of 5 % as generating a loan and managing the loan expenses, with an additional 0.5% as handling charges of managing the cash of SHG. Thereby lending to the SHG at 12 to 14 % who in turn lend to its members at anywhere between 13.5 % to 14 % which is a good deal for the rural poor people of India since Micro Finance Lenders do charge anywhere between 18 % to 24 % and the poor people are exploited by the MFI , so SKDRDP is far ahead in terms of pricing of loan which is essential for energizing Rural India, till date there has been no default in the loan repayment by the SHG and if at all there are any defaults , that much of amount will be deducted from the fees to that extent of default, but until date there has been no defaults and its almost clean Loan portfolio. SKDRDP also works in tandem with NRLM – Program sponsored by the Central Government for the Uplift Ment of Rural poor.

STEPS TAKEN FOR FINANCIAL INCLUSION OF POOR PEOPLE IN RURAL AREAS OF INDIA by SKDRDP

- Rural Insurance schemes

- Pragathi Raksha Kavacha for loans taken

- New Pension scheme - NPS

- Micro Bachat scheme of LIC

- Sampoorna Suraksha for Health Insurance

- Arogya Raksha for Emergency Health issues

- Redevelopment / Rejuvenation of water bodies

What started as a small experiment in rural financing has grown up in to a success full venture having made a profit of almost 620 Crores which has been distributed amongst all the stakeholders bringing a smile on the members of SHG. Even during the adverse Covid of both the First and Second wave, weekly meetings at the ground levels were conducted and the amount collected from the borrowers and deposited the same in to banks to keep the loan records of payments and disbursals straight. SKDRDP can afford to price loan at a lower rate than MFI because Capital adequacy requirements are not applicable to them Like Small Finance Banks & MFI's and they have to concentrate only on arranging and disbursing of the loan and collection of the same on a periodic basis and return the same back to the lender.

For the bankers too it's a win win situation because they are at least risk of losing money and the surplus funds lying with them can be gainfully employed for the Un initiated rural poor borrower, they get customers on a platter and that was the reason why Prime Minister Modiji flew in to Dharmasthala to launch SBI Rupay card for 12 Lakh members for the Empowerment of rural women in October 2017, this only speaks volumes about the success of the scheme.

A Small note on NLRM

Making Poor preferred clients of Financial Institution

National Rural Lending Mission (NRLM) facilitates universal access to the affordable cost-effective reliable financial services to the poor. These include financial literacy, bank account, savings, credit, insurance, remittance, pension and counselling on financial services. The core of the NRLM financial inclusion and investment strategy is "Making poor the preferred clients of the banking system and mobilizing Bank credit".

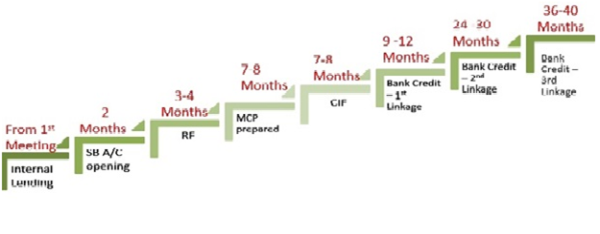

The various processes in lending can be classified as below

- Internal Lending

- SB Account opening

- RF (Revolving Fund)

- MCP (Micro Credit Plan) Prepared

- CIF (Community Investment Fund)

- Bank Credit 1st Linkage

- Bank credit 2nd Linkage

- Bank credit 3rd Linkage

Capitalizing Institutions of the Poor

NRLM provides Revolving Fund and Community Investment Fund (CIF) as Resources in Perpetuity to the institutions of the poor, to strengthen their institutional and financial management capacity and build their track record to attract mainstream bank finance.

- NRLM provides Revolving Fund (RF) to SHGs of Rs.10,000-15,000 as corpus to meet the members' credit needs directly and as catalytic capital for leveraging repeat bank finance. RF is given to SHGs that have been practicing "Panchasutra" they are as follows

- Regular meetings

- Regular savings

- regular inter-loaning

- Timely repayment, and

- Up-to-date books of Accounts

- NRLM provides Community Investment Fund as Seed Capital to SHG Federations at Cluster level to meet the credit needs of the members through the SHGs/Village Organizations and to meet the working capital needs of the collective activities at various levels.

- NRLM provides Vulnerability Reduction Fund (VRF)to SHG Federations at Village level to address vulnerabilities like food security, health security etc, and to meet the needs of the vulnerable persons in the village.

Access to Credit

NRLM expects that the investment in the institutions of the poor would leverage the bank credit of at least Rs.1,00,000 /- accessible to every household in repeat doses over the next five years. For this, SHGs go through Micro-investment Plan (MIP) process periodically. MIP is a participatory process of planning and appraisal at household and SHG levels. The flow of the funds to members/SHGs is against the MIPs. NRLM has provided interest subvention for all eligible SHGs to get loans at 7% per annum from mainstream financial institutions. Further, additional 3% interest subvention is available only on prompt repayment by SHGs in most backward 250 districts.

SHG Credit Linkage

While the Mission provides only catalytic capital support to the community institutions, it is expected that the banks provide the major chunk of funds required for meeting the entire gamut of credit needs for the rural poor households. The Mission therefore expects that the SHGs leverage significant amount of bank credit.

- The Mission assumes that over a period five years, each SHG would be able to leverage cumulative bank credit of Rs. 10,00,000/- in repeat doses, such that on the average each member household accesses a cumulative amount of Rs. 100000/-.

- In order to facilitate bank linkages, State Level Bankers' Committees (SLBC)would constitute exclusive sub-committees for SHG bank linkages and financial inclusion in NRLM activities. Similarly, District Level Coordination Committees and Block Level Coordination Committees would review SHG-Bank linkages and NRLM.

- The Mission units are also expected to use the services of the field level customer relationship managers such as Bank Mitra / Sakhi.

- Further Institutions of the poor are expected will be guided to constituting community-based recovery mechanisms (sub-committees on bank linkage and recovery of loans).

NRLM works towards increasing the portfolio of products of savings, credit, insurance (life, health and assets) and remittance through the institutions of the poor directly or in partnership with mainstream financial institutions using various institutional mechanisms and technologies.

CAclubindia

CAclubindia