Chartered Accountants and Tax Professionals face numerous challenges daily, from complex income tax calculations to tedious TDS/TCS compliance and meticulous audit filings. Efficiently managing these tasks is crucial for their success and client satisfaction.

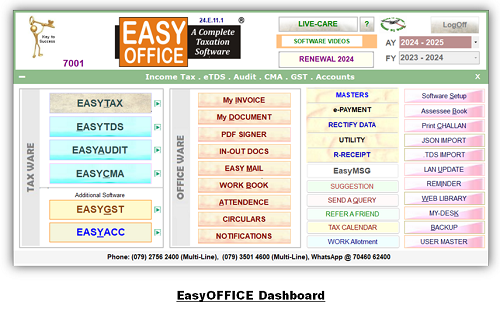

EASYOFFICE - A Complete Taxation Software is a game-changer for tax professionals, providing an all-in-one solution designed to streamline their work. EASYOFFICE covers everything from income and tax computation to the automatic generation of ITR forms and income statements. With direct e-filing capabilities, pre-validation, and seamless upload features, the software simplifies the entire tax management process. The built-in JSON/XML import feature makes data entry fast and error-free, while the auto set-off and carry-forward of losses ensures accurate tax calculations. EASYOFFICE also offers a multi-year income tax summary, integration with the IT Portal to fetch data from 26AS, AIS, and TIS, Tools for calculating various deductions and making income tax challan e-payments smoothly. Additionally, it provides a comparison chart for the New vs. Old Tax Regime, allowing professionals to make informed decisions with ease.

When it comes to TDS and TCS management, EASYOFFICE delivers outstanding functionality. It helps prepare eTDS and eTCS returns, generate TDS/TCS certificates (16, 16A, 27D), verify challans, and enable smooth e-payments. The software's Audit Module further enhances productivity with support for company audits, tax audits, and trust audits, including the generation of reports for Forms 3CA-3CD, 3CB-3CD, 3CEB and 10B/10BB complete with annexures. EASYOFFICE also simplifies the preparation of account statements (as per Schedule III), trial balance entries and the direct upload of audit e-reports.

To complement these powerful features, EASYOFFICE offers a CMA Module for multi-year CMA data preparation, MPBF calculations, depreciation charts, and much more, making it the ultimate tool for financial analysis and reporting.

Why Choose EASYOFFICE Software?

By choosing EASYOFFICE, tax professionals can:

- Streamline their workflow

- Save time

- Reduce errors

- Improve overall efficiency

With its intuitive interface and comprehensive features, EASYOFFICE enables professionals to focus on higher-value tasks, elevating client service and satisfaction.

Are you ready to revolutionize your tax practice?

If you're looking for the best income tax software in India or a trusted and reliable solution for all your Income Tax, TDS and Audit needs, EASYOFFICE Software is the final answer.

Why wait? Try EASYOFFICE Software today with a free demo! Join with the thousands of Chartered Accountants, Tax Professionals and Corporates across India who trust EASYOFFICE Software for their complete Taxation needs.

Key Features

- Income Tax Software: Simplify tax computation, filing, and validation.

- TDS/TCS Software: Manage returns, certificates, and payments effortlessly.

- Audit Software: Streamline audits with pre-formatted reports and audit e-filings.

- CMA Data Software: Prepare detailed CMA Report with financial analyses with ease.

- Office Management Utilities: Boost productivity and organization.

Unlock Your Full Potential

EASYOFFICE is more than just software-it's a solution that enhances your productivity, accuracy, and success. With competitive pricing and unparalleled functionality, EASYOFFICE is a must-have software for Chartered Accountants & Tax Professional.

CAclubindia

CAclubindia