Are you tired of spending hours poring over complex tax forms? Therefore, Do you wish there was an easier way to manage your taxes without the headache of manual calculations? Well, In other words, you're in luck! Introducing the Automated Income Tax Calculator All in One in Excel for the Financial Year 2024-25, designed specifically for non-government employees like you. However, Say goodbye to the stress of tax season and hello to simplicity and efficiency!

Table of Contents

- Understanding the Importance of Tax Calculators

- Introduction to Automated Income Tax Calculator All in One

- Features of the Automated Income Tax Calculator

- How to Download and Install the Tax Calculator

- Navigating the Interface

- Inputting Your Financial Data

- Generating Tax Reports

- Benefits of Using Excel for Tax Calculation

- Tips for Maximizing Efficiency

- Conclusion: Simplify Your Tax Process with Excel

Understanding the Importance of Tax Calculators

Tax season can be overwhelming, especially if you're not familiar with the intricacies of tax laws and regulations. For instance, That's where tax calculators come in handy. They streamline the process, allowing you to accurately calculate your taxes without the need for complex manual calculations.

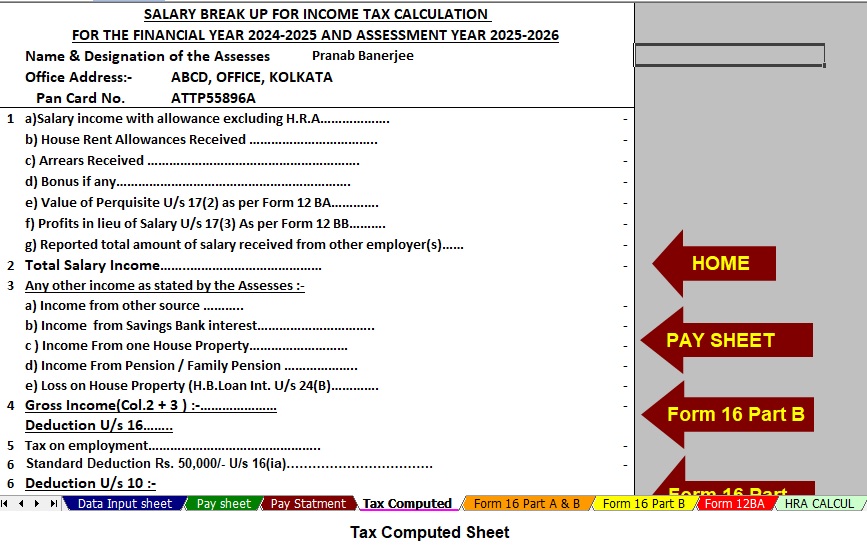

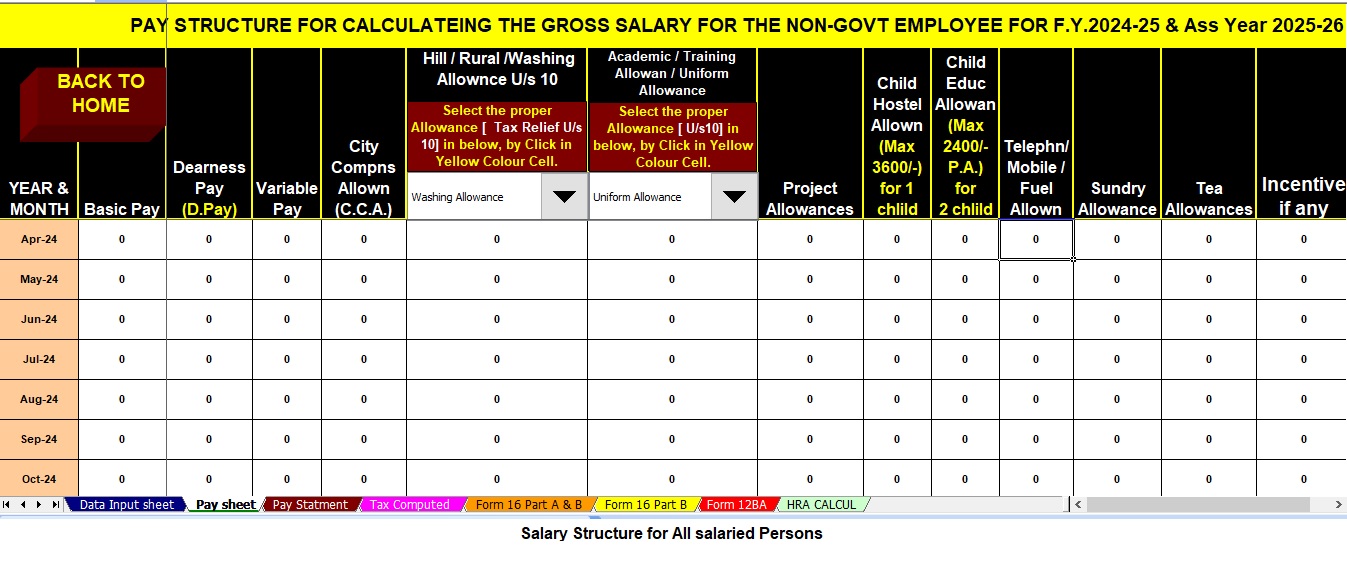

Introduction to Automated Income Tax Calculator All in One

The Automated Income Tax Calculator All in One is a revolutionary tool that simplifies the tax-filing process for non-government employees. In addition, Developed in Excel, this calculator offers a user-friendly interface and powerful features to make tax calculation a breeze.

Features of the Automated Income Tax Calculator

- Comprehensive Calculations: From income tax to deductions and exemptions, this calculator covers it all.

- Automatic Updates: Stay up-to-date with the latest tax laws and changes without lifting a finger.

- Customizable Reports: Generate detailed reports tailored to your specific financial situation.

- User-Friendly Interface: No need to be a tax expert – the intuitive interface guides you through the process step by step.

How to Download and Install the Tax Calculator

Downloading and installing the Automated Income Tax Calculator All in One is quick and easy. Simply click the below link and download the same.

Navigating the Interface

Once installed, you'll find the interface of the tax calculator to be straightforward and user-friendly. Similarly, With clearly labeled tabs and buttons, you can easily navigate through the various sections and input your financial data with ease.

Inputting Your Financial Data

Gather your financial documents and input the relevant information into the designated fields. The calculator will then automatically process the data and generate accurate tax calculations based on the latest laws and regulations.

Generating Tax Reports

With the click of a button, you can generate detailed tax reports that provide a comprehensive overview of your financial situation. Whether you need a summary of your income, deductions, or tax liability, the calculator has you covered.

Benefits of Using Excel for Tax Calculation

Excel is a powerful tool known for its versatility and functionality. By utilizing Excel for tax calculation, you can take advantage of advanced features such as formulas, pivot tables, and macros to streamline the process and save time.

Tips for Maximizing Efficiency

- Keep Records Organized: Maintain organized records of your income, expenses, and deductions to streamline the tax filing process.

- Stay Informed: Stay updated on changes to tax laws and regulations to ensure compliance and maximize deductions.

- Utilize Excel Functions: Take advantage of Excel's built-in functions and formulas to automate repetitive tasks and improve accuracy.

Conclusion: Simplify Your Tax Process with Excel

Say goodbye to the stress and frustration of tax season. With the Automated Income Tax Calculator All in One in Excel, you can simplify the tax filing process and take control of your finances with ease. Download your copy today and experience the difference!

FAQs (Frequently Asked Questions)

1. Is the Automated Income Tax Calculator All in One compatible with all versions of Excel?

Yes, the calculator is compatible with all versions of Excel, ensuring accessibility for all users.

2. Can I use the calculator for multiple financial years?

Yes, the calculator is designed to accommodate multiple financial years, providing flexibility for long-term financial planning.

3. Is the calculator suitable for both individuals and businesses?

While primarily designed for individual taxpayers, the calculator can also be used by small businesses and freelancers to manage their taxes.

4. Are there any hidden fees or subscription charges?

No, the Automated Income Tax Calculator All in One is available for a one-time download fee with no hidden charges or subscription fees.

5. How frequently is the calculator updated with the latest tax laws?

The calculator is updated regularly to ensure compliance with the latest tax laws and regulations, providing users with accurate calculations year-round.

CAclubindia

CAclubindia