Table of Contents

What is Challan 280?

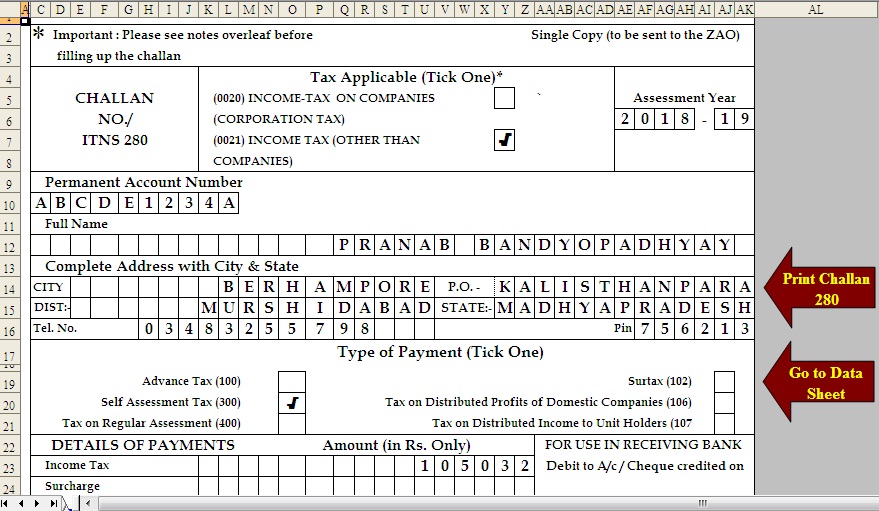

Challan 280 is a form used to pay income tax; Payments can be made both online and offline. It is mainly used to pay advance tax, self-assessment tax, regular liquidation tax, surcharge, internal business distributed profit tax and participant distributed income tax.

|

Challan 280 |

Available Provisions |

|

Taxpayer types |

|

|

Types of Tax Payment |

|

|

Mode of Payments |

|

This form is available on the official NSDL e-Government website. Taxpayers can download the form, fill it and pay offline, or fill it online and pay tax through net banking or debit card. This is a very simple form that is easy to use and allows you to pay taxes conveniently.

You may also like - All in One Auto Calculate Income Tax Preparation Program in Excel for FY 2023-24 and Assessment Year 2024-25 for Government and Non-Government Employees.

|

Canada Bank |

Central Bank of India |

Dena Bank |

HDFC Bank |

|

ICICI Bank |

IDBI Bank |

Indian Bank |

Indian Overseas Bank |

|

Jammu & Kashmir Bank |

Punjab and Sind Bank |

Punjab National Bank |

State Bank of India |

|

UCO Bank |

Union Bank of India |

Vijaya Bank |

|

|

Axis Bank |

Bank of Baroda |

Bank of India |

Bank of Maharashtra |

How to pay taxes offline using Challan 280?

The IT department allows taxpayers to pay taxes at various authorized banks for convenience. Tax Payee can download the Challan 280 form in PDF Format from the NSDL website, properly fill this form with the correct details and deposit it to any of the authorized banks. Let's see how.

- Visit the official website of NSDL E-Gov and click on the "Downloads" button on the home page.

- Download the invitation file 'ITNS 280'. It downloads in PDF format. Take a printout of it. If this is so -

- You may fill out this form with your details as asked from the form.

- Send the tax amount along with this form to the nearest authorized bank. Don't forget to collect proof of payment for your records.

Name of an authorized bank

You may also like Excel-based software for automatic income tax preparation for all salaried individuals for the financial year 2023-24 and assessment year 2024-25.

Challan status check and change requirements

After paying tax with 280 Talana, taxpayers can check their tax status online. They can use this feature to make sure that the tax payments are correctly calculated in their name. This feature can also be used to query the status of issues charged by bank accounts. Name of an authorized bank

Taxpayers have two search options

- CIN-Based View - In this view, by entering the CIN number, the assessee can verify his BSR code, date of submission, Naberezhnye serial number, and master code with description, TAN/PAN, taxpayer name, summons, and the value entered is correct.

- TAN-Based View - In this view, you can view CIN, Basic Basic Code Description, Basic Basic Code, and Nature of Payment.

If the taxpayer finds any error or mistake, he can refund it

- For offline payments made through banks, taxpayers can approach the bank within 7 days to correct the details.

- For online payments, the taxpayer should contact the concerned AO (Assessing Officer) for making the changes.

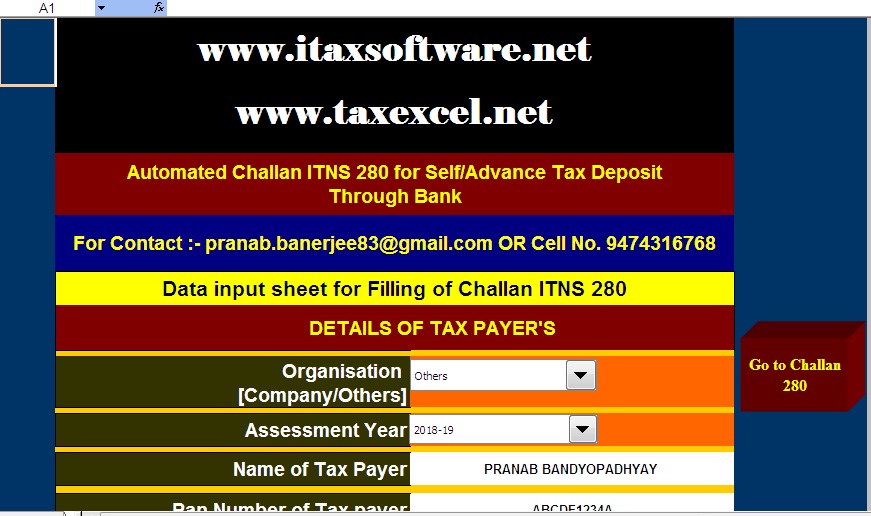

Download from the attached file as Excel Based Auto fill Challan 280 from the attached file (For offline)

CAclubindia

CAclubindia