To have an independent portfolio of work is advantageous and a boon for any freelancer. However, along with it comes the added cautiousness of legal compliances, of which, most of us are completely oblivious to. The chord is struck only when you receive dreadful notices of tax penalties from Tax Authorities. Have you received any such notices as of yet?

Let's bust some myths and have a closer look to know when GST is attracted, and what all we measures we should take.

Are freelancers required to obtain registration under the GST Act?

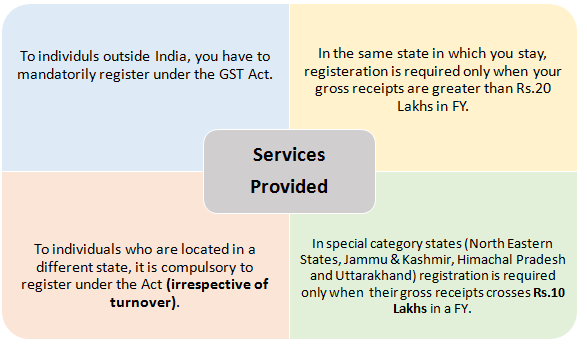

GST Registration is required only when there is:

• Services are delivered outside India

• Gross Receipts (Without deduction of expenses) for services provided in the same state are greater than Rs.20 Lakh (Rs.10 Lakhs for Special Category States). For example, Ram, provides tuitions to Sita, and both reside in Maharashtra.

• Services provided to receiver located in a different state. For example, Shahana, a resident of Madhya Pradesh, provided bridal makeup services to Preeti, a resident of Delhi. In this case, Shahana is compulsorily required to register under the GST Act

A pictorial representation of the same has been provided below:

What are the applicable tax rates for freelancers?

A GST rate of 18% is applicable in most freelancing services. For example, Vaishali designs a campaign for Veet, for which she charges Rs.10,00,000. In this case, she shall issue an invoice for Rs.11,80,000 (18%*10,00,000 + 10,00,000)

What is Input Tax Credit and can a freelancer avail it?

We shall understand the concept of Input Tax Credit with the following example:

Suppose a freelancer photographer charges Rs.25,00,000 for the services carried, had hired a staff for which he had born expenses to tune of Rs.5,00,000.

In this case, the net GST payable shall be computed as follows:

|

Particulars |

Amount(in INR) |

|

Photography Services Provided |

25,00,000 |

|

Add: GST to be paid @18% |

4,50,000 |

|

Total Amount Charged |

29,50,000 |

|

Staffing Charges Paid |

5,00,000 |

|

Add: GST paid @18% |

90,000 |

|

Total Payment made |

5,90,000 |

|

Net amount of GST payable by the photographer |

|

|

GST To be Paid |

4,50,000 |

|

GST Already Paid |

90,000 |

|

Net GST Payable |

3,60,000 |

The above case relates to a freelancer that has been providing services only in India. What happens in case he offers such services outside India? Such services fall under the category of 'zero rated supply of goods' in which the following facilities available:

• One can deliver services by filing a bond or a Letter of Undertaking where he does not does not pay any tax. However, he can claim a refund of taxes paid on expenses incurred earlier.

• One may provide services and pay tax accordingly and claim refund on such tax paid.

The same can be differentiated by an example below:

|

Paying Tax Liability as per the Act and taking a refund |

Signing a Letter of Undertaking |

||

|

Particulars |

Amount(in INR) |

Particulars |

Amount(in INR) |

|

Photography Services Provided Outside India |

25,00,000 |

Photography Services Provided Outside India |

25,00,000 |

|

Add: GST to be paid @18% |

4,50,000 |

Total Amount Charged |

25,00,000 |

|

Total Amount Charged |

29,50,000 |

|

|

|

|

|

|

|

|

Refund of GST Availed |

4,50,000 |

Staffing Charges Paid |

5,00,000 |

|

|

|

Add: GST paid @18% |

90,000 |

|

|

|

Total Payment made |

5,90,000 |

|

|

|

|

|

|

|

|

Refund of GST availed |

90,000 |

How should a GST Invoice generated by a freelancer look like?

A basic invoice generated by a freelancer must cover the following elements:

• Invoice Serial Number

• Date

• Client's Name, Address and GST Number (if applicable)

• The particulars, value and total amount charged for the services offered

• The applicable tax rate

• Signature

Is a freelancer required to file GST Returns?

Every registered person is required to file GST Returns. A summary of such forms have been represented in the table below:

|

Return Form |

Eligibility |

Contents of the Return |

Frequency |

|

GSTR-1 |

Where Annual Turnover* is up to Rs.1.5 crore |

A detailed return of all the sales/ services made. |

Quarterly |

|

GSTR-1 |

Where Annual Turnover* is greater than Rs.1.5 crore |

Monthly |

|

|

GSTR-3B |

All Service Providers |

It is a summary of all services provided, GST paid, Input Tax Credit Availed against such payments. |

Monthly |

|

GSTR-9 |

All Service Providers |

Annual Return |

Annual |

*Gross Receipts (Without deduction of any expenses)

GST is predominantly a new concept. Most people are tensed with the changes that have been brought with the introduction of GST. Do you have doubts which are still unanswered? Don't worry, we're there at your beck and call to resolve all your queries.

The author can also be reached at sakshijain.1995@outlook.com.

CAclubindia

CAclubindia