A. MANDATORY REGISTRATION: The person who is crossing the proposed threshold limit. (i.e. the aggregate turnover in a financial year exceeds Rs. 20 lacs and Rs. 10 lacs (for the taxable person who is conducting business in any of the North Eastern States including Sikkim). A person, though not liable to be registered (i.e. not crossing the proposed threshold limit) may get himself registered voluntarily.

B. TIME LIMIT FOR REGISTRATION

i. For the person who is liable to get registered: Every person who is liable to be registered under Schedule V of this Act shall apply for registration in every such State in which he is so liable within thirty days from the date on which he becomes liable to registration.

ii. For casual taxable person or a non-resident taxable person: He shall apply for registration at least five days prior to the commencement of business.

B. SEPARATE REGISTRATION FOR EACH BUSINESS VERTICAL: A person having multiple business verticals in a State may obtain a separate registration for each business vertical, subject to such conditions as may be prescribed.

C. PREREQUISITES FOR REGISTRATION: It is explained as below:

D. UNIQUE IDENTITY NUMBER (UIN): UIN is the registration number which shall be granted if no deficiency has been communicated to the applicant by the proper officer within that period or, as the case may be, rejected after due verification in the manner and within such period as may be prescribed.

E.SPECIAL PROVISIONS RELATING TO CASUAL TAXABLE PERSON AND NON-RESIDENT TAXABLE PERSON

i. Validity of registration: The certificate of registration issued to a casual taxable person or a non-resident taxable person shall be valid for a period specified in the application for registration or ninety days from the effective date of registration, whichever is earlier and such person shall make taxable supplies only after the issuance of the certificate of registration.

PROVIDED that the proper officer may, at the request of the said taxable person, extend the aforesaid period of ninety days by a further period not exceeding ninety days.

ii. ADVANCE DEPOSITE: As per the following manner-:

a. At the time of submission of application of registration.

b. Amount equivalent to estimated tax liability.

c. Such deposits shall be credited into ECL (Electronic cash ledger) and shall be utilized in the manner provided under section 44.

F. AMENDMENT OF REGISTRATION:

H. CANCELLATION OF REGISTRATION:

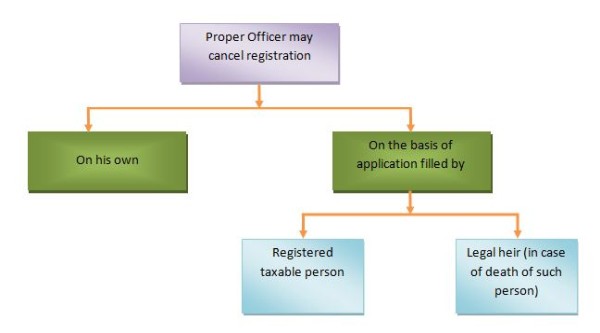

i. Base: The base on which the registration under GST may be cancelled is explained in the following diagram:

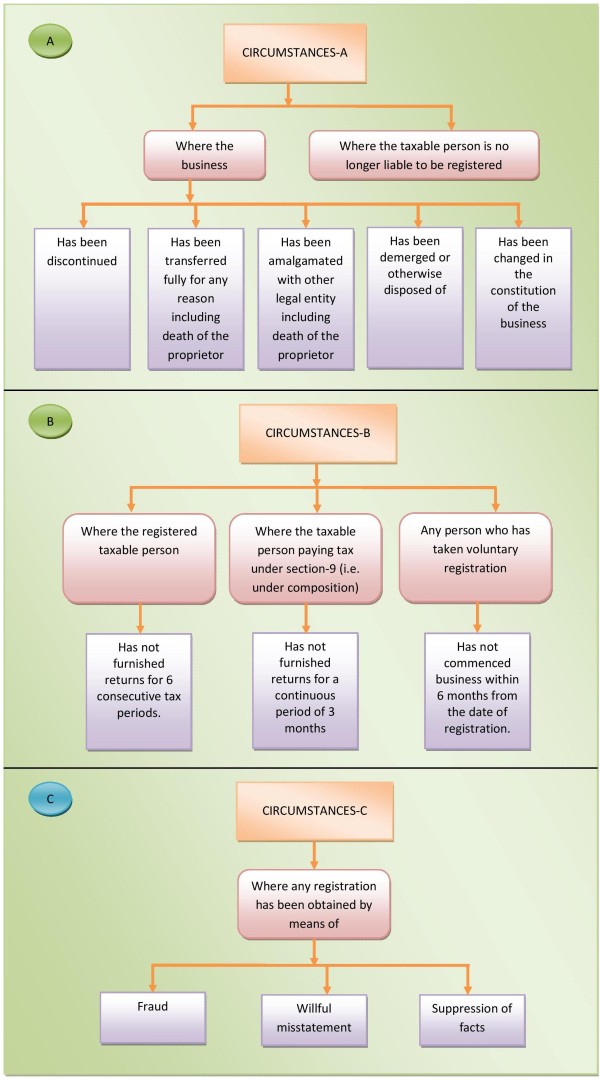

ii. Circumstances: The circumstances which may result in cancellation of the registration under GST are explained in the following diagram:

iii. Effect of cancellation: The effects are explained in the following diagram:

I. REVOCATION OF CANCELLATION OF REGISTRATION: It can be understood by the following diagram:

CAclubindia

CAclubindia