Section 194O has been introduced in the Union Budget 2020. According to Section 194O, an e-Commerce operator is required to deduct TDS for facilitating any sale of goods or providing services through an e-Commerce participant. TDS on e-commerce operators under section 194-O is applicable from 1st October 2020.

Table of Contents

Definition of E-Commerce Operators and Participants

Scope of Section 194O

E-Commerce operators should deduct TDS @1% at the time of credit of the amount of sale of goods, services, or both to the account of an e-commerce participant or at the time of making payment to an e-Commerce participant by any other mode, whichever is earlier.

| E-commerce participant being a resident individual or HUF |

|

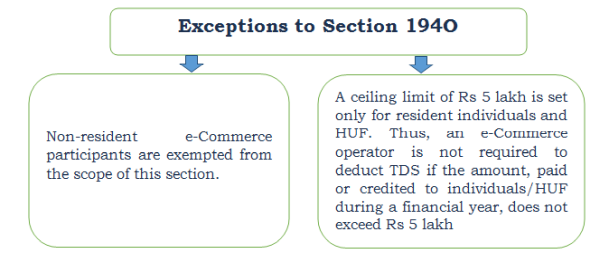

E-commerce operator is not required to deduct TDS if the gross amount of sale of goods, services, or both during the previous year does not exceed Rs 5 lakh and if the e-Commerce participant has furnished his PAN or Aadhaar. If the e-Commerce participant does not furnish his PAN or Aadhaar, TDS must be deducted at the rate of 5%, as per provisions of Section 206AA. |

| E-Commerce participant being a non-resident |

|

As stated earlier, an e-Commerce participant must be a resident of India. Thus, no TDS will be deducted if the participant is a non-resident. For example, a proprietary firm Royal & Co. (e-commerce participant) is selling its products through Amazon (e-commerce operator). Mr.Sachin buys this product online from Royal & Co. for Rs 50,000 on 1 May 2024. Amazon credits the account of Royal & Co. on 1 May 2024, but the customer makes the payment directly to Royal & Co. on 15 May 2024. Here, Amazon is required to deduct TDS @1% on Rs 50,000 at the time of credit to the party or making payment, whichever is earlier. In this case, TDS should be deducted on 1 May 2024. |

Purpose of Section 194O

The purpose of the introduction of Section 194O is to widen the TDS base by bringing e-Commerce participants under the tax. Of late, customers prefer digital platforms for buying or selling of goods and services because:

- From the seller's perspective - It requires less cost for creating the setup and less effort for the search of buyers.

- From the buyer's perspective - Many options are available at one platform and the comparison of products becomes very easy.

This has resulted in an increase in the number of e-Commerce users over a period of time. It is difficult to identify small sellers (e-Commerce participants) who don't file their income tax returns. Thus, the government has enlarged the tax base to bring such e-Commerce participants under the tax base.

Reason for Inserted section 194O

Earlier, there was no tax deduction on payments made to e-Commerce participants. They were required to independently file their income tax returns. Therefore, many small e-Commerce participants didn't file their income tax returns and escaped the tax liability.

Miscellaneous Provisions of Section 194O

Rest all other provisions of the chapter TDS of the act will be applicable i.e. provision related to payment of TDS, filing of TDS return, the provision as applicable for non-filing of return, non-deduction or lower deduction, non-payment post deduction will be remaining as applicable as mentioned in the chapter of TDS of the Act.

- Relaxation is available only for resident Individual and HUF up to a specified amount i.e. apart from that TDS will be deducted in case of every resident person by e-commerce operator irrespective of the transaction amount. So, this is going to be very tough for E-commerce operator for deduction of TDS in case of individual or HUF because a person being individual can sell his goods on multiple platforms and can ask for no deduction of TDS till the time total amount exceeds the threshold limit of Rs. 5 lakhs because the burden for deduction of TDS is on e-commerce operator.

- So, for the ease in respect of avoidance of non-compliance they can go for the options like, in coming days they must ask for a declaration from individual regarding the selling of goods on more than one electronic platform or regarding that the once amount exceeds the specified limit then the individual must inform him about that or continue to deduct the TDS from the starting.

TDS Impact on E-Commerce Transactions - Click Here

TDS on E-commerce Operator (including Practical Case Studies) - Click Here

CAclubindia

CAclubindia